Trade Barriers to Development explored through various lenses

Pluralist Economics Fellowship, 2020

This essay is part of the Pluralist Economics Fellowship, jointly put together by the Minerva Schools at KGI & The Network for Pluralist Economics.

Trade Barriers to Development explored through various lenses

Johannes M. Halkenhaeusser

A central question in development economics literature is, “Why do countries stay poor?” The key disagreements are whether the lack of economic growth stems from institutions or from geography

Let’s unpack that. Firstly, economic development is the study of how economic activity can lead to an increase in welfare. It is answering the Question “How can the lives of people be improved through economic tools rather than looking at merely an increase in GDP?” An increase in per capita incomes is, however, a relevant part of the discussion. Secondly, the institutional hypothesis argues that economic development differs because institutions build incentive structures that either encourage or discourage economic activity. For example, if an institutional structure has loose ownership regulations, then it will disincentivize investment and hence hamper growth (Acemoglu, Johnson and Robinson 2001). Now take a global institution: tariff regimes that confine the ability to trade around the world. By analogy, a high tariff will disincentive trade and consequently development into an export industry because returns to any investment are diminished.[ii] Following the institutional theory, developed nation’s tariff regimes foster cash-crop dependencies in developing countries, which lead to exposure to growth dampening price volatility.

In the following sections Ricardian trade theory and Wallerstein’s World Systems Theory are used to first explore commodities, why they are price volatile, and how a dependency on them prevents a sectoral shift that could permit development. Second, the role of tariffs in the persistence of such dependencies are discussed and how international power dynamics promote the status quo. Contrasting a pure rational and a Marxian perspective the (un-)fairness of the situation is discussed.

