✕

301 results

Critique of neoclassical economics is presented and contrasted with the more realistic assumptions made by an complex adaptive systems and evolutionary approach.

This essay suggests to bring together two aspects of economic thought which so far have developed largely separately: degrowth and feminist economics. In this strive, the concept of care work and its role in feminist economics will be introduced and the downsides of the commodification of care work will be discussed. Subsequently, contributions to the discussion on the (re)valuation of care work will be taken into account.

Towards a post-work future: a necessary agenda to reconcile feminist & ecological concerns with work

In this essay the author outlines the basis for embracing a post-work agenda, rooted in an emancipatory potential from the domination of waged work, which could help answer both feminist and ecological concerns with work.

In this searing and insightful critique, Adrienne Buller examines the fatal biases that have shaped the response of our governing institutions to climate and environmental breakdown, and asks: are the 'solutions' being proposed really solutions? Tracing the intricate connections between financial power, economic injustice and ecological crisis, she exposes the myopic economism and market-centric thinking presently undermining a future where all life can flourish.

As opposed to the conventional over-simplified assumption of self-interested individuals, strong evidence points towards the presence of heterogeneous other-regarding preferences in agents. Incorporating social preferences – specifically, trust and reciprocity - and recognizing the non-constancy of these preferences across individuals can help models better represent the reality.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

This course introduces students to the relevance of gender relations in economics as a discipline and in economic processes and outcomes. The course covers three main components of gender in economics and the economy: (1) the gendered nature of the construction and reproduction of economic theory and thought; (2) the relevance and role of gender in economic decision-making; and (3) differences in economic outcomes based on gender. We will touch on the relevance of gender and gender relations in at least each of the following topics: economic theory; the history of economic thought; human capital accumulation; labor market discrimination; macroeconomic policy, including gender budgeting; household economics; basic econometrics; economic history; and economic crises.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

The Covid-19 pandemic has laid bare the deep structural rifts in modern capitalist economies. It has exposed and exacerbated the long-lasting systemic inequalities in income, wealth, healthcare, housing, and other aspects of economic success across a variety of dimensions including class, gender, race, regions, and nations. This workshop explores the causes of economic inequality in contemporary capitalist economies and its consequences for the economy and society in the post-pandemic reality, as well as what steps can be taken to alleviate economic inequality in the future. Drawing from a variety of theoretical and interdisciplinary insights, the workshop encourages you to reflect on your personal experiences of inequality and aims to challenge the way in which the issue is typically approached in economics.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

In 18th century Europe figures such as Adam Smith, David Ricardo, Friedrich List and Jean Baptiste Colbert developed theories regarding international trade, which either embraced free trade seeing it as a positive sum game or recommended more cautious and strategic approaches to trade seeing it as a potential danger and a rivalry and often as a zero-sum game. What about today?

The Sufficiency Policy Map is an online tool for initiatives, political actors, organisations and individuals. It provides recommendations, strategies and communication tools for realizing projects and policy around the topic sufficiency. Sufficiency projects have the aim to reduce one's own ecological footprint.

This chapter discusses the role of gender in economic relations, processes, and outcomes. Gender differences in economic outcomes such as labor force participation and wages have received growing attention from economists in the last several decades – a positive and much needed development in economic thinking.

This article reviews insights of existing literature on global care chains. A specific focus is laid on the impact that the refugee crisis has on global care chains and in turn how the crisis impacts the de-skilling of the women in the migrant workforce.

Currency hierarchy and policy space: A research agenda for development economics Barbara Fritz

Dependency in Central and Eastern Europe - Self-reliance and the need to move beyond economic growth

In this essay, the author takes a critical perspective on the pursuit of growth as the solution for providing for environmental sustainability and economic stability in the countries of Central and Eastern Europe.

Drawing from the framework of dependency theory and presenting brief insights into European core-periphery relations the author then argues for the implementation of an alternative strategy to development that is built around the concept of self-reliance.

As part of a larger series on Just Transitions, the author describes how the current corona crisis comes with new economic policy responses which would have been considered unthinkable only a year ago. Arguing that with the current high levels of confidence in politicians and scientific advice, combined with the realisation that the market has not been able to solve this problem on its own, we are now in a unique position to implement a radically different solution than was politically possible previously.

