How to strengthen the social economy

Exploring Economics, 2020

Photo by Yogesh Pedamkar on Unsplash

This article summarizes many ideas presented in Chapter 8 of Piero Ammirato’s The Growth of Italian Cooperatives: Innovation, Resilience and Social Responsibiliy, from Routledge, New York, 2018.

How to strengthen the social economy

Learnings from the Italian cooperatives sector in a times of crisis

Jerome Warren | 2020

With memories of the Global Financial Crisis (GFC) still fresh in many people’s minds – especially in the countries of Southern Europe, with their lost decade of economic stagnation – and the next crisis looming as many sectors of the economy are shuttered due to the Covid-19 pandemic (tourism, nightlife, bars & restaurants, etc.), the search for new alternative structures that offer increased stability against cyclical swings is taking place in lecture halls, libraries, online discussion forums and town halls across the world. Much attention has been focused of late, e.g., on Germany’s Kurzarbeit system, already lauded by economists like Dean Baker after the 2008 fallout. Outlets like The Guardian, The Financial Times and The Washington Post, among others, have written extensive pieces on the system that seems to keep Germany’s unemployment rolls stable and low.

Germany itself is a paragon economy with a strong export-base, diversified between the “old-fashioned” machine goods that it sells to many developing economies including China, its car industry and a modern service sector, as well as having an enviously low debt burden. Therefore, it is perhaps not surprising that its economy remains resilient in times of financial crisis. However, less attention has been paid to another phenomenon that portends stability in times of crisis: Italy’s cooperative sector. Italy’s diminished economy lost 1.4 million jobs during the GFC and the ensuing Eurocrisis. 117,000 businesses were shuttered and unemployment more than doubled, from 6% before the crisis to 13% in 2014. (Ammirato, 2018, p. 137) Government debt increased by more than 40%, causing a reduction in public spending on social services and infrastructure and a collapse in credit markets that was accompanied by a collapse in consumer spending. (ibid)

What is remarkable about this is that, at the same time as the Italian economy installed technocratic governments, bent on squeezing as much of GDP as possible to service sovereign debt, one needs scratch just below the surface to discover something quite remarkable: while the rest of the economy was hemorrhaging jobs, the Italian cooperative sector, led by Legacoop, Confcooperative and the Trentino federations, “was a net creator of jobs” during the decade that included the GFC. A study by EURICSE noted that between 2005 and 2011, “16,000 new cooperatives across all sectors of the economy created a total of 389,000 new jobs from 2005 to 2011.” During this time, the share of Italians employed by a cooperative increased to more than 7%, with all affiliated organizations (like farmers that sell exclusively to the cooperative sector) making up more than 10% of Italy’s GDP. Obviously, Italian cooperatives are doing something right.

Cooperative Resilience and Corporate Stagnation

We can only begin to assess the magnitude of success the Italian cooperative sector experienced by comparing some of the numbers:

- Cooperatives accounted for 29.5% of all jobs created between 2001-2011. Amazingly, employment in the cooperative sector actually grew during the GFC, where 8% more people were employed at the end of the period 2007-2011, whereas the private sector shrank by 2.3% during the same period;

- Turnover from 2006 to 2015 grew by roughly 40% in the cooperative sector, while it increased by 7% in the private sector;

- Capitalization was higher in the cooperative sector than in the private sector. Cooperatives actually increased their reserves (i.e., retained profits) during the period by nearly 50%, whereas it grew by only 37% in the private sector; members also increased their equity over the same period, from €1.24 billion to €1.9 billion;

- Investments grew by a significant 25.4% in the cooperative sector between 2001-2011, compared with 15% for publicly listed companies (privately held companies invested at a comparable level to cooperatives);

- Salaries in the cooperative sector increased by roughly 30% over the period 2007-2013, compared with 13.5% in publicly-traded companies and 23% in privately held firms.

- Profits were lower for cooperatives and debt levels higher during the comparable period, emphasizing the counter-cyclical role the sector plays (ibid, pp. 140-141).