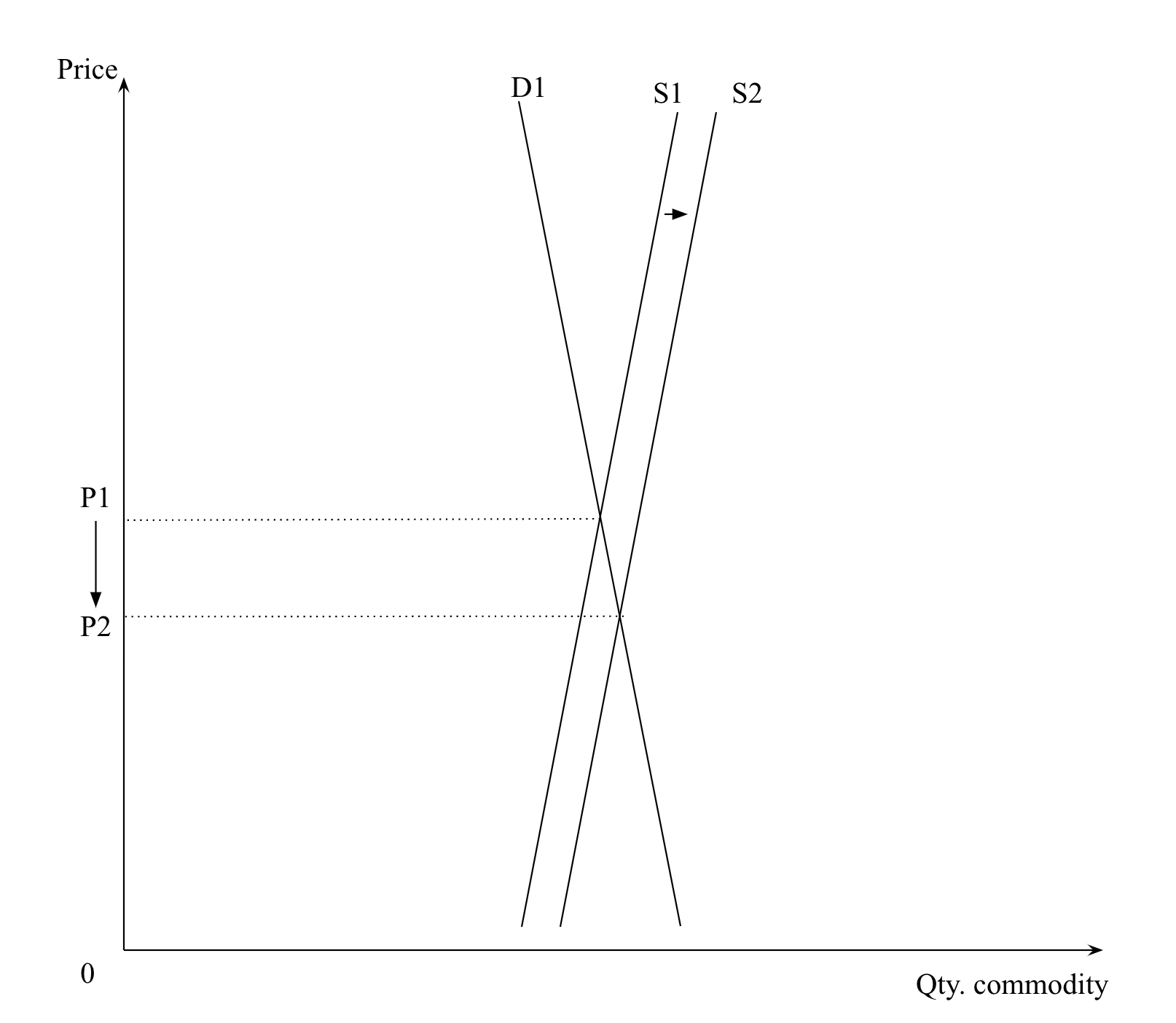

Commodities are primary products such as wheat, cotton, wool, or oil. They are unprocessed and often agricultural. A key characteristic is their price volatility, which is caused by an inelasticity to demand and supply. The elasticity of a product is defined as its relative change in demand or supply in relation to a relative price change. A demand inelastic good (such as a commodity) is one where a change in price changes the demand relatively less. Usually, consumers have a high dependency on these products because only limited substitutes exist (e.g., oil), which means they will still have to purchase the product at a higher price. Supply can be inelastic when price change leads to only little change in supply. This happens when, for example, limitations to a shift in the production such as seasons make it unreasonable to replant an entire field of wheat when its price drops. The farmer than cannot adjust their production and supply stays consistent even though the price has not. Through inverse logic, a tiny shift of demand or supply can, therefore, lead to a rapid change in prices (Figure 1). Due to the advantages of specialization,[iii] farmers will produce only one crop, and entire economies specialize on one product to reap the comparative advantage they have on said product. Comparative advantage is the Ricardian concept of one country being able to produce a product with a lower opportunity cost than another. In a simplistic world of two products and two countries, each country should focus on the product they have a comparative advantage in and then trade with the other country. As both countries produce what they are more efficient in, they can collectively produce more at a lower price than what they could have if they had been acting in isolation. In real life, farmers that seek profit maximization specialize in a product and are consequently highly dependent on the prices of just one product but cannot successfully plan due to the high volatility in prices. Price shocks are thus detrimental to the financial stability of commodity farmers (Jacks, O'Rourke and Williamson 2011). Why do farmers not seek vertical integration and start manufacturing instead?

Figure 1. A small shift in global supply leads to a large decrease in price.

Tariffs by developed countries on the developing world are a reflection of international power dynamics. The view that economies are structured hierarchically is a central theme in “World-Systems Analysis” whose most prominent figure is Immanuel Wallerstein (Goldfrank 2000) (Box 1).

