The Unexpected Reckoning: Coronavirus and Capitalism

Canadian Dimesion, 2020

This contribution is part of the Exploring Economics Dossier “The Next Great Recession?” on the economic fallout of the COVID-19 pandemic and the structural crisis of globalization. It was originally published on the Canadian Dimesion.

The Unexpected Reckoning: Coronavirus and Capitalism

By Radhika Desai |

It is perhaps fitting that the seriousness of the coronavirus threat hit most of the Western world around the Ides of March, the traditional day of reckoning of outstanding debts in Ancient Rome. The previous week had been a veritable roller coaster ride. The World Health Organization (WHO) finally declared the contagion a pandemic, governments scrambled to respond, the virus dominated the news cycle as well as the plethora of mis- and dis-information on social media, cities and even entire countries shut down, markets of every imaginable sort fell and corporations announced layoffs and production stoppages. It became clear that whatever the origins, paths, and lethality of the virus now named Covid-19, it was going to sorely test Western capitalism and its coping mechanisms. Almost certainly, they were going to be found wanting. After all, problems and imbalances have accumulated in the Western capitalist system over four decades, essentially since it took the neoliberal road out of the 1970s crisis and kept going along it, heedless of the crises and problems it led to.

During these decades, as an important analysis put it, the Western capitalist world was ‘buying time’, accumulating debts, both public and private, to stave off reckoning with its narrow and shallow markets, a problem that neoliberalism, with its relentless downward pressure on wages and prices, only further exacerbated.

The 2008 crisis has been a previous moment of truth. However, it did not lead to any serious policy reorientation, only a socialization of mountains of private debts as banks deemed ‘too big to fail’ were bailed out and their executives deemed ‘too big to jail’ continued their old practices. Only ordinary mortals lost homes and jobs and had to contend with the imposition of the misery of austerity in the name of consolidating governments’ finances.

The present pandemic is certain to be different not because it is more lethal than previous ones (it is not), nor because it is causing havoc in financial markets (as most crises of neoliberal era have), but because it is exposing the weaknesses, distortions and imbalances of the productive apparatus that neoliberalism has shaped over four decades.

Neoliberalism was supposed to reinvigorate capitalism, restore the ‘animal spirits’ allegedly dampened hitherto by the ‘dead hand of the state’. However, it never did that. Growth rates over the past four decades have remained consistently below those of the ‘statist’ postwar ‘Golden Age’ of capitalism. Instead, the system of production governed by Western capitalism was stretched taut in at least three ways. Spatially, it girded the world. Temporally, it was tensed with ‘just-in-time’ production, low or no inventories and little financial wiggle room to deal with contingencies. Finally, socially, it squeezed workers and small business suppliers hard, making them yield work and products for low wages and prices and unloading all sorts of social and financial risks on them.

To be sure, the dislocations that the virus and the fight against it have already caused and those that are yet in store have been and will be costly: key parts of the world economy cannot go into shutdown for months without such costs. However, a healthy structure with some fat to spare would have resisted it much better than our lean, overwrought, highly strung, productive structure which was already due for a reckoning.

