GDP Growth: It’s Complicated

Rethinking Economics, 2020

Pluralist Showcase

In the pluralist showcase series by Rethinking Economics, Cahal Moran explores non-mainstream ideas in economics and how they are useful for explaining, understanding and predicting things in economics.

GDP Growth: It’s Complicated

By Cahal Moran

How countries achieve long-term GDP growth is up there with the most important topics in economics. As Nobel Laureate Robert Lucas put it “the consequences for human welfare involved in questions like these are simply staggering: once one starts to think about them, it is hard to think about anything else.” Ricardo Hausmann et al take a refreshing approach to this question in their Atlas of Economic Complexity. They argue a country’s growth depends on the complexity of its economy: it must have a diverse economy which produces a wide variety of products, including ones that cannot be produced much elsewhere. The Atlas goes into detail on exactly what complexity means, how it fits the data, and what this implies for development. Below I will offer a summary of their arguments, including some cool data visualisations.

The notion of complexity begins with a deceptively simple insight: that a contemporary economy is dependent on the interconnected knowledge of its inhabitants. Relative to our ancestors, who each had a good working knowledge of the basic functions necessary for survival (hunting & gathering, fashioning clothing, social interaction) but not much more, modern individuals possess narrow but deep knowledge of a specific function such as dentistry or carpentry. Few of us would be capable of surviving alone these days, but collectively we are capable of not only surviving but producing and distributing things our ancestors couldn’t have dreamed of. While this productivity is dependent on material things, the true source of its value is knowing how to combine and use these material things. Toothpaste is made from chemicals, but it didn’t spring from nowhere: we had to discover which chemicals were necessary for a non-toxic method to eliminate germs and bad breath.

What’s great about the Atlas is that from this wide-ranging philosophical motivation they construct a testable, empirical theory of how modern economies grow. Since specialisation implies a larger collective range of knowledge, the diversity of products produced by an economy can be a measure of the knowledge embedded in its economy. Furthermore, rare products (such as high-quality cars) indicate a more unique set of knowledge than common ones (such as apples). The authors compare this knowledge to scrabble letters: the more words you can make in scrabble, the more letters you are likely to have. Additionally, the more unique your words, the more unique your letters. Just as in scrabble we can observe words but not letters, in economies we can observe products but not embedded knowledge.

In order to qualify as complex a country must not only be able to make a wide variety of products (diversity) – but it must be able to make products few others can make (ubiquity). In Scrabble, players with q and z will be able to make a handful of unique words, but if they have few other letters they will not be able to make too many words and so will not qualify as complex. This is likened to countries with rare natural resources which only export those resources and closely related products, and therefore are not complex (though some may be rich). Conversely, players with a large range of common letters – s, r, a, e, t, d – will be able to make many words, but few will be rare. Examples are the poorer Eurozone countries such as Greece and Portugal, which export a fair number of different products but do not engage in specialist production of unique goods.

In order to qualify as complex a country must not only be able to make a wide variety of products (diversity) – but it must be able to make products few others can make (ubiquity). In Scrabble, players with q and z will be able to make a handful of unique words, but if they have few other letters they will not be able to make too many words and so will not qualify as complex. This is likened to countries with rare natural resources which only export those resources and closely related products, and therefore are not complex (though some may be rich). Conversely, players with a large range of common letters – s, r, a, e, t, d – will be able to make many words, but few will be rare. Examples are the poorer Eurozone countries such as Greece and Portugal, which export a fair number of different products but do not engage in specialist production of unique goods.

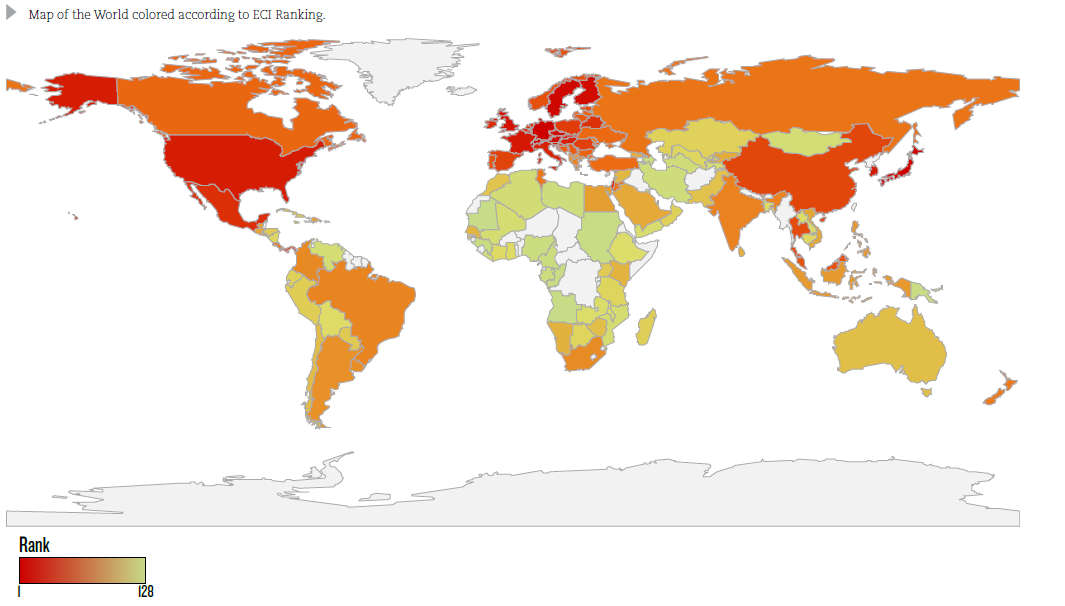

The authors calculate an index of complexity which increases with diversity but decreases with ubiquity using international trade data, and the measure has several appealing features. Firstly, it passes the smell test: it is highly correlated with income per person, and notable countries are generally where you’d expect them to be. The figure above shows a map of the world according to the complexity rankings (red means more complex, while yellow means less complex). Sensibly, hi-tech Germany and Japan are at the top, whereas low-tech countries such as Sudan and Mauritania are at the bottom. The authors show that statistically, the complexity index explains around three quarters of the variation in GDP per capita across countries – no mean feat.

