The Coronavirus and the End of Economics

Exploring Economics, 2020

This contribution is part of the Exploring Economics Dossier “The Next Great Recession?” on the economic fallout of the COVID-19 pandemic and the structural crisis of globalization.

The Coronavirus and the End of Economics

Steve Keen | Distinguished Research Fellow, Institute for Strategy, Resilience & Security, UCL | www.patreon.com/profstevekeen

Commenting on the state of mainstream macroeconomics in 2016, the 2018 recipient of “The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel” Paul Romer observed, in his working paper “The Trouble With Macroeconomics”, that “For more than three decades, macroeconomics has gone backwards … I have observed more than three decades of intellectual regress” (Romer 2016).

It was hardly in an advanced state before then. As the brilliant mathematician John Blatt put it in 1983 in his book Dynamic Economic Systems: A Post Keynesian Approach:

A baby is expected to first crawl, then walk, before running. But what if a grown-up man is still crawling? At present, the state of our dynamic economics is more akin to a crawl than to a walk, to say nothing of a run. Indeed, some may think that capitalism as a social system may disappear before its dynamics are understood by economists.

(Blatt 1983, pp. 4-5. Italics added.)

I used to regard Blatt’s quip as a good hyperbole. Now, with SARS-CoV-2 devastating economies across the planet, it is coming true. Until such time as reliable and rapid tests, anti-virals and mass-produced vaccines are widely available, capitalism will be in the economic equivalent of an induced coma. While that persists, and whether they wish to or not, national governments will be forced to run their economies along command-driven wartime lines. This is needed both to contain the virus so that health systems are not overloaded and to maintain the minimum of production and distribution needed to enable the bulk of their populations to survive the economic shutdown.

"Economics deals with market systems, when what is needed to limit the virus’s spread is a command system."

In these circumstances, conventional economic theory is useless. This is not only because it deals with market systems, when what is needed to limit the virus’s spread is a command system. It is also because today’s mainstream economics provides no tools to help manage a production system, even though such tools did exist in the past in economics.

Economic policy tools forgotten by mainstream economics

One key tool that has fallen out of use in economics is input-output analysis. First developed by the non-orthodox economist Wassily Leontief (Leontief 1949; Leontief 1974), it used matrix mathematics to quantify the dependence of the production of one commodity on inputs of other commodities. Given its superficial similarity to Walras’ model of tatonnement, it was rapidly adopted by Neoclassical economists, and it became an integral part of mainstream macroeconomics back when “general equilibrium” meant “equilibrium of all the markets in a multi-market economy at one point in time”. It was known as CGE: “Computable General Equilibrium”. When I did my PhD on modelling Minsky’s “Financial Instability Hypothesis” (Keen 1995), virtually every other Economics PhD student at the University of New South Wales was building a CGE model of his or her national economy.

If economists were still skilled today in CGE analysis, then they could easily have answered some vital questions for policymakers during the Coronavirus crisis. The most pressing economic is, “if we identify which products are critical, and the level of output needed to sustain the population during 4-8 weeks of lockdown, can you tell us which other products are critical to maintaining that output, and how many workers are needed?”

The vast majority of economists today can’t answer those questions, because those skills have been lost, thanks to “the Lucas critique” (Lucas 1972). This asinine dismissal of “Keynesian economics” (which was in fact the economics of Samuelson and Hicks, not Keynes) led to the replacement of CGE models by “Real Business Cycle” (RBC) and “Dynamic Stochastic General Equilibrium” (DSGE) models that completely ignore input-output processes.

You can find these vital skills only in the backwaters of economics today. Tellingly, there is one paper that did consider the impact of a pandemic using input-output analysis. Entitled “Pandemic Recovery Analysis Using the Dynamic Inoperability Input-Output Model”, it opened with the now clearly prescient observation that:

According to disease control experts, a pandemic—an infection that spreads widely and affects a significant proportion of the population—is inevitable. With the rise of new infections such as SARS and the avian flu, as well as the threat of bioterrorism, experts from the General Accounting Office believe it is imminent. In a pandemic, propagating effects endanger the general population, including those who are not yet sick. For example, pandemic-related risk scenarios include large-scale disruption to workforce sectors, which can lead to further illnesses and mortalities caused by the pandemic’s cascading effects.

(Santos, Orsi et al. 2009, p. 1743)

The duration, locality and the scale of the crisis they modelled are all far lower than we are actually experiencing. They simulated the impact of “a 30-day pandemic scenario” (Santos, Orsi et al. 2009, p. 1750) in the state of Virginia that caused a 20% fall in the available workforce. The issue they considered—the speed of recovery from the “pandemic” (really an epidemic, since it was confined to one state)—is also trivial compared to the problem we face, of maintaining and distributing sufficient outputs of goods and essential services to keep the population alive while the vast majority are confined to their homes.

