✕

1136 results

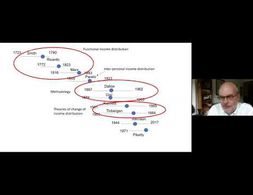

In this lecture, Branko Milanovic gives an overview of the concept of inequality as conceptualized within the classical school of thought.

Since the 1980s, the financial sector and its role have increased significantly. This development is often referred to as financialization. Authors working in the heterodox tradition have raised the question whether the changing role of finance manifests a new era in the history of capitalism. The present article first provides some general discussion on the term financialization and presents some stylized facts which highlight the rise of finance. Then, it proceeds by briefly reviewing the main arguments in the Marxian framework that proposedly lead to crisis. Next, two schools of thought in the Marxian tradition are reviewed which consider financialization as the latest stage of capitalism. They highlight the contradictions imposed by financialization that disrupt the growth process and also stress the fragilities imposed by the new growth regime. The two approaches introduced here are the Social Structure of Accumulation Theory and Monthly Review School. The subsequent part proceeds with the Post-Keynesian theory, first introducing potential destabilizing factors before discussing financialization and the finance-led growth regime. The last section provides a comparative summary. While the basic narrative in all approaches considered here is quite similar, major differences stem from the relationship between neoliberalism and financialization and, moreover, from the question of whether financialization can be considered cause or effect.

The principle of effective demand, and the claim of its validity for a monetary production economy in the short and in the long run, is the core of heterodox macroeconomics, as currently found in all the different strands of post-Keynesian economics (Fundamentalists, Kaleckians, Sraffians, Kaldorians, Institutionalists) and also in some strands of neo-Marxian economics, particularly in the monopoly capitalism and underconsumptionist school In this contribution, we will therefore outline the foundations of the principle of effective demand and its relationship with the respective notion of a capitalist or a monetary production economy in the works of Marx, Kalecki and Keynes. Then we will deal with heterodox short-run macroeconomics and it will provide a simple short-run model which is built on the principle of effective demand, as well as on distribution conflict between different social groups (or classes): rentiers, managers and workers. Finally, we will move to the long run and we will review the integration of the principle of effective demand into heterodox/post-Keynesian approaches towards distribution and growth.

Podcast series with six 12-minute parts introducing the the values and ideas behind our neoliberal economic system: where it came from, how it spread, and how we could do things differently.

Professor Joseph Aldy from Harvard Kennedy School gives us some insights about how economics can set the balance between policymakers, scientists, employers and citizens.

This paper presents an overview of different models which explain financial crises, with the aim of understanding economic developments during and possibly after the Great Recession. In the first part approaches based on efficient markets and rational expectations hypotheses are analyzed, which however do not give any explanation for the occurrence of financial crises and thus cannot suggest any remedies for the present situation. A broad range of theoretical approaches analyzing financial crises from a medium term perspective is then discussed. Within this group we focused on the insights of Marx, Schumpeter, Wicksell, Hayek, Fisher, Keynes, Minsky, and Kindleberger. Subsequently the contributions of the Regulation School, the approach of Social Structures of Accumulation and Post-Keynesian approach, which focus on long-term developments and regime shifts in capitalist development, are presented. International approaches to finance and financial crises are integrated into the analyses. We address the issue of relevance of all these theories for the present crisis and draw some policy implications. The paper has the aim to find out to which extent the different approaches are able to explain the Great Recession, what visions they develop about future development of capitalism and to which extent these different approaches can be synthesized.

Are there any limits to government spending? In times of war, particularly? And what about the aftermath of such special times when treasuries seemingly feel unshackled from any rules? And are those times really any special? That is what this paper is about.

This paper attempts to clarify how the European economic crisis from 2007 onwards can be understood from the perspective of a Marxian monetary theory of value that emphasizes intrinsic, structural flaws regarding capitalist reproduction. Chapter two provides an empirical description of the European economic crisis, which to some extent already reflects the structural theoretical framework presented in chapter three. Regarding the theoretical framework Michael Heinrich's interpretation of 'the' Marxian monetary theory of value will be presented. Heinrich identifies connections between production and realization, between profit and interest rate as well as between industrial and fictitious capital, which represent contradictory tendencies for which capitalism does not have simple balancing processes. In the context of a discussion of 'structural logical aspects' of Marx's Critique of the Political Economy, explanatory deficits of Heinrich's approach are analyzed. In the following, it is argued that Fred Moseley's view of these 'structural logical aspects' allows empirical 'applications' of Marxian monetary theories of value. It is concluded that a Marxian monetary theory of value, with the characteristics of expansive capital accumulation and its limitations, facilitates a structural analysis of the European economic crisis from 2007 onwards. In this line of argument, expansive production patterns are expressed, among other things, in global restructuring processes, while consumption limitations are mitigated by expansive financial markets and shifts in ex-port destinations.

Dr. Katherine Trebeck explains some reasons why we should believe the future of the economy should be a wellbeing economy.

In this paper the main developments in post-Keynesian macroeconomics since the mid- 1990s will be reviewed. For this purpose the main differences between heterodox economics in general, including post-Keynesian economics, and orthodox economics will be reiterated and an overview over the strands of post-Keynesian economics, their commonalities and developments since the 1930s will be outlined. This will provide the grounds for touching upon three important areas of development and progress of post-Keynesian macroeconomics since the mid-1990s: first, the integration of distribution issues and distributional conflict into short- and long-run macroeconomics, both in theoretical and in empirical/applied works; second, the integrated analysis of money, finance and macroeconomics and its application to changing institutional and historical circumstances, like the process of financialisation; and third, the development of full-blown macroeconomic models, providing alternatives to the mainstream 'New Consensus Model' (NCM), and allowing to derive a full macroeconomic policy mix as a more convincing alternative to the one implied and proposed by the mainstream NCM, which has desperately failed in the face of the recent crises.