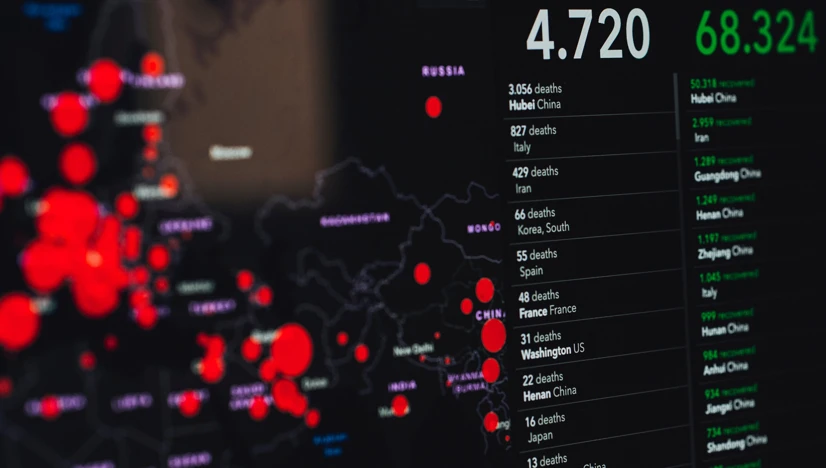

The second week of March, when the WHO upgraded Covid-19 to a ‘global pandemic’, witnessed unprecedented distress in world markets. Stock markets in the US suffered their largest one-day decline since the Crash of ‘87, despite the Federal Reserve’s emergency rate cut and promise to inject trillions (yes) into the system the previous week. This was no comfortable ‘correction’. Unusually, stock markets, usually considered riskier, were not alone. Less risky bond markets also suffered as did markets in that ‘safest’ of assets, US Treasuries and gold markets as investors sought liquidity.

Moreover, the pain was more than financial. As country after country imposed shut-downs and travel restrictions, airlines, cruise companies, airports and other travel-related corporations, along with vast swathes of the large, arguably inflated, service sector which relies mostly on face to face production and consumption, suffered closures, cutbacks and layoffs. Disrupted supply chains and collapsing markets squeezed manufacturing. To top it all, in another development, disunity among OPEC and its allies led to a price cutting war that made US shale production, one of the brighter stars on the US economic firmament in an otherwise gloomy decade, uneconomic as it is dependent on high oil prices.

Though scale of this distress pointed far beyond the virus, it was unlikely to prevent neoliberal governments from pouncing on the pandemic as the culprit responsible for the downturn. George Bush Jr. had, after all, pounced on 9/11 and pinned on it the blame for the recession, which had in fact already started months earlier, famously asking Americans to demonstrate their patriotism by going shopping.

There are at least four distinct elements to the long-term reckoning Western capitalist societies face amid ‘the worst public health crisis for a generation’.

There is still so much to discover!

In the Discover section we have collected hundreds of videos, texts and podcasts on economic topics. You can also suggest material yourself!

Discover material Suggest material

The Demand Problem and Monetary Policy Solutions

Most fundamental of all has been the low level of aggregate demand—consumer and investment—in relation to productive capacity, not to mention productive potential, that caused the growth slowdown in the 1970s. Neoliberalism, the West’s favoured solution, not only did not address it, but made matters worse by making financial ‘investment’ easier, squeezing wages and government spending and increasing inequality. The last only puts money in the pockets of those who will neither spend it nor invest it productively but only further increase the vast sums sloshing around in speculative asset markets. The reckoning with this has been postponed first by increased government borrowing to finance not much-needed social or welfare spending but ever more obscene tax cuts for the rich and vast increases in military expenditure, subsidies to corporations and the like and then through the private indebtedness that culminated in the 2008 crisis.

Such growth that these neoliberal policies afforded was chiefly due to the ‘wealth effects’ of asset price bubbles. They permitted only a narrow elite to increase consumption. In the past dozen years of ‘austerity’, even such growth has dried to a trickle and the West recorded the lowest growth rates of any decade of neoliberalism. The neoliberal option is exhausted even as a strategy for anemic growth. Demand conditions over the past decades have been sluggish, with most new consumer as well as investment demand emerging in China and other non-Western countries.

The demand shock delivered by the current pandemic has worsened this already bad situation. That the inequalities accumulated over the neoliberal decades will worsen the spread of the pandemic and that in turn will deepen inequality will only worsen the demand problem.

