252 Ergebnisse

Marx’s theory of the falling rate of profit is not only empirically borne out, but the theory he proposed seems to describe accurately how that happens. Furthermore, the whole process is useful for understanding the history of contemporary capitalism.

Die übergeordnete Forschungsfrage des Projektsseminars lautet: „Können Low-Profit-Investitionen einen zusätzlichen Beitrag zur Umsetzung der SDG leisten?“

Modern authors have identified a variety of striking economic patterns, most importantly those involving the distribution of incomes and profit rates. In recent times, the econophysics literature has demonstrated that bottom incomes follow an exponential distribution, top incomes follow a Pareto, profit rates display a tent-shaped distribution. This paper is concerned with the theory underlying various explanations of these phenomena. Traditional econophysics relies on energy-conserving “particle collision” models in which simulation is often used to derive a stationary distribution. Those in the Jaynesian tradition rely on entropy maximization, subject to certain constraints, to infer the final distribution. This paper argues that economic phenomena should be derived as results of explicit economic processes. For instance, the entry and exit process motivated by supply decisions of firms underlies the drift-diffusion form of wage, interest and profit rates arbitrage. These processes give rise to stationary distributions that turn out to be also entropy maximizing. In arbitrage approach, entropy maximization is a result. In the Jaynesian approaches, entropy maximization is the means.

An der Leuphana Universität Lüneburg findet jedes Jahr das Leuphana-Semester statt, das alle Studierende im ersten Semester durchlaufen, bevor sie im zweiten Semester ins Fachstudium starten. Die Studierenden sollen in Projektseminaren wissenschaftliche Methoden kennen lernen und einüben, an konkreten gesellschaftlichen Problemen erproben und interdisziplinäre Lösungswege aufzeigen

A concise introduction to Marx's Labour Theory of Value, the three ratios and the falling rate of profit hypothesis.

This paper attempts to clarify how the European economic crisis from 2007 onwards can be understood from the perspective of a Marxian monetary theory of value that emphasizes intrinsic, structural flaws regarding capitalist reproduction. Chapter two provides an empirical description of the European economic crisis, which to some extent already reflects the structural theoretical framework presented in chapter three. Regarding the theoretical framework Michael Heinrich's interpretation of 'the' Marxian monetary theory of value will be presented. Heinrich identifies connections between production and realization, between profit and interest rate as well as between industrial and fictitious capital, which represent contradictory tendencies for which capitalism does not have simple balancing processes. In the context of a discussion of 'structural logical aspects' of Marx's Critique of the Political Economy, explanatory deficits of Heinrich's approach are analyzed. In the following, it is argued that Fred Moseley's view of these 'structural logical aspects' allows empirical 'applications' of Marxian monetary theories of value. It is concluded that a Marxian monetary theory of value, with the characteristics of expansive capital accumulation and its limitations, facilitates a structural analysis of the European economic crisis from 2007 onwards. In this line of argument, expansive production patterns are expressed, among other things, in global restructuring processes, while consumption limitations are mitigated by expansive financial markets and shifts in ex-port destinations.

The economist Thomas Piketty presents a central argument of his book Capital in the Twenty-First century: if the rate of return to capital generally exceeds an economy's growth rate, this leads to a higher concentration of wealth in the long run. He furthermore shows with historical data how wealth and income inequality increased within the past decades.

In this short video 'Raghuram Rajan’s Dosa Economics Explained', the famous theory of Dr. Raghuram Rajan, ex-governor of Reserve Bank of India (RBI), Dosa Economics, has been explained using a very simple example of Dosa ( a delicacy of India). Here, Dr. Raghuram Rajan tries to explain that low interest rate and low inflation is much better than high interest rate and high inflation.

