A holistic theory of financialisation

Photo by Héctor J. Rivas from Unsplash

Exploring Economics, 2023

A holistic theory of financialisation

What is financialisation? This text offers a theoretical grounding of the financialisation debate, arguing that any theory of financialisation – no matter if it makes use of Keynesian or Marxian thought – has to take into account the organic unity of financial and non-financial realms of the capitalist system. Neither is the financial sphere detached from the ‘real world’ of production, nor has it become dethatched from it under neoliberalism. What has changed under neoliberalism is the complex articulation of unity and separation of production and circulation as moments of profit creating activity. This text elaborate on this thought, hereby heavily relying on the work of Sotiropoulos, Milos and Lapatsioras (2013), who in turn developed their analysis in reference to Bryan and Rafferty (2009).

The term ‘financialisation’ appeared already in the 1970s in Marxists academic circles, but became widely used among different scientific schools and disciplines in the 2000s and especially during and after the Great Recession from 2007-2009 (see Lapavitsas & Powell, 2013; Davis & Kim, 2015, 2015; Ascher, Hardin & Klein, 2022 for literature overviews at different stages of the debate). As Lapavitsas and Soydan (2022) have pointed out, the literature on financialisation is vast and continues to grow rapidly. Financialisation refers to the increasing dominance of finance in the economy and society, and it covers a broad range of phenomena related to the expansion and intensification of financial markets, financial institutions, and financial logics. Some of the key aspects of financialisation include the rise of new financial instruments and institutions, such as derivatives, securitisation, hedge funds, and private equity; the growing importance of financial profits for non-financial corporations and the emergence of shareholder value as a dominant corporate governance principle; the spread of financialisation to everyday life, including household debt, consumer credit, and asset-based welfare; and the impact of financialisation on inequality, stability, and sustainability.

The diversity of the literature fits well to the frequently quoted definition by Epstein (2005), equating financialisation broadly with „the increasing role of financial motives, fnancial markets, financial actors and financial institutions in the operation of domestic and interntional economies“ (ibid., p. 3). In the past, however, doubts have arisen about the scientific applicability of the concept, especially when it comes to the analysis of concrete changes of investment patterns in the realm of ‘natural assets’ (Christophers, 2015; Ouma, 2016). According to this critique, the concept of financialisation has undergone a similar career as ‘globalisation’, ‘neoliberalism’ or even ‘capitalism’, in the course of which it changed from the explanandum to the explanans (Ouma, 2015a); the process of financialisation is taken for granted, while the concrete historical and empirical causal conditions of its realisation and perpetuation are being moved into the background (Ouma, 2016, p. 2).

The “limits of financialisation” (Christophers, 2015) as a scientific concept can be illustrated by reference to the dominant narrative of ‘Golden Age’-capitalism, according to which a post-war period of high, stable and inclusive growth has been replaced by a neoliberal period in the 1970s. Financialisation is thought to stand at the heart of neoliberalism, giving rise to a to a predatory version of capitalism which inherently tends to crisis (Sotiropoulos, Milos & Lapatsioras 2013, p. 137). While banks and financial intermediaries have been subjected to the needs and limits of the ‘real economy’ in response to the Great Depression, the 1970s witnessed a fatal paradigm shift in economic science and policy making alike:

Efficient financial market theory … replaced the theoretical visions of Keynes and Minsky, and the existing system of tight financial regulation was deconstructed through radical deregulation pushed by financial institutions and justified by efficient marked theory. (Crotty, 2009, p. 564)

Just as Keynes had cautioned against the dysfunctional role „the function-less investor“ (Keynes, 1997, p. 376), many Post-Keynesian authors associate the neoliberal restructuring of the econ- omy and hence the reasons behind the Great Recession with the re-emergence of a the ‘rentier’ (see e.g. Hudson, 2010). The shift to neoliberalism appears as the “outcome of a conflict between the productive and the parasitic parts of the society” (Sotiropoulos, Milos & Lapatsioras 2013, p. 137).

