Stock Flow Consistent Macroeconomics

Rethinking Economics, 2020

Pluralist Showcase

In the pluralist showcase series by Rethinking Economics, Cahal Moran explores non-mainstream ideas in economics and how they are useful for explaining, understanding and predicting things in economics.

Stock Flow Consistent Macroeconomics

By Cahal Moran

Michael Kalecki famously remarked, “I have found out what economics is; it is the science of confusing stocks with flows”. Stock-Flow Consistent (SFC) models were developed precisely to address this kind of confusion. The basic intuition of SFC models is that the economy is built up as a set of intersecting balance sheets, where transactions between entities are called flows and the value of the assets/liabilities they hold are called stocks. Wages are a flow; bank deposits are a stock, and confusing the two directly is a category error. In this edition of the pluralist showcase, I will first describe the logic of SFC models – which is worth exploring in depth – before discussing empirical calibration and applications of the models. Warning that there is a little more maths in this post than usual (i.e. some), but you should be able to skip those parts and still easily get the picture.

The easiest way to understand stocks versus flows is with the non-economic example of a bath: the body of water in the bath is a stock, while the water coming in through the tap (and out through the plug) is a flow. Changes in one must be accounted for by changes in the other, which in SFC circles is often phrased as “everything must come from somewhere and everything must go somewhere”. According to Marc Lavoie the logic of the approach originates with the neoclassical economist James Tobin, who Lavoie paraphrases succinctly:

“1. Stocks and flows must be fully integrated into the analysis, and their accounting must be done in a fully coherent manner.

2. All models should include a multitude of sectors and of assets,m each with its own rate of return.

3. It is important to incorporate all monetary and financial operations, and thus integrate the central bank and commercial banks.

4. There cannot be any ‘black holes’: all flows must inevitably have an origin and a destination; and all budget and portfolio adding-up constraints must be respected, both for behavioural relations and for the actual Values of the variables. “

In SFC models the constraints on how the economy behaves come from accounting identities. The simplest example is the national income equation from macroeconomics, which will be familiar to any student of economics:

Consumption + Investment + Government Spending + Net Exports = Wages + Profit + Taxes

…which means that total expenditure in an economy is equal to total income in an economy (makes sense!). Accounting identities are tautologies which should not be confused for behavioural relationships, but they can help to structure our thinking and constrain the range of possibilities. For example, a slightly less familiar identity is that in a closed economy (no foreign sector) net private lending and net public lending must sum to zero. If the private sector as a whole is receiving more money than it is spending – net saving - the government must be funding this by spending money than it is receiving – net borrowing (adding in a foreign sector tempers, rather than changes this logic).

Stock-flow economists are concerned with far more than macroeconomic identities, wishing to build up a concrete picture of how the balance sheets of firms, households, banks, governments, central banks and other entities fit together. To do this you have to think about more than accounting – which of course, long predates SFC models – and start thinking about how economic units behave. Thinking behaviour through in terms of accounting can help to build up a picture of how economic activity happens, as the SFC pioneer Wynne Godley illustrated through the example of a single firm:

“In order to finance production, the entrepreneur must obtain the funds necessary to pay his workforce in advance of sales taking place. Starting from scratch, he must borrow from banks, at the beginning of each production cycle, the sum which is needed in order to pay wages, creating a debt for the entrepreneur and, thereby, an equivalent amount of credit money, which sits initially in the hands of the labour force. Production now takes place and the produced good is sold at a price which enables the debt to be repaid inclusive of interest, while hopefully generating a surplus – that is, a profit – for the entrepreneur. When the debt is repaid, the money originally created is extinguished. An entire monetary circuit is now complete.”

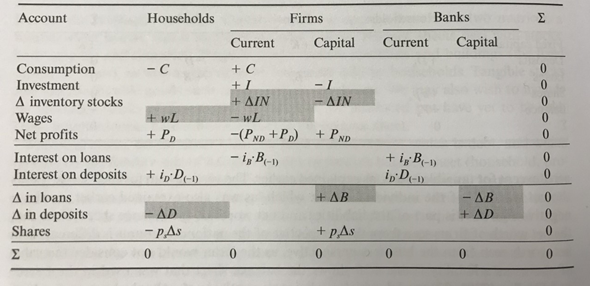

This entire process can be documented – somewhat tediously, it must be admitted – in a rigorous accounting framework. The firm’s loan is recorded, both for the bank (as an asset) and the firm (as a liability), and the wages it pays to its workers are recorded as a ‘source of funds’ for the households but a ‘use of funds’ for the firms; households consume these wages, which are recorded as a gain for the firms; and so on. Just to give you an idea of what a typical SFC ‘transactions-flow matrix’ looks like, see below (note that this only includes the flows of funds, not the assets/liabilities, which are in a separate matrix):