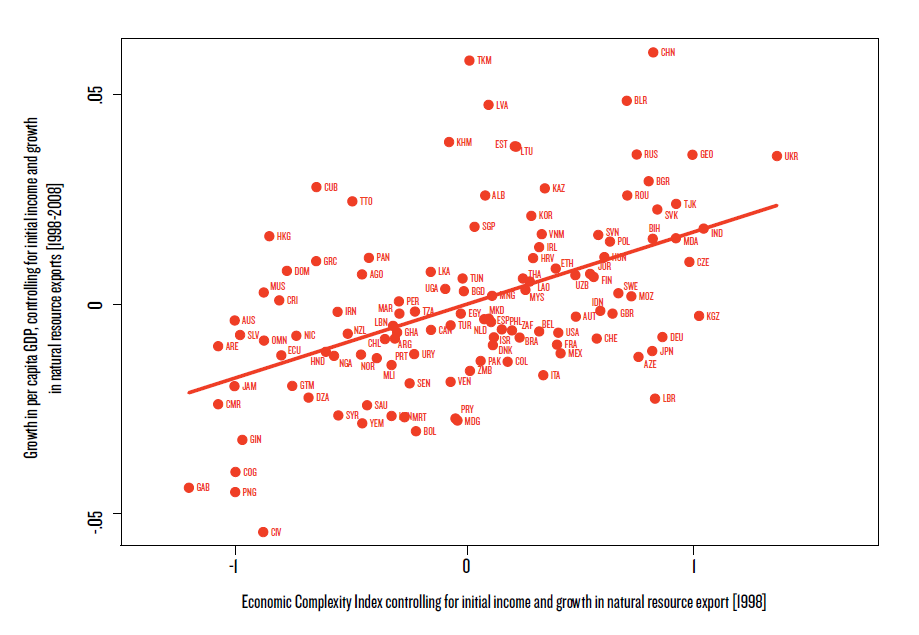

This is a good start, but critical readers might be concerned it is tautological: some countries are rich, and this is reflected in their economic complexity. But does this say anything about causality – what can currently poor and/or non-complex countries to do increase their future growth? The next figure illustrates that the complexity index also has predictive power. If a country is currently complex, its future growth will be higher. Thailand increased its complexity substantially between 1970 and 1985 and as predicted saw a rise in its long-term growth. Ghana, which started out at a similar level of both complexity and GDP, did not improve its complexity and thus saw much lower growth. The authors go on to show that other popular explanations for growth – institutions, competitiveness, and education – do not have anywhere near the same kind of predictive power as complexity.

A natural next step is to ask how a country can hope to increase its complexity. With a few noteworthy exceptions such as the East Asian Tigers, countries find it difficult to leapfrog from agriculture and basic manufacturing to producing medical imaging machines and expensive cars. The authors answer this by introducing one last concept, that of similarity. If a country wants to expand, it is best to do so into industries which require similar knowledge to its existing industries. As they put it, it is easier to go from shirts to blouses than from shirts to engines. Thus, it is better to increase knowledge and investment in targeted areas to complement existing industries than to jump the gun and expand into all new, isolated areas of production.

The authors point out that aforementioned Thailand – as well as Turkey and Poland – increased complexity and growth hugely over the past few decades as they followed this logic, expanding industries which were similar to their existing industries - whereas once more Ghana failed to adhere to this. The below visualisation shows how the goods exported by Turkey changed from 1975-2009. Each industry is a different colour, and the industries Turkey actually engages in have black outlines. It is clear that the growth is concentrated in areas where some industry already existed: for example, from 1975-1990 the growth is mostly on the right hand side of the graph, before it expands into the centre up until 2009.

What policy conclusions can we draw from this? The logic is very Hayekian, emphasising the role of interconnected, local knowledge in coordinating markets. The notion of complexity definitely speaks to the slightly mystical nature of the market system, and this may ward away from intervention. On the other hand, the above conclusions seem to suggest a role for active policy in increasing economic complexity, which is why left-wing think-tanks such as the IPPR have drawn from the Atlas to advocate industrial strategy.

There are of course several limitations of the complexity story. Firstly, as the authors acknowledge their analysis is restricted to goods which are exported – non-exports and services are not included. Not only does this exclude most of modern economies, there is an implicit export-led model of growth in this data choice (which can be disputed). Secondly and relatedly, is it even possible for every country to be ‘complex’? Can everyone export a wide variety of goods, including ones not made by anyone else? Or does the requirement for uniqueness mean there is an inherent limit to the countries which can top the index – after all, new industries are few and far between? Thirdly, ecological economists would likely balk at the absence of any real environmental considerations.

In reality though, I am carping. As a conceptually compelling, data-driven and potentially policy relevant approach to long-term growth, this is one of the more compelling theories I’ve seen. If you visit their website you can find lots of interactive tools and data visualisations, as well as more up to date publications using this framework to study specific countries.

There is still so much to discover!

In the Discover section we have collected hundreds of videos, texts and podcasts on economic topics. You can also suggest material yourself!

Discover material Suggest material