This may depict an exaggerated picture of the ‘Golden Age’-narrative of financialisation. But it helps to understand the Keynesian problematic, which builds on the perception that the separation of ownership and possession in the late 19th century and the emergence of shares as a major investment vehicle gave birth to a new social class, which confronts the business class and the earning class in a tripartite class stratification (Sotiropoulos, Milos & Lapatsioras 2013, p. 20). This investing class makes use of its “cumulative oppressive power” (Keynes, 1973, p. 376) via deriving ‘function-less’ income form lending scare liquid capital. Financial markets thus play an ambivalent role in modern capitalism, “they sometimes facilitate investment but sometimes add greatly to the instability of the system” (ibid. p. 150f), namely if they engage in speculation instead of in enterprise (Sotiropoulos, Milos & Lapatsioras, 2013, p. 21).

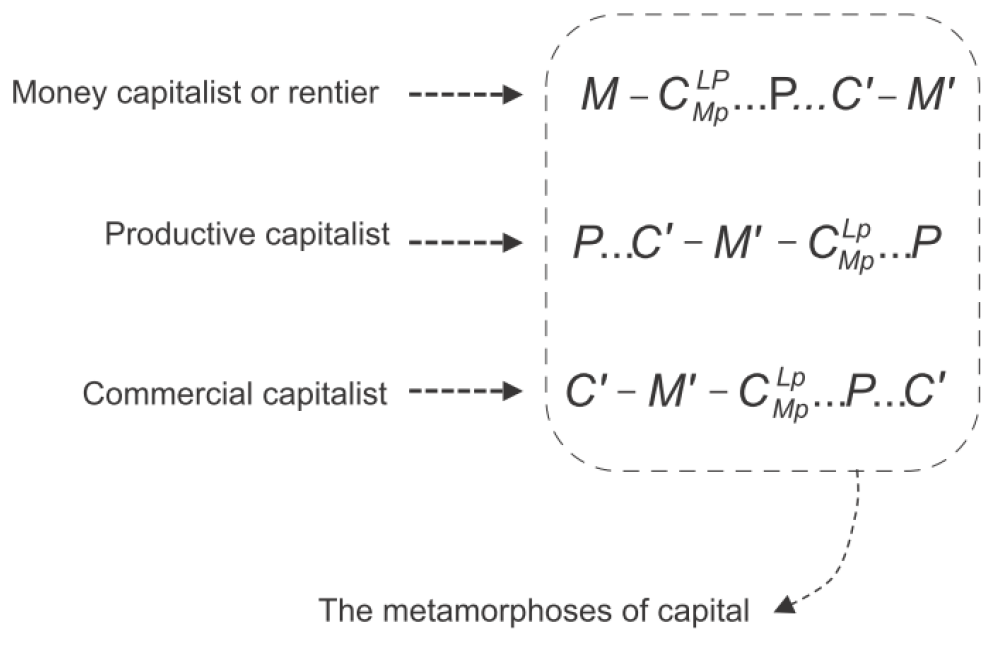

Superficially, a Marxian approach seems to come to similar results. At the beginning of the second volume of capital, Marx presents three moments of the capital circuit (Fig. 1): The circuit of money capital, the circuit of productive capital and the circuit of commercial capital. Is it justified to reason that each of these three moments constitutes a particular fraction of ‘the capitalist class’? Desai and Freeman (2011) answer in the affirmative via contending that “financialization is an ever-present possibility in capitalism because, as Marx noted, capitalist activity is divided into the production of value and its circulation. A variety of parasitic classes have historically participated in this” (ibid., p. 6). They claim to build this analysis on “Marx’s distinction, which has become critical in our times, between activities that produce value and those that merely circulate it” (ibid., p. 3).

Fig. 1 Three fractions of capital? M = Money, C = Commodity, LP = Labour Power, MP = Means of Production. Taken from Sotiropoulos, Milos & Lapatsioras 2013, p. 47.

