✕

174 results

This course provides a simple introduction to problems that social scientists are working on (e.g. racial disparities, inequality and climate change) in a manner that does not require any prior background in Economics or Statistics.

This statistics and data analysis course will introduce you to the essential notions of probability and statistics We will cover techniques in modern data analysis estimation regression and econometrics prediction experimental design randomized control trials and A B testing machine learning and data visualization We will illustrate these concepts with …

The authors show how consumers, business, the Federal Reserve, and government take into account what's going on around them to make critical decisions like buying new products, building new factories, changing interest rates, or setting budget goals. The book provides a clear roadmap to understanding the whole story behind the global economy.

Written by the Nobel Prize winners in Economics Robert Shiller and George Akerlof, this book shows how deception and manipulation play a big role in the economic behavior of individuals, as well as showing how the assumption of "perfect information" is far away from the truth. Through both quantitative data and stories of how to reduce this noxious phenomenon, the authors paint a pretty different picture of how markets really works in a hyper-communicative scenario like nowadays.

How countries achieve long-term GDP growth is up there with the most important topics in economics. As Nobel Laureate Robert Lucas put it “the consequences for human welfare involved in questions like these are simply staggering: once one starts to think about them, it is hard to think about anything else.” Ricardo Hausmann et al take a refreshing approach to this question in their Atlas of Economic Complexity. They argue a country’s growth depends on the complexity of its economy: it must have a diverse economy which produces a wide variety of products, including ones that cannot be produced much elsewhere. The Atlas goes into detail on exactly what complexity means, how it fits the data, and what this implies for development. Below I will offer a summary of their arguments, including some cool data visualisations.

There are three things one can do in this website - 1. Learn 2. Help Teach 3. Sign up MOOC. This is a semester-long graduate course in Econometrics. This course is intended for graduate students in economics-related fields and more generally in social sciences. The course includes an overview of the models and theory and applications using Stata, R, or SAS

programs. This econometrics class covers about 15 of the most commonly used econometric models in economics, such as linear regression, panel data models, probit and logit models, limited dependent variable models, count data models, time series models, and many more.

The Great Recession 2.0 is unfolding before our very eyes. It is still in its early phase. But dynamics have been set in motion that are not easily stopped, or even slowed. If the virus effect were resolved by early summer—as some politicians wishfully believe—the economic dynamics set in motion would still continue. The US and global economies have been seriously ‘wounded’ and will not recover easily or soon. Those who believe it will be a ‘V-shape’ recovery are deluding themselves. Economists among them should know better but are among the most confused. They only need to look at historical parallels to convince themselves otherwise.

Here we look at the effect of the 2008 Climate Change Act passed in Parliament in the United Kingdom as an effort to curb emissions in all sectors. The Act aside from setting goals to become a low-carbon economy sets up an independent committee on Climate Change to ensure the implementation of policies to comply with the ultimate goal of 80% reduction in total emissions in 2050. I make use of the Synthetic Control Method (SCM) to create a comparative case study in which the creation of a synthetic UK serves as a counterfactual where the treatment never occurred (Cunningham, 2018).

Firms are the primary places where economic activity takes place in modern capitalist economies: they are where most stuff is produced; where many of us spend 40 hours a week; and where big decisions are made about how to allocate resources. Establishing how they work is hugely important because it helps us to understand patterns of production and consumption, including how firms will react to changes in economic conditions and policy. And a well-established literature – led by post-Keynesians and institutionalists – holds that the best way to determine how firms work is to…wait for it...ask firms how they work. This a clearly sensible proposition that is contested in economics for some reason, but we’ll ignore the controversy here and just explore the theory that springs from this approach.

Esther Duflo discusses the fact that in social policy one cannot check the big questions, i.e. whether development assistance as an aggregate is helpful, because there is no counterfactual. She then suggests to focus on smaller questions such as what prevents or incentiveses people from immunizing their kids or whether mosquito bednets should be distributed for free. These questions can be answered by using randomized control trials as in the medical sciences. Thus, she argues, by bringing the experimental method to social policy analysis better decisions as to where allocate funds can be made.

This multimedia dossier is part of the series „Understanding Finance“ by Finance Watch. The dossier focuses on universal banks – banks that pursue commercial and investment banking and points out several problems of those megabanks, especially in the context of the financial crisis (too big to fail).

Is our system capable of energy transition and climate protection? How plural is economic policy in practice and who makes the big decisions? What kind of change do we want?

