486 Ergebnisse

Geldpolitische Maßnahmen in Reaktion auf die Finanzkrise enthalten zum einen Gender-, Klassen- und ethnische Normen und haben zum anderen asymmetrische Auswirkungen auf verschiedene gesellschaftliche Gruppen. Sie benachteiligen, wie Brigitte Young zeigt, vor allem auch Frauen und deren ökonomische Situation. Der Vortrag veranschaulicht die Interaktion von Makro- und Mikroebene in der Finanzialisierung.

In this article, Perry Mehrling, a professor of economics at Barnard College, presents and discusses three theories of banking which are guiding bank regulation. These are credit creation theory, fractional reserve theory and debt intermediation theory.

This multimedia dossier is part of the series „Understanding Finance“ by Finance Watch and explores the following questions: What is bank capital and how is it regulated? It further presents controversies on the size of bank capital in the aftermath of the financial crisis and on how bank capital affects economic activity.

"Bank Underground" is the staff blog of the Bank of England, founded to publish the views and insights of the people working for one of the world's oldest central banks. The blog covers a wide range of macroeconomic topics, mostly linked to the effects of monetary policy, of course, but not all the time. It provides timely, relevant analysis of contemporary challenges in economic policy and is thus often a perfect primer.

Recording of the Workshop “The collateral supply effect on central banking”, 04.02.2021, part of the "Next Generation Central Banking - Climate Change, Inequality, Financial Instability" conference by the Heinrich-Böll-Stiftung

In both economics textbooks and public perceptions central banks are a fact of life. On the wall of my A-level economics classroom there was the Will Rogers quote “there have been three great inventions since the beginning of time: fire, the wheel, and central banking”, summarising how many economists view the institution. There is a widespread belief that there is something different about money which calls for a central authority to manage its operation, a view shared even by staunch free marketeers such as Milton Friedman. This belief is not without justification, since money underpins every transaction in a way that apples do not, but we should always be careful not to take existing institutions for granted and central banking is no exception. In this post I will look at the idea of private or free banking, where banks compete (and cooperate) to issue their own currency.

Central banks have once again proven to be the first line of defense in crisis-ridden times. With their far reaching actions they prevented the world from experiencing a collapse of financial markets on top of the severe health and economic crisis caused by Covid-19.

How did the coronavirus almost bring down the Global Financial System? What effects does monetary policy have on inequality? What role do Central Banks have in the social-ecological transformation? How could Central Banks tackle climate change? What is Central Bank Digital Currency?

This panel was part of the conference "Next Generation Gentral Banking - Climate Change, Inequality, Financial Instability" 03. - 05.02.2021.

Could working less make people and the planet better off? Find out in this dossier by exploring the landscape of working time reduction policies and their potential for reimagining, restructuring, and redistributing time as a political resource in the 21st century economy.

In this episode of Jacobin radio, James K. Galbraith elaborates on the economic policies for the corona crisis, and Aaron Benanav on the crisis of unemployment. James K Galbraith also discusses why the economy as currently organized has been unable to deal with the challenges of the pandemic.

This Micro-Masters program on Circular Economy looks at the concept and its application from different angles, covering a very wide variety of topics (From Fossil Fuels to Biomass: A Chemistry Perspective; Circular Economy: An Interdisciplinary Approach; Economics and Policies in a Biobased Economy).

It offers a well-rounded, multidisciplinary perspective, using sciences and humanities together for a deeper understanding of the topic. A great start for newbies with Circular Economy!

The access to the course is for free, but you can also apply for full-time on-campus graduate-level programs, be it Wageninged or other universities.

John K. Galbraith recounts episodes in the history of money such as the creation of the bank of Amsterdam, John Law's fraudulent Bank Royal, the inception of the Bank of England and of the Federal Reserve to illustrate concepts such as money creation by commercial banks, the bank rate, open market operations or the money supply in general. The emotions, myths and struggles surrounding money are addressed and explained in a clear and consistent manner.

Central banking is anything but clear-cut. As this webinar with Benjamin Braun demonstrates, the standard view of central banks as independent public entities that govern financial markets and "print" money is at least partially misleading.

