✕

255 results

This book argues that mainstream economics, with its present methodological approach, is limited in its ability to analyze and develop adequate public policy to deal with environmental problems and sustainable development. Each chapter provides major insights into many of todays environmental problems such as global warming and sustainable growth.

An essay of the writing workshop on contemporary issues in the field of Nigerian economics: In Nigeria, it appears that there is nothing in the constitution, which excludes the participation of women in politics. Yet, when it comes to actual practice, there is extensive discrimination. The under-representation of women in political participation gained root due to the patriarchal practice inherent in our society, much of which were obvious from pre-colonial era till date.

The webinar covers three different topics that relate to reconciling with the Indigenous people in Australia: financial resilience, childcare/child development and economic participation through business procurement. Despite showing significant strength and resilience in the face of colonial injustices, Australian Indigenous people and their families continue to be affected by past trauma.

This panel is about discussing the international development discipline from a critical perspective, exploring how the current practice entangles with Eurocentric/neo-colonial thoughts and how can we move beyond them.

This course will cover recent contributions in economic history that, using geospatial data from anthropological maps, colonial archives and secondary sources, will explore current economic and development challenges by drawing parallels between the past and present.

The outbreak of COVID-19 has substantially accelerated the digitalization of the economy. Yet, this unprecedented growth of digital technology brought novel challenges to the labour market. Rise in income inequalities and precarious working conditions or polarization of jobs. In this essay, we try to assess what tools to use to counter these trends.

In spite of the manifold critique about the state of economics in the aftermath of the financial crisis, an even increasing presence of economists and economic experts can be observed in the public sphere during the last years. On the one hand this reflects the still dominant position of economics in the social sciences as well as the sometimes ignorant attitude of economists towards findings of other social sciences. On the other hand this paper shows that the public debate on politico-economic issues among economists is dominated by a specific subgroup of economists, tightly connected to an institutional network of “German neoliberalism”. This group of “public economists” (i) is dominant in public debates even after the financial crisis, (ii) reproduces the formative German economic imaginary of the Social Market Economy in a German neoliberal interpretation and (iii) has a good access to German economic policymaking, rooted in a long history of economic policy advice.

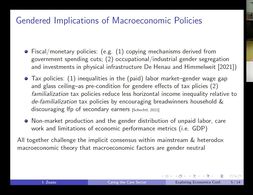

Caring the Care Sector - Contributions of Feminist Macroeconomics to Economics in the Post-COVID Era

This lecture was held in the context of the a two day conference called Which pluralism for thinking about how to achieve a more sustainable and resilient economy The practices institutions and system logics of today s economy are not suitable for appropriately addressing fundamental human needs The climate crisis …

This book is a collection of Steve Keen's influential papers published over the last fifteen years. The topics covered include methodology, microeconomics, and the monetary approach to macroeconomics that Keen - along with many other non-mainstream economists - has been developing.

This is an introductory lecture to Stock Flow Consistent SFC modelling Antoine Godin presents this family of macroeconomic models which is based on a rigorous accounting framework and guarantees a correct and comprehensive integration of all the flows and the stocks of an economy SFC models focus especially on interactions …

This lecture was held in the context of the a two day conference called Which pluralism for thinking about how to achieve a more sustainable and resilient economy The practices institutions and system logics of today s economy are not suitable for appropriately addressing fundamental human needs The climate crisis …

This book demonstrates the continuing relevance of economics for understanding the world, through a restatement of the importance of plurality and heterodox ideas for teaching and research.

In the last half century, economics has taken over from anthropology the role of drawing the powerful conceptual worldviews that organize knowledge and inform policy in both domestic and international contexts. Until now however, the colonial roots of economic theory have remained relatively unstudied. This book changes that.

The notion that the demand and supply side are independent is a key feature of textbook undergraduate economics and of modern macroeconomic models. Economic output is thought to be constrained by the productive capabilities of the economy - the ‘supply-side' - through technology, demographics and capital investment. In the short run a boost in demand may increase GDP and employment due to frictions such as sticky wages, but over the long-term successive rises in demand without corresponding improvements on the supply side can only create inflation as the economy reaches capacity. In this post I will explore the alternative idea of demand-led growth, where an increase in demand can translate into long-run supply side gains. This theory is most commonly associated with post-Keynesian economics, though it has been increasingly recognised in the mainstream literature.

In this roundtable conversation, Post-Colonialisms Today members, Omar Ghannam, Kareem Megahed and Tetteh Hormeku-Ajei, look to policies from early post-independence Africa to tackle issues exacerbated by the COVID- 19 pandemic.

Post-Colonialisms Today researcher Chafik Ben Rouine looks to Tunisia’s post-independence central banking method to provide insight on what progressive monetary policy can look like.

Post-Colonialisms Today researchers Kareem Megahed and Omar Ghannam explain how early post-independence Egypt sought economic independence via industrialization.

If there’s one method economists have neglected the most, it’s qualitative research. Whereas economists favour mathematical models and statistics, qualitative research seeks to understand the world through intensive investigation of particular circumstances, which usually entails interviewing people directly about their experiences. While this may sound simple to quantitative types the style, purpose, context, and interpretation of an interview can vary widely. Because of this variety, I have written a longer post than usual on this topic rather than doing it a disservice. Having said that, examples of qualitative research in economics are sadly scant enough that it doesn’t warrant multiple posts. In this post I will introduce qualitative research in general with nods to several applications including the study of firm behaviour, race, Austrian economics, and health economics. More than usual I will utilise block quotes, which I feel is in the spirit of the topic.