The third edition of Political Economy: The Contest of Economic Ideas is a fully updated overview of the political economy and its connection with social concerns. This book investigates the main traditions of economic ideas and provides a 'big picture' overview of the analytical tools and value judgements associated with competing schools of economic thought.

Examine what would happen if we were to deploy blockchain technology at the sovereign level and use it to create a decentralized cashless economy. This book explains how finance and economics work today, and how the convergence of various technologies related to the financial sector can help us find solutions to problems, such as excessive debt creation, banks getting too big to fail, and shadow banking.

Big challenges lie ahead for our society: increased automation of work, and the threat of catastrophic climate change. But so, too, are the huge possibilities presented by new technology and better ways of organising our economy in the wake of neoliberalism's failure.

Although money plays a key role in our lives, the workings of our monetary system are a mystery to most of us. ‘The Waterworks of Money’ by cartographer Carlijn Kingma is an attempt to demystify the world of big finance. It visualizes the flow of money through our society, its hidden power made manifest.

If you see money as water, our monetary system is the irrigation system that waters the economy. The better the flow, the more prosperous society will be. Just as water makes crops thrive, so money sets the economy in motion. Or at least that’s the idea. In reality, inequality is growing in many countries and people are dealing with a ‘cost of living crisis’. Meanwhile, the progress with making our economies sustainable is stalling, and financial instability remains an ongoing threat. These problems cannot be seen in isolation from the architecture of our money system. If we truly want to tackle them, we will have to address the design flaws of our current money system.

For more info check: https://www.waterworksofmoney.com or https://www.carlijnkingma.com

For the Dutch version of the animation check: https://www.ftm.nl/waterwerk

Current exhibitions: 'The Future of Money' at Kunstmuseum Den Haag, 14 April, 2023 - 8 September 2023. 'Plumbing The System' at the Dutch Pavilion of the Venice Biennale, 20 May 2023 - 26 November 2023

The second animation video of this series will be released in September 2023.

The Waterworks of Money is a collaboration of cartographer Carlijn Kingma, investigative financial journalist Thomas Bollen, and professor New Finance Martijn van der Linden. Kingma spent 2300 drawing hours, based on in-depth research and interviews with more than 100 experts –ranging from central bank governors and board members of pension funds and banks to politicians and monetary activists.

The structure of our monetary system is not a natural phenomenon. We can choose to change its architecture. Designing the money system– and the laws and institutions that govern it–is ultimately a democratic task, and not a commercial or technocratic one. In practice, however, there is a major obstacle impeding the democratic process: financial illiteracy. By making finance and money needlessly complex, economists, bankers and tax specialists have turned most of us into ‘financial illiterates’. Everyone who doesn’t speak their financial jargon is excluded from the democratic debate on how our monetary system should work.

The Waterworks of Money bypasses the financial jargon. It is an attempt to boost systemic financial literacy. Only if ordinary citizens develop their own vocabulary to participate in the debate about their financial future, can they tell their politicians which kind of ‘financial irrigation system’ they want.

Authors: Carlijn Kingma, Thomas Bollen, Martijn Jeroen van der Linden

Animation: Tiepes, Christian Schinkel, Cathleen van den Akker

Narrator: Loveday Smith

Translation: Erica Moore

Voice recording: Huub Krom

Music and sound: Rob Peters

Photography: Studio OPPA

Partners: Follow the Money, De Haagse Hogeschool, Stimuleringsfonds Creatieve Industrie, Brave New Works, Rabobank, Kunstmuseum Den Haag, Rijksmuseum Twenthe

Sporting events can be seen as controlled, real-world, miniature laboratory environments, approaching the idea of “holding other things equal” when exploring the implications of decisions, incentives, and constraints in a competitive setting (Goff and Tollison 1990, Torgler 2009). Thus, a growing number of studies have used sports data to study decision-making questions that have guided behavioral economics literature.

The Atlas of Economic Complexity is an award-winning data visualization tool that allows people to explore global trade flows across markets, track these dynamics over time and discover new growth opportunities for every country.

The outbreak of COVID-19 has substantially accelerated the digitalization of the economy. Yet, this unprecedented growth of digital technology brought novel challenges to the labour market. Rise in income inequalities and precarious working conditions or polarization of jobs. In this essay, we try to assess what tools to use to counter these trends.

In this article, Hannah Ritchie presents the data we need to understand the scale of their contribution, and which countries are most reliant on Ukraine for their food supplies.