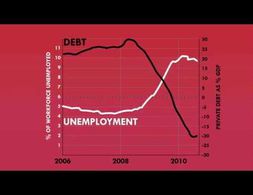

This paper attempts to clarify how the European economic crisis from 2007 onwards can be understood from the perspective of a Marxian monetary theory of value that emphasizes intrinsic, structural flaws regarding capitalist reproduction. Chapter two provides an empirical description of the European economic crisis, which to some extent already reflects the structural theoretical framework presented in chapter three. Regarding the theoretical framework Michael Heinrich's interpretation of 'the' Marxian monetary theory of value will be presented. Heinrich identifies connections between production and realization, between profit and interest rate as well as between industrial and fictitious capital, which represent contradictory tendencies for which capitalism does not have simple balancing processes. In the context of a discussion of 'structural logical aspects' of Marx's Critique of the Political Economy, explanatory deficits of Heinrich's approach are analyzed. In the following, it is argued that Fred Moseley's view of these 'structural logical aspects' allows empirical 'applications' of Marxian monetary theories of value. It is concluded that a Marxian monetary theory of value, with the characteristics of expansive capital accumulation and its limitations, facilitates a structural analysis of the European economic crisis from 2007 onwards. In this line of argument, expansive production patterns are expressed, among other things, in global restructuring processes, while consumption limitations are mitigated by expansive financial markets and shifts in ex-port destinations.

In this essay the authors take a look at how welfare could be provided in a degrowth society.

South Africa’s taxi industry was established by black people in the 1930s and has faced numerous challenges, including those posed by decades of apartheid laws. Covid-19 has highlighted contemporary challenges facing the industry and has also raised questions about how it can keep ‘driving forward’. This podcast explores questions such as what changes need to be made, and who can be the ‘drivers’ of such change.

An essay of the writing workshop on contemporary issues in the field of Nigerian economics: In Nigeria, it appears that there is nothing in the constitution, which excludes the participation of women in politics. Yet, when it comes to actual practice, there is extensive discrimination. The under-representation of women in political participation gained root due to the patriarchal practice inherent in our society, much of which were obvious from pre-colonial era till date.

This article by Rüdiger Bachmann et.al. discusses the economic effects of a potential cut-off of the German economy from Russian energy imports.

How do people make decisions? There is a class of models in psychology which seek to answer this question but have received scant attention in economics despite some clear empirical successes. In a previous post I discussed one of these, Decision by Sampling, and this post will look at another: the so-called Fast and Frugal heuristics pioneered by the German psychologist Gerd Gigerenzer. Here the individual seeks out sufficient information to make a reasonable decision. They are ‘fast’ because they do not require massive computational effort to make a decision so can be done in seconds, and they are ‘frugal’ because they use as little information as possible to make the decision effectively.

"Energy issues have always been important in international relations, but in recent years may have become even more important than in the past due to the widespread awareness of existing limits to energy sources and negative climate impacts. The course discusses global trends in energy consumption and production, various available scenarios for potential developments in the coming decades, the availability of oil reserves and the evolution of the oil industry. It then discusses natural gas and highlights the differences between oil and gas. It will also discuss renewable energy sources, nuclear energy and EU energy policy.

The course aims at providing students whose main interest is in international relations a background on energy resources, technology and economic realities to allow them to correctly interpret the political impact of current developments. It also aims at providing students, who already have a technical background in energy science or engineering, with the broad global view of energy issues that will allow them to better understand the social, economic and political impact of their technical knowledge."

Marx’s theory of the falling rate of profit is not only empirically borne out, but the theory he proposed seems to describe accurately how that happens. Furthermore, the whole process is useful for understanding the history of contemporary capitalism.

Firms are the primary places where economic activity takes place in modern capitalist economies: they are where most stuff is produced; where many of us spend 40 hours a week; and where big decisions are made about how to allocate resources. Establishing how they work is hugely important because it helps us to understand patterns of production and consumption, including how firms will react to changes in economic conditions and policy. And a well-established literature – led by post-Keynesians and institutionalists – holds that the best way to determine how firms work is to…wait for it...ask firms how they work. This a clearly sensible proposition that is contested in economics for some reason, but we’ll ignore the controversy here and just explore the theory that springs from this approach.

Environmental catastrophe looms large over politics: from the young person’s climate march to Alexandria Ocasio-Cortez’s Green New Deal, increasing amounts of political space are devoted to the issue. Central to this debate is the question of whether economic growth inevitably leads to environmental issues such as depleted finite resources and increased waste, disruption of natural cycles and ecosystems, and of course climate change. Growth is the focal point of the de-growth and zero-growth movements who charge that despite efficiency gains, increased GDP always results in increased use of energy and emissions. On the other side of the debate, advocates of continued growth (largely mainstream economists) believe that technological progress and policies can ‘decouple’ growth from emissions.

Why is money more valuable than the paper on which it is printed Monetarists link the value of money to its supply and demand believing the latter depends on the total value of the commodities it circulates According to Prabhat Patnaik this logic is flawed In his view in any …

The current international financial system has created a huge gap between the wealthy and the rest. Grounded and straightforward in his approach, Brahm calls for a turn away from economic systems dangerously steeped in ideology and stymied by politics, outlining a new global consensus based on pragmatism, common sense, and grass-roots realities.

Exploring Economics, an open-source e-learning platform, giving you the opportunity to discover & study a variety of economic theories, topics, and methods.

We use cookies on our website. Click on Accept to help us to make Exploring Economics constantly better!