Ammirato concludes that “[t]he data supports the view that cooperatives have performed an anti-crisis role by increasing investments and creating more jobs…[and, moreover,] [i]t also supports the view that cooperatives are professionally-managed enterprises with a long-term horizon that allows them to manage operational and labor costs in the short term (without cutting staff) and exploit market opportunities in the long run” (ibid). Indeed, one can compare the Italian results with statistics on cooperative sectors internationally and see similar trends: cooperatives tend to expand or maintain employment during downturns to avoid the pro-cyclical effect of mass layoffs, whose macroeconomic effects were felt during past downturns, like the Great Depression.

Cooperative banks increased their market share as well during the GFC, from 8.1% in 2007 to 9.4% in 2014. Moreover, during the GFC, many cooperative banks suspended debt payments and offered members forbearance. They also offered higher deposit interest rates and lower interest rates on loans than traditional banks (Stefani and Vacca, 2016, cited in Ammirato, 2018, p. 152).

What makes the Italian case stand out is the sheer size of its cooperative sector. In most countries, cooperatives make up – at most – 1-2% of GDP, but in Italy, the size of the cooperative sector is roughly one degree of magnitude greater. What has contributed to this exponential growth?

Factors Leading to Cooperative Growth & Resilience

Italy’s economy was ravaged probably more than most others by the vicissitudes of globalization and the stagnation of the post-Bretton Woods era. It has faced secular stagnation since the 1990s, as its relatively high wage rates and ineffective State apparatus failed to insulate the country in the wake of globalization and its concomitant heightened competition. Italy’s cooperatives were no exception to this pressure, and the sector faced major restructuring in the wake of a crisis of inter-European competition. Consumer cooperatives met strong competition from international discounters, and EU Competition policy deprived construction cooperatives of their privileged status in State contract allocation.

In the end, this era was a learning moment for the cooperative sector, which engaged in significant reform and restructuring. Legacoop, for instance, responded by “producing a code of ethics in 1993…, governance guidelines in 2008… and a good practice guide to encourage member participation in 2012” (ibid, p. 168). It took advantage of State failure in the provision of social services by introducing social cooperatives, which provide many of the services the welfare system was providing at inadequate levels. Other governance measures such as mergers and acquisitions also played a central role. Bulgarelli notes that between 1988 and 2008, the number of large cooperatives in Legacoop was reduced from 241 to 119 (cited in Ammirato, 2018 p. 145). In addition, rationalization and restructuring occurred in a number of the large Consortia, or organized partnerships of cooperatives. It engaged in a high degree of consolidations, like that of its Coop Italia consumer cooperatives, which, after some turbulence, exited the crisis in a strengthened position and today are the dominant player in the Italian supermarket sector.

These shifts, and the shift away from the – very pro-cyclic – construction industry, into diversified fields within the service industry (making up roughly 80% of employment in cooperatives today), including social services, the fastest growing portion of the sector, provided a solid foundation for transitioning the Italian cooperatives from marginal players to a position of global competitiveness, where many cooperatives today accrue billions in revenue, employing many thousands, and are competitive in a sophisticated global supply chain. An example of this is SACMI, a ceramics giant, employing more than 5,000 and with subsidiaries in Brazil, the United States and an annual turnover in the billions. These shifts helped the cooperative movement weather the GFC and similar crises.

These facts, and the fact that the cooperative federations – and particularly Legacoop -- “had developed a de-facto crisis management approach from previous experiences” meant that “[w]hen the crisis came in 2008, the cooperative sector was ready” (p. 145).

Stay tuned!

Subscribe to our newsletter to learn about new debates, conferences and writing workshops.

Subscribe!

