Japanification, Quantitative Easing, money creation and Re-Igniting the U.S. Economy

Odd Lots Podcast, 2020

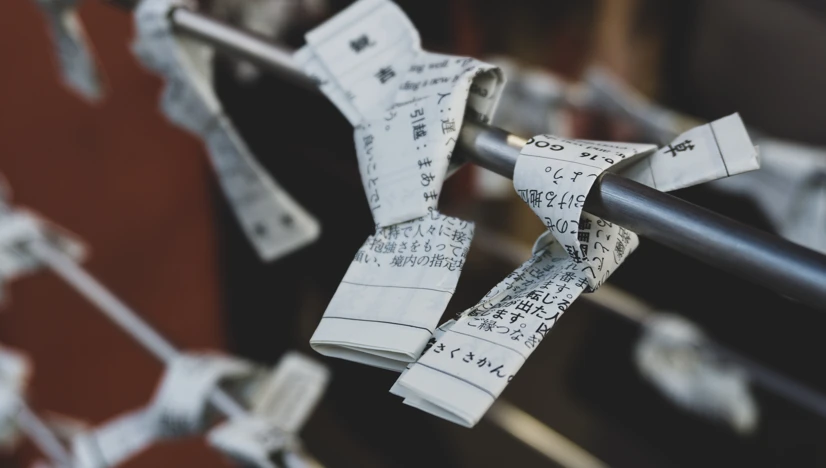

Photo by Marco Marques on Unsplash

Richard Werner, an economist at Linacre College at the University of Oxford, touches on a number of topics in this Odd Lots Podcast episode. As one of the pioneers when it comes to money and credit creation, he gives interesting insights into his early research on this topic. He then explains what he calls the “Quantity Theory of Credit”. This is an alternative to the "Quantity Theory of Money". Finally, as the title suggests he touches upon "Quantitative Easing" and on what he learned studying years of the Japanese economy, and what it means for the current crisis.

Comment from our editors:

Still, many economists use the so-called loanable-funds theory and model banks as merely financial intermediaries. However, to understand the world, the economy and some of the problems these both are facing, it is crucial to understand that banks can simply create money. The majority of credit and money is created by commercial banks. Right in the beginning of the talk, Richard Werner, takes you through how he discovered this misunderstanding in the early 1990s and, more importantly, how it shaped his thinking about economics throughout his career. Also, he explains a number of highly relevant economic concepts regarding money, capital flows and modern central banking.

Go to: Japanification, Quantitative Easing, money creation and Re-Igniting the U.S. Economy