Though the financialisation theories considered up to this point clearly grasp many relevant phenomena on the descriptive level, one can ask if they are sufficient to conceptualise the complex nature of modern finance. As Lapavitsas (2009) argues:

The ability to extract rent-like income through financial operations is … a by-product of the transformation of finance rather than its driving force. The ascendancy of finance has systemic origins, and its outcomes are far more complex than industrialists being presumably squeezed by rentiers. (ibid., p. 143).

Following this line of reasoning, I argue that a holistic theory of finance and financialisation – no matter if it makes use of Keynesian or Marxian thought – has to take into account the organic unity of financial and non-financial realms of the capitalist system, or put differently, of production and circulation (respective of production and consumption). Neither is the financial sphere detached from the ‘real world’ of production, nor has it become dethatched from it under neoliberalism. Capital builds on the unity of unity and separation of production and circulation. What has changed under neoliberalism is the complex articulation of unity and separation of production and circulation as moments of profit creating activity. I will elaborate on this thought in the following, hereby heavily relying on the work of Sotiropoulos, Milos and Lapatsioras (2013), who in turn developed their analysis in reference to Bryan and Rafferty (2009).

'Interior financialisation' and 'second-order' commodification of capital

The three different moments of the capitalist circuit depicted in Fig. 1 have been described by Marx as the ‘metamorphoses’ of capital as a complex social relation in process, which, considering the total movement M – C … P … C’ – M’, “goes through a sequence of connected and mutually determined transformations” (Marx, 1992, p. 132-133). Marx defines “capital that assumes these forms in the course of its total circuit” (ibid.) as industrial capital. Thus, industrial capital is not industry, but the unity of money capital, productive capital and commodity capital. ‘Production’ or ‘productive activity’ in Marx’ concept of capital means not the physical production of ‘useful’ things, but, far more abstract, the ‘production’ of surplus value, respective of profit. Labour power is productive because and if it is employed by capital in order to valorise it. “The concept of a productive worker therefore implies not merely a relation between the activity of work and its useful effects […], but also a specifically social relation of production”, Marx (1990, p. 644) writes. Every “capitalist enterprise, regardless of the economic sector in which it is primarily active (primary, secondary, circulation, finance) is equally a process of buying commodities (‘creating costs’), […] in order to sell commodities of a different form and use value” (Sotiropoulos, Milos & Lapatsioras 2013, p. 50).

Also, companies in the financial sector “employ labour and means of production to create and sell certain (sui generis) commodities (exchange values that are at the same time use values for others)” (ibid., p. 45). Intermediation (trading credit and financial titles) is a sui generis “service by itself and is therefore a productive activity” (ibid.) in the sense that it produces profit via selling commodities. Industry does not occupy the place of production, finance not the place of circulation, but every capitalist enterprise is a “process of unifying production and circulation” (ibid., p. 43, emphasis added). The production of profit via creating costs and selling commodities (defined as things that unify exchange value and use value), is the mode of operation of capital5. Financial products, also derivatives, are produced commodities, which have a price and fulfil useful functions for their buyers.

Marx makes it very clear that ‘interest bearing capital’ is no perverted form of money-as-capital or does make up a distinct, parasitic social class. On the contrary, he treats it as the most developed form of capital. If money-as-capital is not immediately spent for purchasing labour power or production means but for the purchase of a security, it “acquires an additional use-value, namely that of serving as capital. Its use value then consists precisely in the profit it produces when converted into capital. In this capacity of potential capital, as a means of producing profit, it becomes a commodity […], capital as capital becomes a commodity” (Marx, 1991, p. 459-460). Money-as-capital in the form of a security thus is the “pure form of ownership over capital” (Sotiropoulos, Milos & Lapatsioras 2013, p . 53). (Productive) capital and finance capital are not distinct entities, but “finance is the everyday mask of capital: it’s capital’s form of existence” (ibid., p . 139, emphasis in the original). The use value financial titles bear lies in their existence as a “forward-looking claim for the appropriation of the surplus value that will be produced in the future” (ibid., p. 53, emphasis in the original).