Role of the Legislative Environment

The legislative environment also contributed to the stability and resilience of the cooperative sector. Firstly, Article 45 Italy’s Constitution provides key protections of cooperatives and recognizes the positive role they play in social terms. Moreover, subsequent reforms, like 1985’s Marcora Law, which enables unemployed workers to receive 2 years of their unemployment subsidy in the form of financing towards starting a cooperative, have removed barriers to cooperative entrepreneurship. Subsequent laws like that governing micro-cooperatives (some as small as 3 members), social enterprises and worker buyouts (which we discuss in further detail below) have further assisted in creating a granular legal ecosystem that responds to the demand of the cooperative sector to reduce the barriers to starting new cooperatives.[i]

Italy’s prevalently mutual cooperatives are required to deposit 30% of their profits in so-called “indivisible reserves” that act as a reservoir for financing investment. This has both the benefit of increasing stability and independence, and in dealing structurally with the problem of underinvestment that often plagues cooperatives. An additional 3% of profits are required to go to cooperative development funds, which each of the three major federations has one of. These funds act as intermediaries, often performing fiduciary services, reviewing investment proposals, granting emergency funding or factoring, providing consultancy services to firms and, on occasion, planning restructuring of firms. Most of the profits directed to these reserve or investment funds are either not taxed or receives tax concessions. Such legislation, and laws like Law 2001/142 provide a context where existing cooperatives are strengthened and put into a position of managing organizational change.

Law 2001/142 provide formal structures by which ailing cooperatives may restructure or weather cyclical downturns. According to this law, granted that a firm has a restructuring plan (which cooperative development funds help develop), it can enforce so-called “solidarity contracts”, which “enabl[e] it to place members and non-members on the temporary unemployment list, reduce work hours or reduce their pay for a limited period” (p. 144). These employees are entitled to receive unemployment benefits and secure retraining with the ultimate aim to re-employing them at a later date.

A plethora of other legal innovations have contributed to the strong position Italy’s cooperative sector finds itself in, as the next financial and economic crisis looms in the winter of 2020. These include pluralistic ownership structures like cooperative-led joint ventures and Cooperative Groups of Firms, Consortia-like structures led by cooperatives that can also include traditional enterprises. Cooperative groups, which Ammirato discusses in Chapter 6 of his book, have allowed the cooperative sector access to external financing and formalized ties to suppliers that, while themselves not cooperatives, have deep ties with the cooperative sector. These financing structures have allowed cooperatives bridge the gap between their own developments and external capital, in order to expand into international markets by investing in capital-intensive sectors and establishing foreign subsidiaries.

Social Cooperatives. A New Model for Providing Social Services

As mentioned, laws governing social cooperatives have also given an impetus to Italy’s Social Economy, led by its cooperative sector. The first law on social cooperatives was introduced in 1991, and defined what functions these serve and whose interests they advance. An innovative feature of the social cooperative, and which distinguishes it even from traditional cooperatives, is the fact that the interest group is not restricted to members. While traditional cooperatives seek to advance the interests of their members (whether consumers, investors, workers, tenants, etc.), social cooperatives have “the purpose of pursuing the general interests of the community, promoting human development and the social integration of citizens” (Law 381/1991).

Social cooperatives are a direct result of the concurrent failure of the Italian welfare state to meet the demand for social assistance and the changing organization of social life: as more women entered the workforce, new structures were needed to care for both children and the elderly. As Italy faced a fiscal crisis for many years, which was only exacerbated in the wake of the Eurocrisis, many traditional social services were outsourced, and the cooperative sector was ready to step in.