Over the past decade, Western governments and central bankers have found a new way of buying time for the capitalist system: making a big show of addressing growth problems through monetary policy alone. They keep the public mesmerized as policy-makers and pundits pull ingenious, even bizarre, monetary policy rabbits out of their hats—ever lower interests rates, negative interest rates, quantitative easing (QE), central bank policy guidance and what not—creating the impression that they are straining every grey cell to save the world economy. However, it is all a classic red herring: John Maynard Keynes long-ago warned that a time would come when monetary policy alone would not “be sufficient by itself to determine an optimum rate of investment”, and thus an acceptable rate of growth. Its effectiveness would be tantamount to “pushing on a string”.

What all the talk of monetary policy is distracting the public’s attention from is fiscal policy, that is, increases in government spending and investment. While sections of the financial press recognise this, they fancifully imagine that a small dose of it will prove sufficient. They forget that Keynes had gone on, in the very next sentence, to say, “I conceive, therefore, that a somewhat comprehensive socialisation of investment will prove the only means of securing an approximation to full employment.” (For Keynes, full employment was the overriding economic policy objective, one which, it would not be too much of an exaggeration to say, was the first step beyond capitalism towards a better society).

Needless to say, what Keynes coyly called “a somewhat comprehensive socialization of investment” would amount to some sort of socialism in which governments step up to make investments, if for no other reason than the private sector is unable and/or unwilling to make them. To put it another way, the scale of fiscal activism that will be required to restore an acceptable level of growth, employment and demand will indeed be so great as to raise some fundamental questions. If capitalists are unable and unwilling to do the one thing that makes the worst of them tolerable, invest and produce employment, what is the use value of the capitalist class? Why should our democratic states leave them in control of our economies? Capitalism has been at this point for at least the past decade. The current crisis may make it impossible to ignore this.

Monetary Policy Runs Out of Road

While the focus on monetary policy has diverted public attention from much needed fiscal activism, it has wreaked great havoc of its own and may now have exhausted even its perverse utility. The financial sector, the greatest beneficiary of neoliberalism’s deregulatory thrust, as well as of the adverse demand conditions it created, which sent funds into asset markets rather than into productive investment, now faces the crumbling of its main prop. The 1987 stock market crash was the first major financial crisis of the neoliberal era and the then Federal Reserve Chairman, Alan Greenspan, responded with his infamous Greenspan Put, essentially restoring vanishing liquidity—replenishing the punch bowl—so that the speculative party could go on. Since then the Federal Reserve and its sister Western central banks have responded to financial crises with further injections of liquidity, both by lowering interest rates and by the more direct means of purchasing less liquid assets, otherwise known as quantitative easing.

These practices have been justified as necessary for restoring investment, economic activity and employment. However, the only thing they have restored is the ability of the financial sector to continue its unproductive, inequality exacerbating, speculation. The result has been the series of asset bubbles, which increased the fortunes of the 1 percent and to a lesser extent, the 10 percent, and caused great economic distress among the 90 percent when they burst. The infamous lineup includes the 1987 stock market crash, the various financial crises of the early and mid 1990s culminating in the East Asian Financial Crisis of 1997-8, the dot-com crash of 2000 and the 2008 crisis.

While monetary policy has continued replenishing the punch bowl, the party has been distinctly less merry. International capital flows, for instance, remain 65 percent below their pre-2008 peak despite central bank generosity. Banks and financial institutions are weighed down by higher reserve requirements which the otherwise ineffectual post-crisis re-regulation managed to impose. Given just how much monetary throw-weight is needed to make money in financial markets today—the sheer scale of money seeking returns cannot but thin margins—even this relatively weak imposition has affected financial sector profits.

Even so, the past decade has witnessed a considerable stock market bubble which now appears to have burst. The Federal Reserve’s emergency rate cut and promise to inject trillions into the system in the first week of March not having worked, it announced a further reduction in interest rates to near zero, more asset purchases and the usual promise to “use its full range of tools” on Sunday, March 15, just before markets opened in the East. With this move, the Fed has pretty well used up all its ammunition. Since 2015, it had raised interest rates with the explicit purpose of keeping some powder dry for another crisis, to be able to have some room to reduce rates. Within the last six months, it has lost it all, most of it in March 2020. There is nothing left. Negative interest rates are so much hot air. Even the more adventurous Europeans have not ventured beyond –o.5 percent and the Fed has hitherto been unwilling to go into negative territory at all. Given this, the fact that markets refused to respond the following day, dropping like stones from the morning in the East to evening in the West, delivered a chilling verdict on the possibilities of monetary policy.