Dependency in Central and Eastern Europe - Self-reliance and the need to move beyond economic growth

In this essay, the author takes a critical perspective on the pursuit of growth as the solution for providing for environmental sustainability and economic stability in the countries of Central and Eastern Europe.

Drawing from the framework of dependency theory and presenting brief insights into European core-periphery relations the author then argues for the implementation of an alternative strategy to development that is built around the concept of self-reliance.

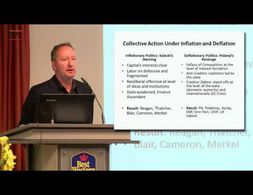

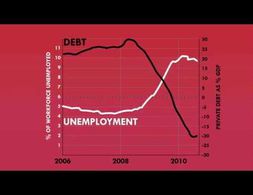

Mark Blyth criticises the political inability to solve the persistent economic crisis in Europe against the background of a deflationary environment. Ideological blockades and impotent institutions are the mutually reinforcing causes of European stagnation. The deeper roots lie in the structural change of the economic system since the 1980s, when neoliberalism emerged as hegemonic ideology. This ideology prepared the ground for austerity and resulting deflationary pressures and a strategy of all seeking to export their way out of trouble. Worryingly this is breeding populist and nationalist resentments in Europe.

This book provides a new methodological approach to money and macroeconomics. Realizing that the abstract equilibrium models lacked descriptions of fundamental issues of a modern monetary economy, the focus of this book lies on the (stylized) balance sheets of the main actors. Money, after all, is born on the balance sheets of the central bank or commercial bank.

This teaching pack focuses on the practice and real-world activities of central banks. It assumes students have a grasp of basic macroeconomic concepts already, and is therefore most suitable to be used at the end of introductory macro courses, or in more advanced macro or monetary economics courses.

The Great Recession 2.0 is unfolding before our very eyes. It is still in its early phase. But dynamics have been set in motion that are not easily stopped, or even slowed. If the virus effect were resolved by early summer—as some politicians wishfully believe—the economic dynamics set in motion would still continue. The US and global economies have been seriously ‘wounded’ and will not recover easily or soon. Those who believe it will be a ‘V-shape’ recovery are deluding themselves. Economists among them should know better but are among the most confused. They only need to look at historical parallels to convince themselves otherwise.

Eine Paneldiskussion der Online-Konferenz "Next Generation Central Banking", die im Rahmen des Projekts "Transformative Responses" von Finanzwende und in Kooperation mit der Heinrich-Böll Stiftung organisiert wurde.

Modern Monetary Theory (MMT) is a school of monetary and macroeconomic thought that focuses on the analysis of the monetary and credit system, and in particular on the question of credit creation by the state.

This panel was part of the conference "Next Generation Gentral Banking - Climate Change, Inequality, Financial Instability" 03. - 05.02.2021.

Since 2007, central banks of industrialized countries have counteracted financial instability, recession, and deflationary risks with unprecedented monetary policy operations. While generally regarded as successful, these measures also led to an exceptional increase in the size of central bank balance sheets. The book first introduces the subject by explaining monetary policy operations in normal times, including the key instruments (open market operations, standing facilities, reserve requirements, and the collateral framework).

There was a time when the world still seemed a good and above all simple place for monetary authorities Every few weeks they had to decide whether in view of the latest price developments it would be better to raise the key interest rates by a quarter point or not …

Tetteh Hormeku-Ajei, member of the Post-Colonialisms Today Working Group, discusses the role of the state in Africa during the COVID-19 pandemic.

Lukas Zeise gives an overview of economic and financial crises in the past decades (since 80s). He explains how policies and which kinds of policy were used to mitigate the crises, but also how the emergence of the crises was influenced by these policies. Furthermore, he introduces past attempts of financial market regulation and argues why present policies have not been effective and which further regulatory measures should be implemented in order to overcome financial instability and to avoid future crises.

What’s inflation? Why is it relevant? And is there an agreed theory about its roots and causes, or is it a contentious concept? That’s what this text is all about: We define what inflation actually means before we delve into the theoretical debate with an interdisciplinary and pluralist approach: What gives rise to it, what factors might influence it, and, consequently, what might be done about it?

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Wir nutzen Cookies. Klicke auf "Akzeptieren" um uns dabei zu helfen, Exploring Economics immer besser zu machen!