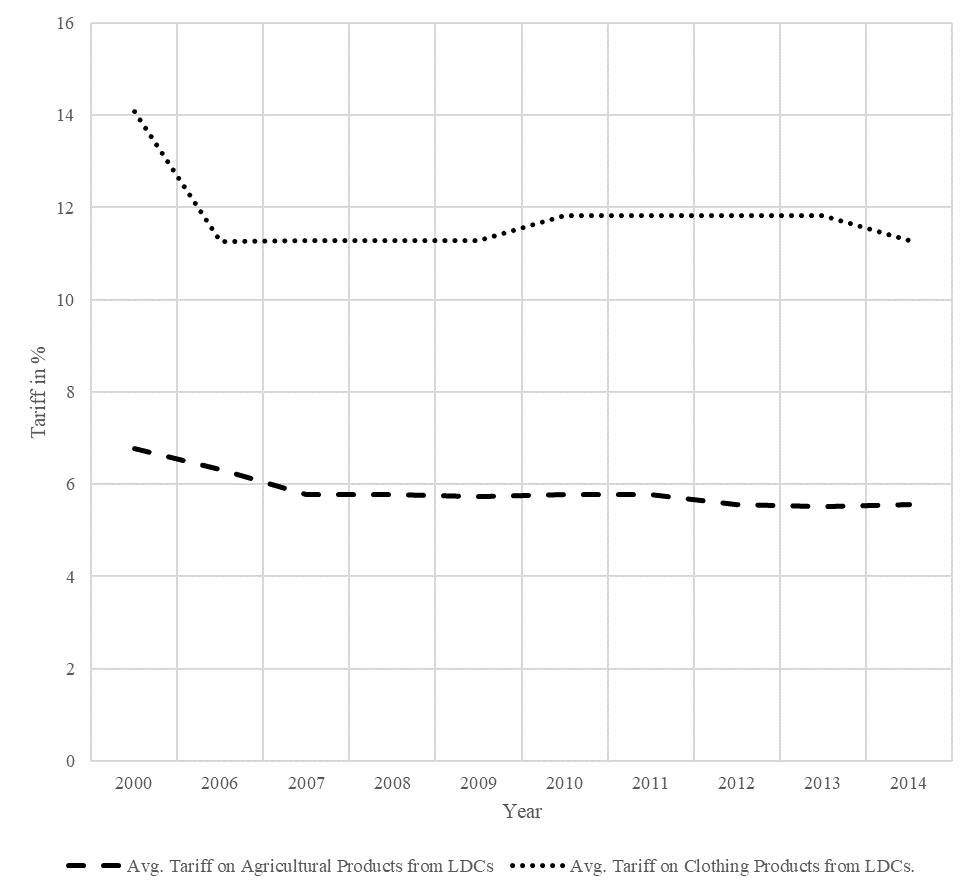

In practice, the influential, economically, and politically strong countries or customs unions such as the US or the EU will impose tariffs to suit their economic objectives. That is, tariffs are set low for primary products that are happily imported from developing countries at low cost and high for secondary or tertiary products that are the bulk of GDP and where competition is unwanted (Fig. 2). Hence, each country is put into place: developed countries produce high-profit, manufactured products while developing countries produce a low profit, volatile-price commodities. The dynamic persists because there is a relatively large supply of commodities and their economic and political power leaves individual agricultural countries dependent on developed countries’ “benevolence” to allow exports from other countries products while depending on the capital developing countries export. Thereby, the developing countries can exploit their relative power and prevent a sectoral shift.

A way for countries to break out of this trap is to protect infant industries within their economy. This strategy is also known as import substitution. An infant industry is an industry which cannot yet compete against the prices achieved by the economies of scale from decade long research and development that enabled them to have lower prices and innovate. However, such an approach is costly as the opportunity cost of not importing the products at a lower price is high. Further the transition period between the import being substitution by locally produced good may be too long pay off for any political candidate within their legislative term. Hence, the short-term costs trump the long-term benefits.

The issues of commodity dependency and power dynamics, leading to a society of inequality have not been unaddressed by the international community. A key achievement by the WTO has been that tariffs by developed countries have been decreased significantly over the past decades. However, it is the relative magnitudes of these tariffs that matter. As shown in Figure 2, average tariffs from the US on agricultural (that is commodity) products from least developed countries (LDCs) have been lower than those on textile (that being manufactured secondary) products from LDCs. Thus, they still create the incentive structure for farmers to stick to agricultural products rather than pivot to secondary products.