No matter how high asset valuations go in any speculative frenzy, no matter how much the Federal Reserve encourages them, ultimately they are governed by the gravity exerted by the productive economy, its needs and wants. The dot-com bubble had to burst given the valuelessness of so many of its ‘asset lite’ stocks. The housing and credit bubbles burst in 2008 when interest rates had to be raised to preserve the US dollar’s value amid rising commodity prices, leading to slowing house price rises and more and more ‘underwater mortgages’ worth more than the prices of the houses they were hypothecated to. Today the problem for the stock market may have been triggered by the pandemic but touches on deeper underlying problems.

As asset markets, which finance speculation in the value of already produced assets, grew in size over the decades, they far outstripped any reasonable proportion with productive activity—investment in the production of new goods and services (what some call the ‘real’ economy)—even as they relied on it. In the present crisis, the pertinent form of reliance is this: Banks and financial institutions accept deposits of productive corporations as their highest quality funding. Under the impact of supply and demand shocks, however, the productive corporations have been drawing down these deposits and even borrowing. Moreover, all big corporations are doing it all together at once.

While this has not triggered an immediate banking crisis, trouble may not be far off: as a Financial Times columnist recently noted, the very Dodd-Frank and other post-2008 regulatory tightening that has made banks more resilient requires them to have a minimal level of such quality deposits. “Losing these deposits so quickly threatens the liquidity profile and regulatory compliance of banks themselves. And that is before we start to see the spike in corporate downgrades and defaults that will create even more funding pressure.”

The Fed’s offer of liquidity no longer works because what the economy now needs is some way to create demand, both consumer and investment demand, to restore and expand production. In the current circumstances of low private spending and investment, this can only be the work of governments. This poses a problem. On the one hand, without it, a generalised financial and economic crisis far deeper than the temporary dip on production and consumption that the pandemic alone would cause is not far away. On the other hand, if the government steps in and actually does what is needed, it will put a question mark over the future of capitalism.

Become part of the community!

Exploring Economics is a community project. As an editor you can become part of the editorial team. You can also join one of the many groups of the international Curriculum Change movement.

Become an editor Join the movement

The Overstretched Productive Economy

As we have noted, the temporally, spatially and socially overwrought productive system shaped by four decades of neoliberalism was already due for a reckoning. While for about a decade after 1995, Western supply chains reached half-way around the world into China, their growth was already slowing well before the 2008 crisis, thanks to a complex of factors including the saturation of Western markets strangulated by neoliberalism and rising wages in China. After 2008 and the onset of austerity, moreover, the chickens of decades of ‘free trade agreements’ which were, in reality, agreements to facilitate foreign investment unfettered by labour, environmental and other standards, began to come home to the West to roost. Notwithstanding reams of literature arguing that Western wage and employment levels had nothing to do with trade, in reality, trade agreements were eating into both, particularly for blue collar workers in the West.

Whereas this discontent should have been mobilised by the left, decades of vilification of the left by the ascendant neoliberal right and decades of rightward-lurching on the part of traditionally left-wing parties, possibly thanks to their own historically deep-rooted limitations, this did not happen. Instead, as right-wing populism exploited this suffering and resulting divisions electorally through gimmicks like Brexit and trade wars, while doing little to heal them, the result has further destabilised already tenuous globe-girding productive arrangements. The coronavirus epidemic has only accelerated the advance toward a reckoning.