However, the technique they employed can be modified to handle the issue of identifying critical goods and services, working out the minimum scale of output needed to sustain the population with these goods during lockdown, calculating what proportion of which other goods and services are needed to keep those critical commodities flowing, and even identifying which relatively unskilled jobs would be needed to sustain that output, so that uninfected workers could be redirected from non-essential services—the vast array of tasks that David Graeber rightly calls Bullshit Jobs (Graeber 2018)—to unskilled labour in these essential tasks (one of which, fittingly, is sanitation).

But that possibility lies in a parallel universe where economic theory has been driven by practical need and realism, rather than ideology and fantasy. Far from being an applied science of use to policymakers at a time like this, it has been a myth-laden “science” that has encouraged policymakers to remake the real economy in the image of their textbooks, in the quaint and false belief that these textbooks actually describe the real world (Keen 2011). Consequently, rather than enabling humanity to fight this inevitable crisis, it has made real-world capitalism far more susceptible to it.

As Romer indicates, change in economics has been driven more by a desire to achieve theoretical purity within economics than to realistically model the actual economy. Romer describes modern macroeconomics as “post-real”, and argues that deference to authority—meaning to figures like Lucas and Prescott who built the Real Business Cycle (RBC) models of a single consumer/capitalist/worker agent maximizing its lifetime utility by optimizing the trade-off between work and leisure with perfect foresight of the future, which in turn became the foundation of the only slightly less fantastical Dynamic Stochastic General Equilibrium (DSGE) models of today—has eliminated realism as the guiding force in the development of economic theory:

Deference leads to effort along the specific lines that the leaders recommend. Because guidance from authority can align the efforts of many researchers, conformity to the facts is no longer needed as a coordinating device. As a result, if facts disconfirm the officially sanctioned theoretical vision, they are subordinated. Eventually, evidence stops being relevant. Progress in the field is judged by the purity of its mathematical theories, as determined by the authorities

This has resulted in the paradoxical situation of a discipline of economics which is, to any dispassionate observer, completely detached from reality, while at the same time its practitioners defend it as essential for understanding the real world.

It is no more essential to the understanding of economics than Ptolemaic astronomy is essential to understanding the Universe. Worse still, rather than simply being wrong, as Ptolemaic astronomy was, it has been used to reshape the real world in the belief that making it more closely resemble the Neoclassical model will make the world a better place. In fact, it set the world up by making this crisis far more damaging to our production and distribution systems than it could have been.

Mainstream economics has propagated the dismantling of the state and the globalization of production - both of which make the crisis now so devastating

Economic theory assisted the dismantling of the welfare state via the concoction of “Ricardian Equivalence”, along with many other crazy concepts. This is the fantasy that a government deficit now must be financed by higher future taxes (an assertion that 120 years of US data contradicts), and therefore that “rational agents” will (because of altruism!) make bequests to their distant descendants to enable them to pay those future taxes, thus offsetting government stimulus programs:

A finite horizon seems to generate the standard result that a budget deficit reduces desired national saving. The argument works, however, only if the typical person feels better off when the government shifts a tax burden to his or her descendants. The argument fails if the typical person is already giving to his or her children out of altruism… a network of intergenerational transfers makes the typical person a part of an extended family that goes on indefinitely. In this setting, households capitalize the entire array of expected future taxes, and thereby plan effectively with an infinite horizon.

(Barro 1989, p. 40. Emphasis added.)

This bizarre theory was one of many Neoclassical fantasies that facilitated the deliberate weakening of the State over the last forty years, when, as we are now realizing during this crisis, only the State is capable of organizing our defence against a pandemic.

Economic theory justified the imposition of austerity in the aftermath to the Global Financial Crisis via misunderstanding the nature of a monetary economy. In a monetary economy, there is no need for a government with its own central bank to “save money”, and in fact, the government’s surplus necessarily causes an identical deficit for the private sector, as Modern Monetary Theory (MMT) points out. If the government taxes more than it spends, then the bank accounts of the non-government sector fall by precisely as much as taxes exceed spending. Austerity actually weakens the private sector as well as the public sector, while deluding its believers that they are “saving for a rainy day”.

