✕

90 results

Florian Kern replies to Zoltan Pozsar's analysis about the effects of the war in Ukraine on the global financial order and refutes the latter's prognosis of the demise of the US dollar as the world's reserve currency

This Blog Post describes the U.S. federal reserve money system from the perspective of the Modern Monetary Theory (MMT). Therefore it presents a theory of money creation, gives simple examples how this influences the economy and the historical process of why the monetary system of the US has developed this way.

The Currency of Politics explains why only through greater awareness of the historical limits of monetary politics can we begin to articulate more democratic conceptions of money.

Currency hierarchy and policy space: A research agenda for development economics Barbara Fritz

This is the second part of the seminar A Hard Currency of Politics The discussion centers on the The Currency of Politics by Stefan Eich and is hosted by the journal European Law Open Stefan Eich s presentation of his argument starts at minute 7 53 The discussion centers on …

Colonialism persists in many African countries due to the continuation of imperial monetary policy. This is the little-known account of the CFA Franc and economic imperialism.

The authors analyse the role and effects of the US dollar as factual global reserve currency. They demonstrate that a flight into the dollar creates adverse effects for the global economy as it represents a tightening of financial conditions.

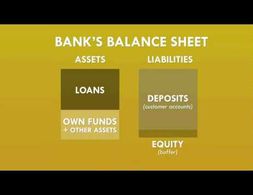

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

The novel coronavirus (Covid-19) is rapidly spreading around the world. The real economy is simultaneously hit by a supply shock and a demand shock by the spread of coronavirus. Such a twin shock is a rare phenomenon in recent economic history.

Whether a black swan or a scapegoat, Covid-19 is an extraordinary event. Declared by the WHO as a pandemic, Covid-19 has given birth to the concept of the economic “sudden stop.” We need extraordinary measures to contain it.

The Great Recession 2.0 is unfolding before our very eyes. It is still in its early phase. But dynamics have been set in motion that are not easily stopped, or even slowed. If the virus effect were resolved by early summer—as some politicians wishfully believe—the economic dynamics set in motion would still continue. The US and global economies have been seriously ‘wounded’ and will not recover easily or soon. Those who believe it will be a ‘V-shape’ recovery are deluding themselves. Economists among them should know better but are among the most confused. They only need to look at historical parallels to convince themselves otherwise.

In both economics textbooks and public perceptions central banks are a fact of life. On the wall of my A-level economics classroom there was the Will Rogers quote “there have been three great inventions since the beginning of time: fire, the wheel, and central banking”, summarising how many economists view the institution. There is a widespread belief that there is something different about money which calls for a central authority to manage its operation, a view shared even by staunch free marketeers such as Milton Friedman. This belief is not without justification, since money underpins every transaction in a way that apples do not, but we should always be careful not to take existing institutions for granted and central banking is no exception. In this post I will look at the idea of private or free banking, where banks compete (and cooperate) to issue their own currency.

Western sanctions on Russia after its invasion of Ukraine quickly led the Ruble to lose more than 45 percent of its value. But these days, the Russian currency is back to its pre-war value. Cameron and Adam explain the turnaround and discuss what it means for the war.

In March 2020, the Reserve Bank Board introduced a target for the yield on the three-year Australian Government bond which was discontinued in November 2021. This review examines the experience with the yield target and draws lessons from this experience.

How did the coronavirus almost bring down the Global Financial System? What effects does monetary policy have on inequality? What role do Central Banks have in the social-ecological transformation? How could Central Banks tackle climate change? What is Central Bank Digital Currency?

This course is an introduction to macroeconomics with a specific focus on the euro area. The theoretical part provides a critical presentation of the two key macroeconomic models: the (neo)classical approach and the Keynesian approach. This allows a comparative analysis of important macroeconomic topics:

- unemployment

- inflation

- government debt and Modern Monetary Theory

- banks and financial crises.

The policy-oriented part discusses the monetary policy of the ECB and the specific challenges for fiscal policy in the euro area. The course also presents other euro area specific topics: Optimum currency area, euro crises, Next Generation EU and Green New Deal.

Croatia adopted the euro as its currency on 1 January 2023, becoming the 20th member state of the eurozone. In this teaching pack, students learn what it entails to join the eurozone and discuss what its effects might be. In this way, the case helps students connect theoretical insights about monetary unions with real world knowledge and economic developments in the news.

The authors show how consumers, business, the Federal Reserve, and government take into account what's going on around them to make critical decisions like buying new products, building new factories, changing interest rates, or setting budget goals. The book provides a clear roadmap to understanding the whole story behind the global economy.

Balance of payments stability is of paramount importance for developing countries, both to secure the value of their domestic currencies as well as reliable foreign currency inflows. But how is that stability ensured and how important is the growth of exports for stability?

This episode from Odd Lost podcast with financial analyst Zoltan Pozsar features a discussion on the potential long-term financial effects of the Ukraine-Crisis on dollar and the global currency system centered around it.

This is a new online course at bachelor level. It presents an introduction into macroeconomics with a specific focus on the euro area. The theoretical part provides a critical presentation of the two key macroeconomic models: the (neo)classical approach and the Keynesian approach. This allows a comparative analysis of important macroeconomic topics:

unemployment

inflation

government debt and Modern Monetary Theory

banks and financial crises.

The policy-oriented part discusses the monetary policy of the ECB and the specific challenges for fiscal policy in the euro area. The course also presents other euro area specific topics: Optimum currency area, euro crises, Next Generation EU and Green New Deal.

John K. Galbraith recounts episodes in the history of money such as the creation of the bank of Amsterdam, John Law's fraudulent Bank Royal, the inception of the Bank of England and of the Federal Reserve to illustrate concepts such as money creation by commercial banks, the bank rate, open market operations or the money supply in general. The emotions, myths and struggles surrounding money are addressed and explained in a clear and consistent manner.

In this article, Perry Mehrling, a professor of economics at Barnard College, presents and discusses three theories of banking which are guiding bank regulation. These are credit creation theory, fractional reserve theory and debt intermediation theory.

In this short video 'Raghuram Rajan’s Dosa Economics Explained', the famous theory of Dr. Raghuram Rajan, ex-governor of Reserve Bank of India (RBI), Dosa Economics, has been explained using a very simple example of Dosa ( a delicacy of India). Here, Dr. Raghuram Rajan tries to explain that low interest rate and low inflation is much better than high interest rate and high inflation.

Since 2007, central banks of industrialized countries have counteracted financial instability, recession, and deflationary risks with unprecedented monetary policy operations. While generally regarded as successful, these measures also led to an exceptional increase in the size of central bank balance sheets. The book first introduces the subject by explaining monetary policy operations in normal times, including the key instruments (open market operations, standing facilities, reserve requirements, and the collateral framework).

This is an overview of (possibly transformative) proposals to address the economic consequences of the corona crisis

It is perhaps fitting that the seriousness of the coronavirus threat hit most of the Western world around the Ides of March, the traditional day of reckoning of outstanding debts in Ancient Rome. After all, problems and imbalances have accumulated in the Western capitalist system over four decades, ostensibly since it took the neoliberal road out of the 1970s crisis and kept going along it, heedless of the crises and problems it led to.

We use cookies on our website. Click on Accept to help us to make Exploring Economics constantly better!