This article provides a contextual framework for understanding the gendered dimensions of the COVID-19 pandemic and its health, social, and economic outcomes. The pandemic has generated massive losses in lives, impacted people’s health, disrupted markets and livelihoods, and created profound reverberations in the home. In 112 countries that reported sex-disaggregated data on COVID-19 cases, men showed an overall higher infection rate than women, and an even higher mortality rate. However, women’s relatively high representation in sectors hardest hit by lockdown orders has translated into larger declines in employment for women than men in numerous countries. Evidence also indicates that stay-at-home orders have increased unpaid care workloads, which have fallen disproportionately to women. Further, domestic violence has increased in frequency and severity across countries. The article concludes that policy response strategies to the crisis by women leaders have contributed to more favorable outcomes compared to outcomes in countries led by men.

Post-Keynesians focus on the analysis of capitalist economies, perceived as highly productive, but unstable and conflictive systems. Economic activity is determined by effective demand, which is typically insufficient to generate full employment and full utilisation of capacity.

The blog post by Marc Lavoie contrasts what he perceives as the two main interpretations of the current inflationary tendencies (the 'excessive demand inflation' story and the 'profit inflation' story) and contrasts them with a third interpretation. This interpretation acknowledes rising profits but argues in favor of a different mechanism that centers on changes in the relative composition of costs.

‘We cannot afford their peace & We cannot bear their wars’:

Value, Exploitation, Profitability Crises & ‘Rectification’

The guides provide links to texts by Marx and Engels and present possible questions to discuss in study groups. The texts include Capial Volumes I – III, Economic & Philosophical Manuscripts or “Value, Price and Profit”.

The podcast exposes the concept and principles of co-operatives and the three main types of co-operatives: the consumer, credit and farmers buying and selling co-operatives. Furthermore, the history of the co-operative movement is presented. The authors draw the line from co-operatives to "degrowth" by arguing that these organisations discourage profit maximisation due to their ownership structure, their social purpose and their primacy of people over capital. The value of the members' co-operative share does not increase with the growth of a co-operative and it can not be used for speculation. Finally, the authors give examples for current co-operatives which empower (local) communities fostering social justice and environmentalism.

Wie werden demokratische Übergänge zu einem Leben und Wirtschaften möglich, deren Qualität und Stabilität nicht vom permanenten ökonomischen Wachstum abhängen? Reicht dafür eine Bottom-up-Strategie? Reichen all die Non-profit-Unternehmen, Tauschläden und Kulturen des Selbermachens als Keime einer im Entstehen begriffenen Postwachstumsökonomie und -gesellschaft?

John K. Galbraith recounts episodes in the history of money such as the creation of the bank of Amsterdam, John Law's fraudulent Bank Royal, the inception of the Bank of England and of the Federal Reserve to illustrate concepts such as money creation by commercial banks, the bank rate, open market operations or the money supply in general. The emotions, myths and struggles surrounding money are addressed and explained in a clear and consistent manner.

Eckhard Hein criticises the mainstream's view of secular stagnation as the result of a negative real equilibrium interest rate. Arguing in a Keynesian spirit with particular reference to Steindl, secular stagnation is considered to be a result of shift in the functional income distribution, and oligopolistic organisation of industries, leading to excess capacity and reluctance to invest. This acts as a drag on effective demand and results in secular stagnation. Distributional policies and public investment can, however, overcome stagnation its tendencies.

Based on a paper by Jason Hickel and Giorgos Kallis Decoupling refers to the separation of economic value creation material extraction and pollution. Ecological limits pose a challenge to growth-led development and the low historical and predicted rate of decoupling suggests that long-term sustainable growth-led development is impossible.

In a challenge to conventional views on modern monetary and fiscal policy, this book presents a coherent analysis of how money is created, how it functions in global exchange rate regimes, and how the mystification of the nature of money has constrained governments, and prevented states from acting in the public interest.

Nature and communities in the global south is being overwhelmed at a shocking rate. In many places this is due to ventures such as large-scale open-pit mining, oil extraction in tropical areas, and the spread of monocultures. These and other such forms of natural resource appropriation are usually known as extractivisms.

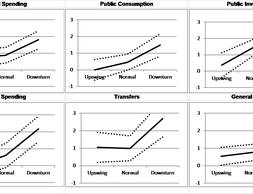

What influence do changes in tax policy or state decisions on expenditure have on economic growth? For decades, this question has been controversially debated.