Even if budget surpluses were necessary for the State to accumulate money—which they are not, since a government with its own Central Bank can create as much money as it desires—these monetary “savings” by the government sector were accumulated in part by not funding the construction of, for example, stockpiles of ventilators. When the crisis hit, we were short of the very savings we did needed: ventilators, as well as the skilled human resources—medical staff and researchers—that we actually need right now.

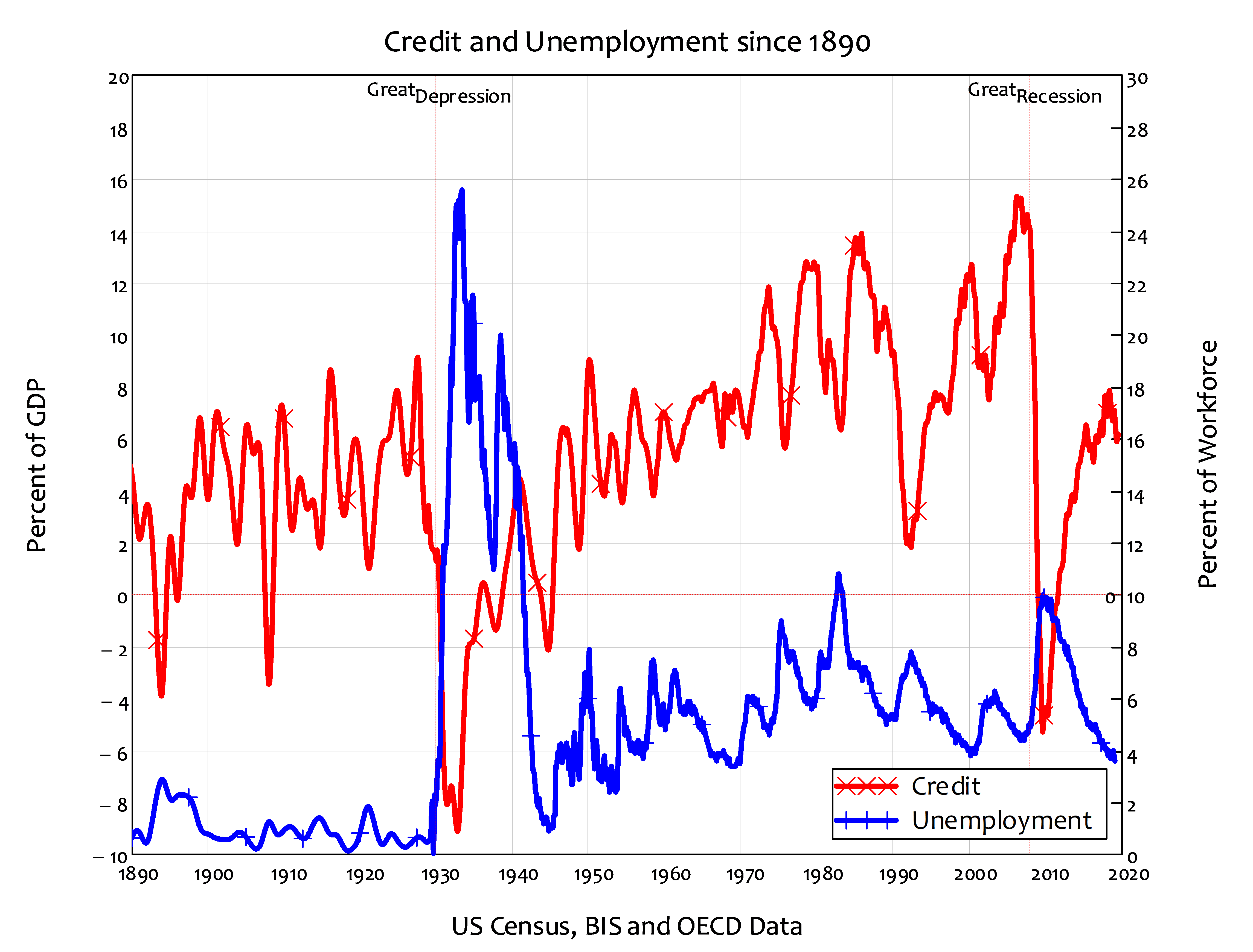

Mainstream economic theory led policymakers to obsess about government debt while ignoring a huge increase in private sector debt, under the false belief that bank loans to the public are “pure redistributions” which “should have no significant macroeconomic effects” (Bernanke 2000, p. 24). The argument is a logical fallacy (Keen 2020) arising from a belief in the false “Loanable Funds/Money Multiplier” models of money creation (McLeay, Radia et al. 2014), but it can also be easily invalidated by a cursory glance at the empirical data. Firstly, the correlation between credit[1] and unemployment is overwhelmingly strong—and the causal argument behind it can be found in (Keen 2020). Far from having “no significant macroeconomic effects”, credit is by far the major determinant of economic crises—see Figure 1.