The Crisis of Crisis Management

The final element in this nasty cocktail relates to the mechanisms through which crises in capitalism have historically been managed—the state and politics. Decades of neoliberalism have so eroded both state and broader political capacities in Western societies that we cannot rely on them to produce a coherent response to the current crisis, whether in controlling and ending the pandemic in the short run or in the long-term economic reorientation that will be necessary.

This is most clearly seen in the sluggishness of Western responses to the pandemic. Having spent months finding fault with China’s response, the West’s own response has compared poorly to Beijing’s. The Report of the WHO-China Joint Mission on Coronavirus Disease 2019 (Covid-19) concluded that:

In the face of a previously unknown virus, China has rolled out perhaps the most ambitious, agile and aggressive disease containment effort in history. The strategy that underpinned this containment effort was initially a national approach that promoted universal temperature monitoring, masking, and hand washing. However, as the outbreak evolved, and knowledge was gained, a science and risk-based approach was taken to tailor implementation. Specific containment measures were adjusted to the provincial, county and even community context, the capacity of the setting, and the nature of novel coronavirus transmission there.

The contrast with the West could not have been starker. Take its two leading neoliberal nations, the United States and the United Kingdom. In both, four decades of neoliberalism has reduced state capacity, destroyed critical institutions and lost the best personnel. In both, political classes have lost their credibility and political systems have been disarrayed to such an extent that they have permitted outright charlatans to occupy their highest political offices. How can such depleted systems produce the political willingness and the state capacity to deal with the crisis that is unfolding? (We may add here that the pandemic is also testing the very architecture of the Eurozone.)

In the US, with a private medical system, insurance, cost and other commercial parameters continue to dictate a haphazard response in which even testing remains spotty, leaving the true scale of the pandemic itself a mystery. The UK, where the decade and more of austerity had already left the National Health Service (NHS) unable to cope with routine annual influenza seasons without postponing elective procedures, sought to make a virtue of necessity by claiming that it was aiming at ‘herd immunity’. This was nothing but a sanitized declaration of bankruptcy with a strong whiff of genocide. Considering that the pandemic would hit the poor hardest, accepting that the virus would spread, dozens of ‘loved ones’ would die, and only the fittest would survive was like saying ‘let the devil take the hindmost’. Across the Western world, the domination of information systems by private media and social media has meant a level of mis- and dis-information which can only compound the problems.

Moreover, the national-level incapacities are compounded by international rivalries and tensions making an internationally coordinated response difficult. The roots of the rivalries that characterise the twenty-first century lie, of course, in the shift in the world’s economic centre of gravity away from the West. It was, of course, compounded by the West’s slow growth in the neoliberal decades and the ability of China and certain other governments to escape from or adapt to its strictures. The West had long-ago started reacting badly to this shift: stepping up military and economic warfare against rivals and ‘upstarts’. The rise of populism has only made matters worse.

While the level of international amity after 2008 was always exaggerated, and the G20’s efforts did little to alleviate the crisis, the age of ‘America First’ and Brexit indicates a new level of discord. Trump’s attempt to offer pharmaceutical companies ‘large sums’ for exclusive access to a vaccine is perhaps the newest of lows in the behaviour of Western States amid the crisis. Even learning from China’s success is resisted in most Western policy and media quarters, so much so that medical advances towards successful treatment are not reported, let alone discussed or adopted. Meanwhile international sanctions regimes prevent demonised governments, such as Venezuela’s, from buying drugs for treatment.

Had the coronavirus pandemic struck a healthy and harmonious world economy, it would have caused great damage, but the damage would have been limited in time and space. However, it hits a world economy and capitalist system already weakened by decades of neoliberalism. Its effect is, and will remain, inextricably bound up with these underlying weaknesses. It should be clear from the foregoing that the situation contains great possibilities for left advance. That, however, we must leave to another time.

Radhika Desai is a professor in the Department of Political Studies at the University of Manitoba and currently serves as the director of the Geopolitical Economy Research Group.

Stay tuned!

Subscribe to our newsletter to learn about new debates, conferences and writing workshops.

Subscribe!