How do people make decisions? There is a class of models in psychology which seek to answer this question but have received scant attention in economics despite some clear empirical successes. In a previous post I discussed one of these, Decision by Sampling, and this post will look at another: the so-called Fast and Frugal heuristics pioneered by the German psychologist Gerd Gigerenzer. Here the individual seeks out sufficient information to make a reasonable decision. They are ‘fast’ because they do not require massive computational effort to make a decision so can be done in seconds, and they are ‘frugal’ because they use as little information as possible to make the decision effectively.

The principle of effective demand, and the claim of its validity for a monetary production economy in the short and in the long run, is the core of heterodox macroeconomics, as currently found in all the different strands of post-Keynesian economics (Fundamentalists, Kaleckians, Sraffians, Kaldorians, Institutionalists) and also in some strands of neo-Marxian economics, particularly in the monopoly capitalism and underconsumptionist school In this contribution, we will therefore outline the foundations of the principle of effective demand and its relationship with the respective notion of a capitalist or a monetary production economy in the works of Marx, Kalecki and Keynes. Then we will deal with heterodox short-run macroeconomics and it will provide a simple short-run model which is built on the principle of effective demand, as well as on distribution conflict between different social groups (or classes): rentiers, managers and workers. Finally, we will move to the long run and we will review the integration of the principle of effective demand into heterodox/post-Keynesian approaches towards distribution and growth.

This open access book presents an alternative to capitalism and state socialism through the modelling of a post-market and post-state utopia based on an upscaling of the commons, feminist political economy and democratic and council-based planning approaches.

Post-Colonialisms Today researchers Kareem Megahed and Omar Ghannam discuss the importance of industrial policy during the pandemic to improve domestic capacity for manufacturing essential goods.

Tetteh Hormeku-Ajei, member of the Post-Colonialisms Today Working Group, provides insight on the history of primary commodity export dependence in Africa, and relates it to the difficulties African governments are facing finding necessary resources to tackle the COVID-19 pandemic.

In this article, Jihen Chandoul discusses the importance of food sovereignty in Africa, reflecting on the continent’s early post independence movements for self sufficiency.

This course will fundamentally ask whether we can, or even should use the word ‘decolonising’ in our pursuit of a better economics?

What’s inflation? Why is it relevant? And is there an agreed theory about its roots and causes, or is it a contentious concept? That’s what this text is all about: We define what inflation actually means before we delve into the theoretical debate with an interdisciplinary and pluralist approach: What gives rise to it, what factors might influence it, and, consequently, what might be done about it?

Tetteh Hormeku-Ajei, member of the Post-Colonialisms Today Working Group, discusses the role of the state in Africa during the COVID-19 pandemic.

Along with addressing core conceptual issues in defining heterodox economics, we will cover in some detail five heterodox traditions in economics: Marxian Economics, Institutional Economics, Post-Keynesian Economics, Feminist Economics, and Ecologi-cal Economics. In the first class meeting, we discuss the structure and goals of the course, as well as the expectations and requirements from the students. In addition, we will discuss the concept of heterodoxy in economics, along with discussing the concepts and key issues in mainstream and neoclassical economics.

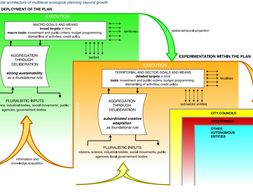

The present working paper is dedicated to fill a void in the degrowth literature related to the aspect of planning to achieve post-growth models of societies. The authors propose a new framework that focuses on non-market forms of planning and propose multi-level planning institutions to mediate the local level with society-wide and global institutions.

Michael Kalecki famously remarked “I have found out what economics is; it is the science of confusing stocks with flows”. Stock-Flow Consistent (SFC) models were developed precisely to address this kind of confusion. The basic intuition of SFC models is that the economy is built up as a set of intersecting balance sheets, where transactions between entities are called flows and the value of the assets/liabilities they hold are called stocks. Wages are a flow; bank deposits are a stock, and confusing the two directly is a category error. In this edition of the pluralist showcase I will first describe the logic of SFC models – which is worth exploring in depth – before discussing empirical calibration and applications of the models. Warning that there is a little more maths in this post than usual (i.e. some), but you should be able to skip those parts and still easily get the picture.

Firms are the primary places where economic activity takes place in modern capitalist economies: they are where most stuff is produced; where many of us spend 40 hours a week; and where big decisions are made about how to allocate resources. Establishing how they work is hugely important because it helps us to understand patterns of production and consumption, including how firms will react to changes in economic conditions and policy. And a well-established literature – led by post-Keynesians and institutionalists – holds that the best way to determine how firms work is to…wait for it...ask firms how they work. This a clearly sensible proposition that is contested in economics for some reason, but we’ll ignore the controversy here and just explore the theory that springs from this approach.

In both economics textbooks and public perceptions central banks are a fact of life. On the wall of my A-level economics classroom there was the Will Rogers quote “there have been three great inventions since the beginning of time: fire, the wheel, and central banking”, summarising how many economists view the institution. There is a widespread belief that there is something different about money which calls for a central authority to manage its operation, a view shared even by staunch free marketeers such as Milton Friedman. This belief is not without justification, since money underpins every transaction in a way that apples do not, but we should always be careful not to take existing institutions for granted and central banking is no exception. In this post I will look at the idea of private or free banking, where banks compete (and cooperate) to issue their own currency.

We use cookies on our website. Click on Accept to help us to make Exploring Economics constantly better!