Figure 1: Credit & Unemployment (Correlation -0.3; 1920-1940 -0.81; 1990-2020 -0.84)

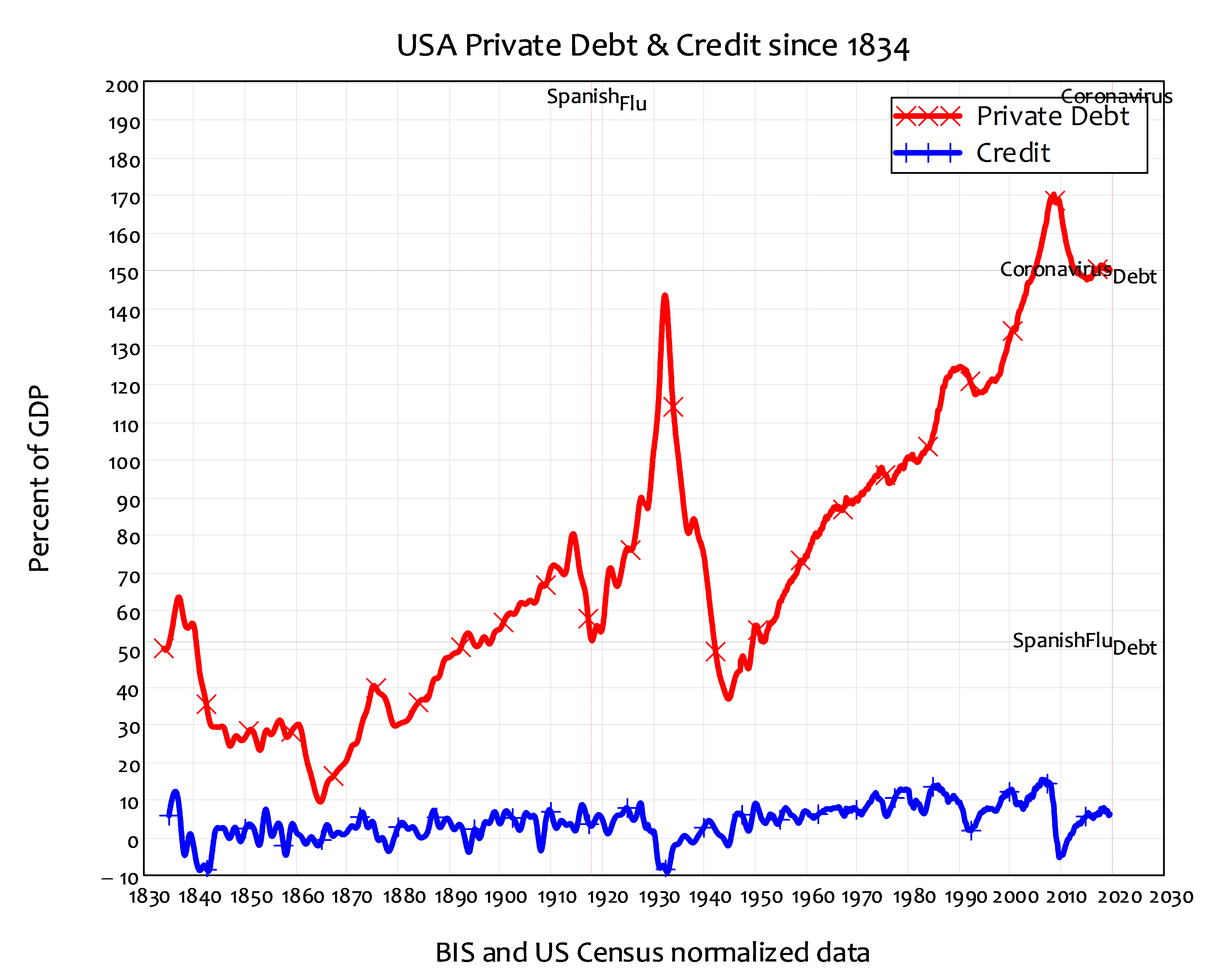

Secondly, the USA’s three major crises before this one—the “Great Recession” of 2007-10, the Great Depression, and the “Panic of 1837” (Roberts 2012) all occurred when debt levels were comparatively high, and when after a credit-fuelled boom, credit went negative and remained negative for years—see Figure 2.