The mandate of central banks has seemed clear for decades : keep inflation low. Nevertheless borders between monetary, financial and economic policy have been blurry even before the pandemic.. Faced with the challenges of the climate crisis, slow growth, unemployment and inequality, does the financial and monetary system need a new constitutional purpose.

Exploring Economics, an open-access e-learning platform, giving you the opportunity to discover & study a variety of economic theories, topics, and methods.

Central banking is anything but clear-cut. As this webinar with Benjamin Braun demonstrates, the standard view of central banks as independent public entities that govern financial markets and "print" money is at least partially misleading.

How did the coronavirus almost bring down the Global Financial System? What effects does monetary policy have on inequality? What role do Central Banks have in the social-ecological transformation? How could Central Banks tackle climate change? What is Central Bank Digital Currency?

The resource map contains links to a collection of resources related to the circular economy, which include videos, presentations, graphics, business case studies and articles. Many of the resources were created by the Ellen MacArthur Foundation, others are given credit where due.

This short video visualizes the destabilizing effects financial markets can have on food prices, based on a paper by Jayati Ghosh. It introduces and explains the idea of future contracts and how those are used to speculate with basic food stuffs. After establishing the concepts, the video sketches out how the increase in those practices resulted in a substantial rise and later collapse of food prices around 2008 with severe consequences for many developing countries and their people.

This lecture briefly discusses historic understandings of the limits to infinite economic growth on a finite planet (from John Stuart Mill to Marx). Taking a ecological economics perspective it discusses the metabolism of the economy, the economy as a subsystem of the environment, biophysical limits to growth, and sustainable economic scales.

How should we discuss welfare when understanding the role of growth and the viability of Growth-led development? One option is to look at subjective happiness. This provides an anti-materialistic view which may superficially appear more compatible with significant reductions in consumption in order to remain within safe ecological limits.

Public lectures on some Traditional Economic Solutions to poverty in Nigeria, specifically the Igbo Apprentice System, Yoruba Ajo Thrift Savings, and Hausa Integral Communalism.

The Trialogue is a podcast about combining historic ideas of the high-culture of the Inca and modern problems. The three authors each put their own perspectives of the topic and show insights into their actual view of economics.

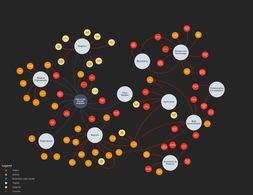

This paper provides a logical framework for complexity economics Complexity economics builds from the proposition that the economy is not necessarily in equilibrium economic agents firms consumers investors constantly change their actions and strategies in response to the outcome they mutually create This further changes the outcome which requires them …

In this short video, John Holmwood problematizes Marxian Economics from a post-colonial perspective.

Steven G. Medema is a Research Professor at Duke University. His research focuses on the History of Economic Thought, having published extensively on the issue of social costs of production (conceptualized as externalities in neoclassical economics). In this recorded seminar, he exposes his working paper on the history of the concept of externalities in economic literature, starting from Pigou’s “The Economics of Welfare” (1920), where Pigou makes the case for governmental intervention in the market where there is a divergence between private and social costs or benefits of a productive activity. T

The Nobel laureate Amartya Sen´s text analyzes three main figures in social sciences and the relation between them: the Italian economist Piero Sraffa, the Austrian philosopher Ludwig Wittgenstein, and the Italian politician and philosopher Antonio Gramsci.

This article introduces the series, “Reclaiming Africa’s Early Post- Independence History,'' from Post-Colonialisms Today. It explores the policies and thinking of African governments in the early post-independence period, and the lessons for today’s struggles for political and economic agency on the continent.

"Alexander Kravchuk is an economist and editor at Commons: Journal for Social Criticims, who has previously written about IMF conditions on loans to Ukraine. Jacobin’s David Broder asked him about the country’s economic situation and why debt cancellation is important if Ukrainians are to be able to shape their future." (quote from the interview)

Cédric Durand locates the Russian War on Ukraine in relation to Russian Economic Development and Political Economy after the collapse of the soviet union.

In this short essay, Jayati Ghosh gives an overview over the multiple ways in which the economic "fall-out" of the War in Ukraine is hitting economies and societies in the developing world.

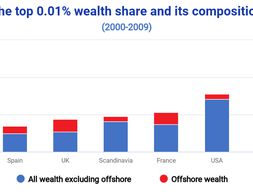

This note, by Theresa Neef, Panayiotis Nicolaides, Lucas Chancel, Thomas Piketty, and Gabriel Zucman, provides data on wealth inequality in Russia and advocates for a European Asset Registry.

"Yuliya Yurchenko is a senior lecturer and researcher in political economy at University of Greenwich. She is currently in Ukraine on an extraordinary leave. And while she writes that she is, for the moment, in relative safety, that could change any moment. Being a Ukrainian, an activist and an academic, Yuliya traveled to Ukraine on Feb 19, 2022 as part of a fact-finding and solidarity mission with a number of MPs, trade unionists and journalists. The goal, she says, of this mission is to connect with civil society organizations, trade unions, activists and politicians, and “to express direct, cross-border solidarity from the UK working class to the Ukrainian working class.”

This article by Rüdiger Bachmann et.al. discusses the economic effects of a potential cut-off of the German economy from Russian energy imports.

In this article, Hannah Ritchie presents the data we need to understand the scale of their contribution, and which countries are most reliant on Ukraine for their food supplies.

We use cookies on our website. Click on Accept to help us to make Exploring Economics constantly better!