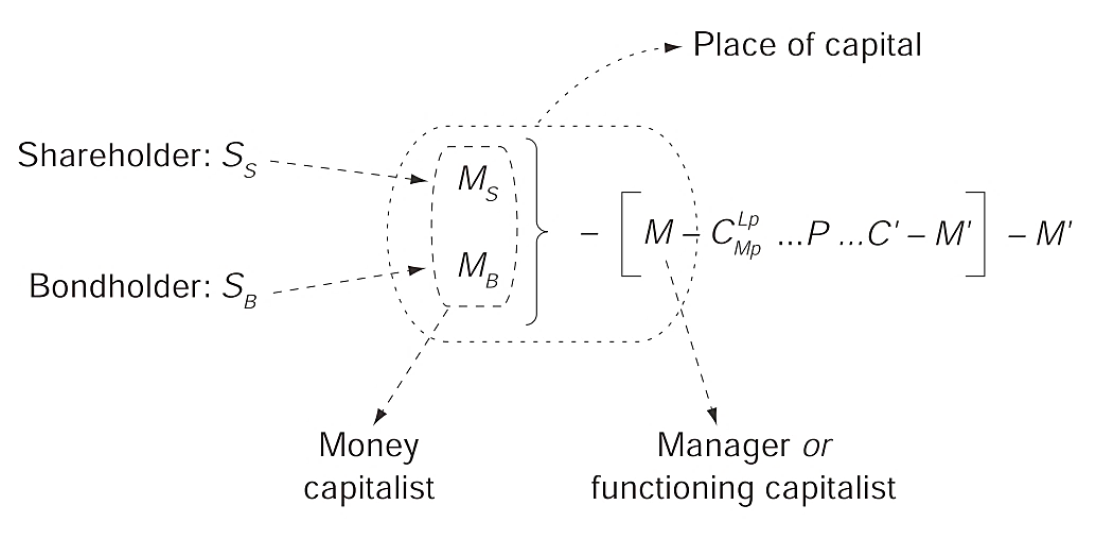

The Marxian analysis above is summarized in Fig. 2, in which an operation of capital is attributed with a money function (‘money capitalist’) and a controlling function (‘manager’). The ‘capitalist’, however, is an artificial category, since capital is neither a thing nor a certain group of people, but a social relation in process (an operation), where, as shown above, the “movement of money as capital binds the production process to the circulation process” (ibid. p. 43). Under capitalism “commodity production becomes a moment […] of the circuit of capital” (ibid.). In other words, the ‘place of capital’ (Fig. 2) is both internal and external to the process of (surplus value-) production. Finance and the production of surplus value are both linked and separated within capital; capital builds on the unity of unity and separation of production and circulation. Money-as-capital in the form of a security cannot be attributed to an encapsulated section of the economy but is organically interwoven with the process of production (of profit).

Fig. 2 The place of capital is both internal and external to the enterprise. Taken from Sotiropoulos, Milos & Lapatsioras 2013, p . 52

Since the production of surplus value (respective the collection of taxes, the issuing of debt or the “financial expropriation” (Lapavitsas, 2009) of wages) is a contested, political terrain, the security turns this risk into a commodity and makes it tradable. It gives the functioning capitalist entity (respective the state, the debt taker) a price regarding its capacity to capitalize the security. In Fig. 2, two types of ‘paper duplicates’ occur, an ownership title that represents ceded money capital on the one hand (bonds) and an ownership title that represents ‘material’ capital on the other hand (shares) (Sotiropoulos & Lapatsioras, 2014, p. 91). Those securities, which are integral elements of the production process, can be understood as simple forms of derivatives, since they derive their price regarding to the future earning capacities of the liquid or illiquid capital they refer to (however to a one-time fixed rate in the case of bonds). Financialisation, however, cannot be understood without considering the additional level of risk commodification that comes with the spread of more developed financial derivatives. While a security turns capital, which in turn is a specific social relation, into a commodity that is priced respective to the capacities of that social relation to produce a future income stream for the owner of this commodity, the security still represents a concrete risk that is related to the specifities of the social relation considered. Financial derivatives translate several concrete risks that are associated with commodified capital into quantitative signs and thereby make them comparable and tradable “without giving up the ownership of the underlying commodity” (ibid., p. 97). While the security represents a concrete embodiment of risk, “it is only with the rise of derivatives that these risks can be priced and traded independently of the security itself” (Sotiropoulos, Milos & Lapatsioras 2013, p. 175).