Figure 2: Negative credit caused the USA's 3 largest economic crises

Neoclassical economics, far from warning about the dangers of excessive private debt, actually encouraged its growth via childish theories like the Modigliani-Miller Hypothesis (Modigliani and Miller 1958), ignored its growth from the end of WWII till the Great Recession, and actually tried to encourage private debt growth in the aftermath to the Great Recession. Consequently, this crisis has hit at a time when households and corporations are more financially fragile than they have ever been, and when they are carrying three times the debt load they were at the time of the last pandemic, the Spanish Flu of 1918.

Economic theory encouraged globalized production, since it fitted the fantasy model of comparative advantage (Keen 2017), with the result that the outbreak in one country (fittingly China, the country that has benefited most from globalization) broke the global supply chain and not just the supply chain of one country.

Here I would be remiss not to criticize Modern Monetary Theory as well for its attitude to trade, which is in many ways more extremely pro-globalization than Neoclassical economics itself. While I fully support MMT’s analysis of the monetary system, its argument concerning international trade, that “Imports are real benefits and exports are real costs” (Mosler 2010, p. 59) is seriously flawed on numerous levels. The Coronavirus is brutally exposing one critical flaw: if you rely upon imports to supply critical goods like ventilators and surgical masks, then when a pandemic strikes, foreigners will not “produce and export, and we get to import and consume” (Mosler 2010, p. 60). Instead they will keep goods once intended for export for themselves, while you—the USA in this case—lacking the productive capacity itself, will instead allegedly resort to piracy to get what you can’t produce for yourself. This aspect of MMT should be ditched by its supporters in favour of support for relatively localized production.

Finally, mainstream economics has actively undermined alternative analyses of human society which could have led us to reduce the threat of this pandemic, by reducing rather than mindlessly increasing the pressure humanity is putting on the biosphere. Mainstream economists, especially but not exclusively William Nordhaus, disparaged and dismissed system dynamics, the novel approach to modelling human society behind the Limits to Growth study (Meadows, Randers et al. 1972; Nordhaus 1973; Forrester, Gilbert et al. 1974; Nordhaus 1992; Meadows, Meadows et al. 2005). Had humanity adopted that approach to modelling the complex system in which we actually live, then both the global ecosystem and the global economy would be very different, and much more resilient, than they are today.

States can prevent a financial pandemic with their central banks

Despite the chaos being caused by the Coronavirus today, it is feasible to overcome it in as little as five weeks, if strict social isolation and testing regimes are imposed, according to experts on complex systems like Yaneer Bar-Yam (see his Op-Ed “We need an immediate five-week national lockdown to defeat coronavirus in America”, USA Today, March 21st 2020). Of course, this cannot be financed by ordinary Americans—or by the working class of any other country—out of their meagre personal savings. Here the State, acting through its Treasury and Central Bank, can create the money needed to allow financial payments to be covered so that a financial pandemic does not follow—or heaven forbid, coincide with—the medical pandemic. I explain one way that this could be financed by conventional means here (CoronaBonds to hold the payments system together), but it could also be financed by direct loans from the Central Bank to the Treasury, as are being considered in the UK.

To return to the opening of this article, mainstream economics is not only ignorant of the real dynamics of a capitalist economy, but it is also possibly the biggest threat to those dynamics. By modelling a fantasy world rather than the real one, and by mismanaging the real one by a simplistic pursuit of “efficiency” in the absence of resilience, Neoclassical economics has led capitalism itself to the brink of collapse. It is time that Neoclassical economics joined Ptolemaic astronomy on the scrap-heap of human intellectual history.

References

Bernanke, B. S. (2000). Essays on the Great Depression. Princeton, Princeton University Press.

Blatt, J. M. (1983). Dynamic economic systems: a post-Keynesian approach. Armonk, N.Y, M.E. Sharpe.

Graeber, D. (2018). Bullshit Jobs: A Theory. New York, Simon & Schuster.

Keen, S. (2011). Debunking economics: The naked emperor dethroned? London, Zed Books.

Keen, S. (2017). "Trade and the gains from diversity." Journal of American Affairs 1(3): 17-30.

Leontief, W. (1949). "Structural Matrices of National Economies." Econometrica 17: 273-282.

Meadows, D. H., D. Meadows, et al. (2005). Limits to growth : the 30-year update. London, Earthscan.

Meadows, D. H., J. Randers, et al. (1972). The limits to growth. New York, Signet.

Mosler, W. (2010). The Seven Deadly Innocent Frauds, Valance Co., Inc.

[1] I define “credit” as the annual rate of change of private debt, which is denominated in dollars per year, in contrast to the actual level of debt which is denominated in dollars.