It posits the view that the integrated world economy contains a capital-intensive core and labour-intensive periphery. The core continually reaps of the relative surplus of their exports and exploits the periphery, thereby reinforcing the barriers to development they have constructed. “’ Backwardness’ is not seen as a late start in the race of development but as the continued deepening of a long-standing structural relation” (Goldfrank 2000). In its structuralist approach, the World Systems Theory is strongly connected to Marxist Economics themes.[1]

Figure 2. Comparing US tariffs on LDC products. Data:

To recap, we have explored why commodity prices are volatile and that this volatility is harmful to individual farmers by being a constraint to financial planning. Further, we have found that developed nations such as the US or Europe build incentive structures that drive developing countries towards commodity products frequently encouraged through the interest of their powerful private sectors (Stiglitz 2006).

From a rational perspective, the developed countries have no incentive not to pursue this strategy because it means that they would have to compete in their secondary markets with the developing countries in the long run. By depressing their ambitions, they can achieve two goals: secure cheap commodity imports and ensure export markets for their manufactured products. From the Ricardian perspective, any tariff is a barrier to an efficient market and hence a loss in welfare for all involved. That is another argument why import substitution has been opposed. However, as Stiglitz explained, the fact that developing countries open themselves up to global markets feeds back into the commodity volatility as farmers now depend on these global prices that are more volatile. At the same time, developed countries’ farmers are cushioned by government subsidies against the unpredictability of price swings (on top on getting a competitive advantage) (Rhodes and Barbieux 2019) (read this article on why British farmers are worried about losing subsidies after Brexit). Overall, developed nations do not have an incentive to create a trade policy that is fair towards developing nations.

They are unfair because, from the Wallerstein perspective, the strategy reflects classism and will ultimately lead to a radical change. Therefore, continuing with such a trade strategy will contribute to a deepening of the divide between periphery and core.

Further, the unfairness originates from the lack of alternatives that is presented to developing countries. There is no choice for them but to pay the price that exporting nations are setting through their tariff policy as developed nations have enough alternative suppliers that they can pivot to those countries that agree to the conditions. A collaboration of developing countries is unlikely as there is a large number of countries and high incentive not to comply.[iv] By extension, if developing countries desire any capital such as machinery, they have no other choice but to import it from the developed world by opening their markets as technology is protected heavily through intellectual property regulations (Stiglitz 2006).

In summary, the barriers to sectoral shift outlined above are a representation of an inequitable world system that is part of Stiglitz’s reasons why globalization has failed. They combine rational Ricardian and Marxian Wallerstein theories in an interplay of power dynamics.

Bibliography

Acemoglu, D.,, S. Johnson, and J.A. Robinson. 2001. "Reversal of fortune: Geography and institutions in the making of the modern world income distribution." National Bureau of Economic Research Working Paper No. 8460.

Blink, Jocelyn, and Ian Dorton. 2011. Economics : Course Companion. Oxford: Oxford University Press.

Goldfrank, W. L. 2000. "Paradigm Regained? The Rules Of Wallerstein s World-System Method." Journal of world-systems research 150-195.

Jacks, D. S., K. H. O'Rourke, and J. G. Williamson. 2011. "Commodity price volatility and world market integration since 1700." Review of Economics and Statistics 800-813.

Nunn, N. 2009. "The Importance of History for Economic Development." Annual Review of Economics 65-92.

Rhodes, David, and Hugo Barbieux. 2019. Brexit: EU subsidy loss 'could wipe out farms'. 07 09. Accessed 12 05, 2019. https://www.bbc.co.uk/news/uk-england-48880939.

Stiglitz, Joseph. 2006. Making Globalization Work. NEW YORK LONDON: W. W. NORTON & COMPANY.

World Bank Group. 2019. Data Bank | Millennium Development Goals . 12. https://databank.worldbank.org/reports.aspx?source=1184&series=TM.TAX.AGRI.CD.LD#.

[i] Check out https://www.exploring-economics.org/de/entdecken/stiglitz-on-globalization-why-globalization-fails-/ for famous economist Joseph Stiglitz’s explanation barriers to economic development

[ii] https://www.exploring-economics.org/de/entdecken/free-trade-economic-theories/

[iii] https://www.exploring-economics.org/de/entdecken/economic-theory-methodology-and-secure-foundatio/

[iv] Check out https://www.exploring-economics.org/en/discover/an-introduction-to-game-theory-in-public-policy/ from last year’s fellowship