With the spread of financial derivatives after the collapse of the Bretton Woods system, commodified capitals (including securitized debt) worldwide became integrated into “an international space of multiple investment spheres for individual and isolated capitals” (ibid., p. 117). Financial markets thus have developed “into a complex and multi-dimensional system” (ibid.), including not only money markets, bond markets, share markets, currency markets, but also markets for commodified risks of commodified capitals. “As a result, an international of capital has come into existence that is permanently on the lookout for secure profits and self-valorization of money” (ibid., emphasis in the original). It becomes clear that with the commodification of individual ‘income streams’ and the subsequent commodification of the expected or price or income developments of those ‘income streams’, the mutual control and potential investment – in other worlds: competition – between different capitals reaches a new quality. Since the production of surplus value is dependent on financing in the form securities, and since the risk of securities is commodified in the form of derivatives, financial markets “have the dual function of assessing and effectively organizing individual capitals (within enterprises facilitating exploitation strategies favorable for capital) and at the same time promoting a particular form of financing” (Sotiropoulos & Lapatsioras, 2013, p. 13). To put it simple, financialisation reinforces the competition-induced imperative of profitable capital utilisation within a capitalist social relation. Present-day finance-dominated capitalism thus can be perceived as a power system “that is associated with an active port-folio management process” (ibid., p. 72), where sub-optimal capital utilisation is structurally eliminated, while finance, money-as-capital in the form of a ‘paper duplicate’, is the technology behind this power (Sotiropoulos, Milos & Lapatsioras 2013, p . 54).

On a strictly theoretical level, financialisation has to be understood as a development of the commodity form (and not primarily of the money form) that implicates a development of the concept of capital itself, as the unfolding and autonomization of capital as the self-valorization of value. Instead of a clearly distinguishable form of capitalism that is marked by the dominance of a specific capital fraction (or ‘the sphere of circulation’) in the first place, financialisation involves a development of all phases of the circuit of capital and their relationship among each other and is in this sense a deeply rooted transformation that unfolded the functioning of capital without altering the logic of capital and without producing a necessarily unsustainable version of capitalism. Instead of a specific phase of capitalism that will be followed by an easily distinguishable future phase (e.g. of de-financialisation), financialisation is deeply intertwined with the development of capitalism and represents a continuous process, which goes hand in hand with discontinuities (e.g. financial crises, shifting fields of investment).

With the help of the above made theoretical clarifications, financialisation can be defined in two steps. In a broader sense it means the increasing weight of ‘the financial’ within the unity of financial and non-financial dimensions of capital as profit-creating activity. The ‘rise of finance’ is not simply the result of a class project by the ‘investing class’ in the first place, but a shift in the complex articulation of the separation of production and finance under the unity of capital. As finance “has followed the dynamics of capital on the background of class struggles from the very beginning of capitalism” (Sotiropoulos, Milos & Lapatsioras 2013, p . 139), financialisation responded to “deep tendencies at the level of capital-accumulation and profitability that drove deregulation and that underpin the current crisis […]; deregulation followed and responded to structural transformations – most notably the rise of multinational corporations with international financing requirements” (McNally, 2009, 42). Transnational corporations (TNCs), in turn, form „a category of their own“ (Serfati, 2008, p. 35) and can be described as „an organizational modality of finance capital“ (ibid.). TNCs can be involved in a growing number of financialized capital movements, while banks can act as big stockholders of industrial companies or make investments with their profits (Milberg, 2008, p. 423). Financialisation thus means a qualitative shift in the way how ‘the financial’, meaning the exchange-value side of commodities and assets, are perceived and treated within the course of profit-creating activity and thus can be referred to as ‘interior financialisation’ (Müller, 2012).

