Modern Money and the War Treasury

Global Institute for Sustainable Prosperity, 2019

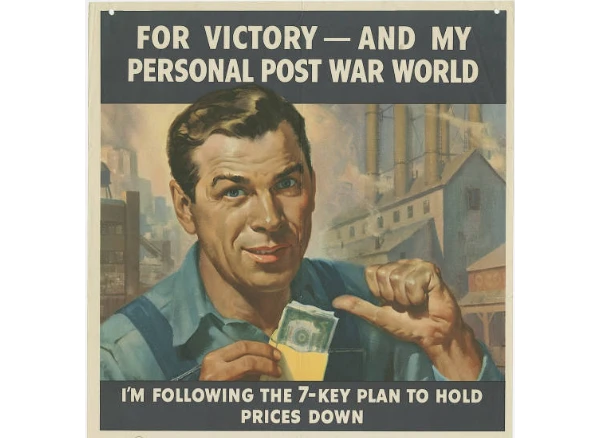

In this working paper, Sam Levey discusses the US government's approach to finance during the second world war. Quoting liberally from internal Treasury memos, he shows that, under conditions of perceived existential threat, there was no question of "whether" the government could find money for the war. The question, rather, was how to handle the effects that the diversion of real resources away from the consumer economy would have on prices. This way of framing things is surprisingly consistent, Levey points out, with the perspective of Modern Monetary Theory (MMT), according to which countries which issue their own fiat currency don't face budgetary constraints at all, only inflationary constraints.

Comment from our editors:

This paper makes several ideas important to the MMT perspective accessible by making them historically concrete. The first is that inflation isn't a purely "monetary" phenomenon, but in fact has everything to do with the availability of real resources and goods in an economy. The second is that the point of selling bonds isn't, as is commonly assumed, to raise money that the government then spends, but to take money out of circulation or "drain liquidity."

Go to: Modern Money and the War Treasury