One of the worlds leading economists of inequality, Branko Milanovic presents a bold new account of the dynamics that drive inequality on a global scale. Drawing on vast data sets and cutting-edge research, he explains the benign and malign forces that make inequality rise and fall within and among nations.

The economist Thomas Piketty presents a central argument of his book Capital in the Twenty-First century: if the rate of return to capital generally exceeds an economy's growth rate, this leads to a higher concentration of wealth in the long run. He furthermore shows with historical data how wealth and income inequality increased within the past decades.

First some definitions regarding econometrics, regressions, types of data and independent and dependent variables are given. Then the basic function of a simple regression analysis is explained. Lastly, there is discussion of the meaning of the error term.

In this keynote lecture during the conference „The Spectre of Stagnation? Europe in the World Economy“, Till van Treek presents research on how changes in income distribution lead to macroeconomic instability and crisis, focusing on currents accounts. Treek presents the relative income hypothesis in contrast to other mainstream and Post-Keynesian explanations. The relative income hypothesis proposes that aggregate demand increases and savings decrease with rising personal income inequality due to upward looking status comparison – but effects depend on the quantile where income inequality increases. Treek points to the importance of accounting for both income and functional income distribution and underlines his arguments with data comparing different pattern in Germany and the U.S.

Economist and politician Costas Lapavitsas: presents differing theoretical definitions of financialization, namely from Marxist and Post-Keynesian thinkers and compares their approaches. By presenting pattern and features of the economic and financial crisis, he interprets the latter as a crisis of financialization. Lapavitsas emphasizes his arguments by presenting data from the U.S. and Germany on the transformation of business, banks and households.

What data is used in the economic models of the IPCC? How problematic is it, that tipping points are often ignored? A very interesting presentation by Steve Keen during the OECD Conference "Averting Systemic Collapse".

This article provides a contextual framework for understanding the gendered dimensions of the COVID-19 pandemic and its health, social, and economic outcomes. The pandemic has generated massive losses in lives, impacted people’s health, disrupted markets and livelihoods, and created profound reverberations in the home. In 112 countries that reported sex-disaggregated data on COVID-19 cases, men showed an overall higher infection rate than women, and an even higher mortality rate. However, women’s relatively high representation in sectors hardest hit by lockdown orders has translated into larger declines in employment for women than men in numerous countries. Evidence also indicates that stay-at-home orders have increased unpaid care workloads, which have fallen disproportionately to women. Further, domestic violence has increased in frequency and severity across countries. The article concludes that policy response strategies to the crisis by women leaders have contributed to more favorable outcomes compared to outcomes in countries led by men.

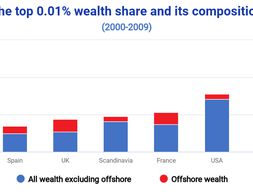

This note, by Theresa Neef, Panayiotis Nicolaides, Lucas Chancel, Thomas Piketty, and Gabriel Zucman, provides data on wealth inequality in Russia and advocates for a European Asset Registry.

This course will cover recent contributions in economic history that, using geospatial data from anthropological maps, colonial archives and secondary sources, will explore current economic and development challenges by drawing parallels between the past and present.

Macroeconomics in Context: A European Perspective lays out the principles of macroeconomics in a manner that is thorough, up to date, and relevant to students. With a clear presentation of economic theory throughout, this latest addition to the bestselling "In Context" set of textbooks is written with a specific focus on European data, institutions, and historical events, offering engaging treatment of high-interest topics, including sustainability, Brexit, the euro crisis, and rising inequality. Policy issues are presented in context (historical, institutional, social, political, and ethical), and always with reference to human well-being.

In this book, the author critically examines a number of socialist proposals that have been put forward since the end of the Cold War. It is shown that although these proposals have many merits, their inability effectively to incorporate the benefits of information technology into their models has limited their ability to solve the problem of socialist construction. The final section of the book proposes an entirely new model of socialist development, based on a "needs profile" that makes it possible to convert the needs of large numbers of people into data that can be used as a guide for resource allocation. This analysis makes it possible to rethink and carefully specify the conditions necessary for the abolition of capital and consequently the requirements for socialist revolution and, ultimately, communist society.

The policy briefing provides a data-rich overview over the budgets planned for public services in the UK and their connection to inflation expectations. It highlights the fact that inflation might lead to "invisible" cuts to public sector budgets.

We use cookies on our website. Click on Accept to help us to make Exploring Economics constantly better!