In a narrower sense, and connected to the the increasing weight of ‘the financial’ within profit-creating activity, financialisation means the process in which expected price or income developments of liquid or illiquid assets (‘income streams’) are transformed into an objective, quantitative, calculable and legally protected form, in order to make them as commodities tradable on internationally integrated financial markets (Ouma, 2014, p. 197). As described above, the commodification and bundling of several concrete risks of underlying ‘income streams’ in the form of derivatives, which can be understood as ‘second-order’ forms of commodification of capital, increase the pressure on the commodified and financially valued capitals to increase their prof- itability and thus reinforces the weight of ‘the financial’ within those capitals. The emergence of derivatives and their quantitative increase thus can be seen as the ‘tip of the iceberg’ as part of a deeply rooted shift in the role of assets and their price and income developments that has also and especially taken place within ‘productive’ enterprises (Müller, 2012).

There is still so much to discover!

In the Discover section we have collected hundreds of videos, texts and podcasts on economic topics. You can also suggest material yourself!

Discover material Suggest material

Literature

A. (ed.), Politische Ökonomie der Finanzialisierung, Globale Politische Ökonomie. Wiesbaden: Springer.

Ascher, Ivan; Hardin, Carolyn; Klein, Steven; Montgomerie, Johnna and Rosamond, Emily. 2022. Finance and the Financialization of Capitalism. In: Albena Azmanova and James Chamberlain, eds. Capitalism, Democracy, Socialism: Critical Debates. Cham, Switzerland: Springer, pp. 71-97.

Christophers, B., 2015. The limits to financialization. Dialogues Hum. Geogr. 5 (2), 183–200.

Davis, G. F., & Kim, S. (2015). Financialization of the Economy. In Annual Review of Sociology (Vol. 41, Issue 1, pp. 203–221). Annual Reviews.

Desai, R. & Freeman, A. (2011). Value and Crisis Theory in the ’Great Recession’. World Review of Political Econ- omy, 2(1), 35-47.

Epstein. (2005). Financialization and the world Economy (Cheltenham, UK: Edward Elgar Publishing).

Historical Materialism, 17, 35-83.

Hudson, M. (2010). From Marx to Goldman Sachs: The Fictions of Fictitious Capital, and the Financialization of Industry. Critique: Journal of Socialist Theory, 38, 419-444.

Lapavitsas, C. & Powell, J. (2013). Financialisation Varied: A Comparative Analysis of Advanced Economies, Cam- bridge Journal of Regions, Economy and Society, 6, 359–379.

Lapavitsas, C. (2009). Financialised Capialism: Crisis and Financial Expropriation. Historical Materialism, 17, 114- 148.

Lapavitsas, C., & Soydan, A. (2022). Financialisation in developing countries: approaches, concepts, and metrics. In International Review of Applied Economics (Vol. 36, Issue 3, pp. 424 447). Informa UK Limited.

McNally, D. (2009). From financial Crisis to world slump: accumulation, financialization and the global slowdown.

Mezzadra, S., Neilson, B., (2015). Operations of capital. South Atlantic Quarterly, 114, 1-9.

Müller, J. (2012). Das Verhältnis von Industrie und Finanzsektor unter der Finanzialisierung. PROKLA, 42 (2012), 169, 557-578.

Ouma, S. (2014). „The new enclosures“. Zur Finanzialisierung von Land und Agrarwirtschaft. In Heires, M., Nölke,

Ouma, S. (2015a). Assembling Export Markets: The Making and Unmaking of Global Food Connections in West Africa. Chichester: Wiley-Blackwell.

Ouma, S. (2016). From financialization to operations of capital: Historicizing and disentangling the finance–farm- land-nexus. Geoforum, forthcoming.

Serfati, C. (2008). Financial dimensions of transnational corporations, global value chain and technological innova- tion. Journal of Innovation Economics, 2, 35-61.

Sotiropoulos, D., Milios, J., & Lapatsioras, S. (2013). A Political Economy of Contemporary Capitalism and its Crisis. Routledge.

This content is licensed under a Creative Commons-Licence (CC BY-NC-ND 4.0).