Coloured in grey are the activities of the firm described above, for example, the wage bill wL, which is a plus for the households and a minus for firms. Notice how the entries in the bottom row and final column are all zero? They’re everything in that column or row (respectively) added up, which is the mathematical version of “everything must come from somewhere and go somewhere”. In the real world there are a very large number of stocks and flows to account for, so the models must necessarily simplify. Even with this simplification, the models can get much more complex than the table above, but the basic logic remains the same.

Stock-Flow Consistent Empirics

One bonus of SFC models is that they look much closer to the kind of framework that actual banks, firms and governments use when they are recording their economic activity, giving them an element of realism. In particular, talking about actual financial flows between entities allows for easy application of both macroeconomic and microeconomic data as they are recorded. Behavioural relationships – such as the proportion of income spent by households – are often fairly easy to estimate from this data. Along with Francis Cripps, it was Godley who built the earliest SFC model – the Global Policy Model (GPM) for the UN – and fitted it to data, running simulations of the global economy. Recent evaluations of this model have suggested that it fits empirical estimates of the effect of increased government spending on GDP and other features of the data very well, though these are ‘stylised facts’ rather than concrete empirical tests.

One pioneer in this area has been Stephen Kinsella, who only a few years ago bemoaned the state of empirical SFC modelling before setting about fixing it, along with his co-authors. I have already referenced one of Kinsella’s SFC models in the post on Agent-Based Models, and that paper was a (pretty successful!) hybrid of the two. However, Kinsella and co have also built ‘pure’ SFC models including a 2016 model of the UK economy which aims to take account of the financial balances which govern modern economies. They use data to set key features of the model – such as tax rates, the labour share of GDP, company’s dividend and equity levels – and use it to make forecasts of the likely path of the UK economy under different scenarios. For instance, what would happen if UK prices rise? As would be expected, there is a short-term boost to consumption and GDP but an 8% expansion of mortgage debt. More interestingly, banks’ need to fund this leads to a rise in debt purchases from overseas, which the authors argue was a key imbalance of the pre-crisis period.

In economics, we sometimes have to settle for less than precise scientific predictions, since the world is so much more complex than any model. Godley gave probably the best example of what could be called qualitative prediction in his well-known 2001 paper Seven Unsustainable Processes, where he used stock-flow consistent thinking, informed by his models, to analyse the path of the US economy. Through these models he was able to make conditional predictions, stating in particular that “if the growth in net lending and money supply were to continue for another 8 years, the implied indebtedness of the private sector would then be so extremely large that a sensational day of reckoning could then be at hand”. According to Godley’s models, more government spending would allow the private sector to deleverage (remember the second macro identity above?) and prevent this. I’ll let the reader decide how useful this qualitative prediction turned out to be.

Beyond the US and UK, many researchers have applied SFC models to specific countries to understand and forecast their behaviour including Denmark, Greece, and South Africa. It would not be much of exaggeration to call the Levy Institute something of an SFC-factory, and the papers explore important scenarios such as job guarantees, or the effect of quantitative easing on asset prices. Modern work has even integrated the environment (perhaps our ultimate source of stocks and flows) into the framework. One final and particularly noteworthy application of SFC models is from the Chief Economist of Goldman Sachs (!) Jan Hatzius, who - like Godley - called the crash by using his SFC framework and continues to argue that thinking about financial balances is the best way to understand and predict the behaviour of the US (or perhaps any) economy. Having said this, his actual research papers have proven difficult to find I can’t say much more about how exactly he approaches the issue.

SFC models convincingly integrate the financial and ‘real’ sides of the economy better than any other class of model out there, making it evident that the real and monetary sides of the economy cannot be separated. As the examples of Godley and Hatzius show, the result is that SFC authors are more likely to notice financial imbalances and are better at analysing the financial side of the economy, including related sectors such as housing. Indeed, Adam Tooze gave arguably the account of the 2008 financial crisis by looking at balance sheets and financial flows and he was inspired explicitly by the work of Godley and others. As with everything macro, it would be great to see some better empirics from SFC authors, especially proper quantitative testing, but recent years show they are moving in the right direction and the usefulness of the framework as a whole is hard to deny.

There is still so much to discover!

In the Discover section we have collected hundreds of videos, texts and podcasts on economic topics. You can also suggest material yourself!