Although sometimes used as synonyms, economic growth and economic development refer to different processes. While economic growth refers to an increase in real national income and output (i.e., GDP growth rate), economic development refers to an improvement in the quality of life and living standards (i.e., life expectancy).

Mainstream inflation theories in economics do little to explain the recent acceleration in price increases. The associated economic policy recommendations further increase the misery of low-income groups.

This essay focuses on the sources of government revenue within the Middle East and North African (MENA) region and proposes the implementation of a regional tax reset through increased taxation and tax reforms, deregulation in the private sector and economic diversification to reduce macroeconomic volatilities caused by the hydrocarbon industry.

The notion that the demand and supply side are independent is a key feature of textbook undergraduate economics and of modern macroeconomic models. Economic output is thought to be constrained by the productive capabilities of the economy - the ‘supply-side' - through technology, demographics and capital investment. In the short run a boost in demand may increase GDP and employment due to frictions such as sticky wages, but over the long-term successive rises in demand without corresponding improvements on the supply side can only create inflation as the economy reaches capacity. In this post I will explore the alternative idea of demand-led growth, where an increase in demand can translate into long-run supply side gains. This theory is most commonly associated with post-Keynesian economics, though it has been increasingly recognised in the mainstream literature.

What’s inflation? Why is it relevant? And is there an agreed theory about its roots and causes, or is it a contentious concept? That’s what this text is all about: We define what inflation actually means before we delve into the theoretical debate with an interdisciplinary and pluralist approach: What gives rise to it, what factors might influence it, and, consequently, what might be done about it?

The concept of financialisation has undergone a similar career as ‘globalisation’, ‘neoliberalism’ or even ‘capitalism’, in the course of which it changed from the explanandum to the explanans; the process of financialisation is taken for granted, while the concrete historical and empirical causal conditions of its realisation and perpetuation are being moved into the background.

Um die Klimakrise und ihre Ursachen wirklich zu bekämpfen, müssen die derzeitige Wirtschaftsweise grundlegender hinterfragt und Möglichkeiten einer sozial-ökologischen Transformation untersucht werden. Ein Beitrag von Elena Hofferberth.

The Great Recession 2.0 is unfolding before our very eyes. It is still in its early phase. But dynamics have been set in motion that are not easily stopped, or even slowed. If the virus effect were resolved by early summer—as some politicians wishfully believe—the economic dynamics set in motion would still continue. The US and global economies have been seriously ‘wounded’ and will not recover easily or soon. Those who believe it will be a ‘V-shape’ recovery are deluding themselves. Economists among them should know better but are among the most confused. They only need to look at historical parallels to convince themselves otherwise.

Die marxistische Ökonomie stellt eine Wirtschaftstheorie dar, die im Wesentlichen auf Karl Marx Hauptwerk „Das Kapital“ beruht. Aufbauend auf den Ansätzen der klassischen Nationalökonomie werden hierbei die kapitalistischen Produktionsweisen sowie der Grundwiderspruch zwischen Kapital und Arbeit analysiert und kritisiert (vgl. Kirchgässner 1988, S. 128). Ausgehend von der marxistischen Kapitalismuskritik werden insbesondere das Wesen der kapitalistischen Ausbeutung und der Klassenkonflikt zwischen Bourgeoisie und Proletariat behandelt (vgl. Utz 1982, S. 22-23).

Diese Webseite widmet sich der Vielfalt bestehender ökonomischer Theorien und Methoden. Orientiere Dich, vergleiche, entdecke und studiere die unterschiedlichen ökonomischen Perspektiven.

Wechselkurstheorie in drei Standardlehrbüchern der Volkswirtschaftslehre Jan Priewe Quelle van Treeck Till and Janina Urban Wirtschaft neu denken Blinde Flecken in der Lehrbuchökonomie iRights Media 2016 Das Buch kann hier bestellt werden http irights media de publikationen wirtschaft neu denken Rezensierte Bücher Krugman P Obstfeld M Melitz M J 2015 …

Wir nutzen Cookies. Klicke auf "Akzeptieren" um uns dabei zu helfen, Exploring Economics immer besser zu machen!