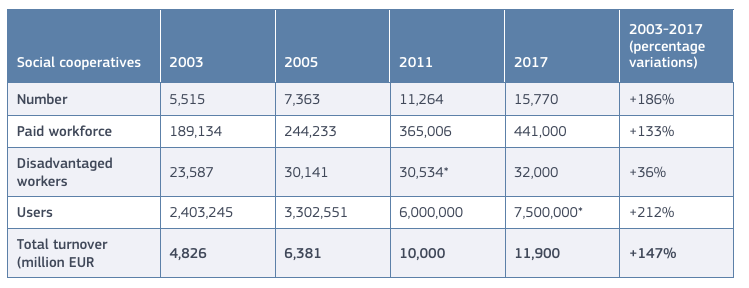

Thus, social cooperatives today are the fastest-growing segment of Italy’s cooperative sector (growing at a rate of almost 200% between 2003-2017), with at present more than 15,000 in existence, providing employment to nearly 500,000 and social services to over 7,000,000 young, disadvantaged and handicapped persons, as well as migrants and refugees, who would otherwise receive inadequate State support. This fact should reassure anyone whose sole knowledge of the situation of refugees in Italy has been Salvini’s bellicose rhetoric. Italy’s social cooperatives are a shining example of successful integration and activation of otherwise marginalized individuals that deserves a lot more attention than they currently receive[ii].

Worker Buyouts: Saving Industry

Lastly, the phenomenon of worker buyouts (WBOs) should be mentioned. 1985’s Marcora Law is named after Giovanni Marcora, the then-Minister of Trade and Industry. This framework establishes a fund, managed by the intra-cooperative consortium named CFI, which together with the Ministry of Development, the cooperative development funds, institutional investors and cooperative financial networks, provides equity and loans to workers towards acquiring a stake in their companies (somewhat similar to the American phenomenon of ESOPs). In essence, workers “buy out” the owners in order to create cooperatively-held firms. CFI claims to enact between 1 and 2 WBOs a month in this way, and has managed to create roughly 380 cooperatives between 1985 and 2018, saving nearly 20,000 jobs during this period (https://www.cfi.it/download/cfi_eng_04_2019.pdf).

Since 1999, Baca Populare Etica has joined the mix of institutional investors. It is a growing cooperative bank with a commitment to investing in ethical, sustainable and socially-conscious practices. It joins a growing list of institutional investors supporting WBOs, including CCFS, Cooperfidi. An established network of State, private and cooperative institutions therefore exists, often acting synergistically to prevent jobs from being outsourced.

|

|

Potential Limitations

Despite making major advances, there are some issues it would behoove the Italian cooperative sector, and others wishing to emulate its successes, to take note of.

Ammirato points out that, while cooperatives and the Social Economy provide stable employment and carry out a counter-cyclical function in times of economic downturn, “they are not immune to a prolonged economic crisis.” For instance, he points out that between 2009 and 2014, roughly 12,000 cooperatives ceased to operate, and especially young and small firms suffered the most dramatic collapse of turnover. Additionally, even some large and established firms in the construction sector collapsed during the crisis, in some cases because of inadequate governance (p. 154). Nevertheless, a legislative environment conducive to starting up new cooperatives compensated for the losses, in many cases, explaining for the fact that the number of people employed by cooperatives continued to grow over this period.

Additionally, the fact that cooperatives have limited avenues available to them for financing outside of their indivisible reserves (they usually cannot sell shares, like publicly traded firms), means that external financing is often a necessity. Since debts and interest have to be paid in most cases, a heavier debt burden means more money being directed to servicing debt. Although, even here, there is some flexibility, as institutional investors like Legacoop only receive a dividend on equity investment if a cooperative makes a profit. Certainly, as can be seen, the cooperative sector is in an excellent position to step up and maintain employment during downturns, but there is a limit to the level of debt they can realistically take on to serve this role. Thus, Ammirato offers a cautionary word: “The failure of [established] construction cooperatives reinforces the view that cooperatives can perform an anti-cyclic function for a limited period. In a prolonged recession they would be required to change strategies…[i]t also highlighted the importance of finding a balance between the principles of mutuality… and economic performance” (p. 155). In other words: cooperatives can relieve States in recessions by maintaining stable employment and keeping people of the unemployment rolls to a degree, but they are not miracle workers.

Certainly, these obstacles are not insurmountable, and the cooperatives’ lobbying of European governments in favor of this summer’s bailout fund points toward potential avenues in which a synergistic relationship between States and the private sector can be maintained. Recognition needs to be given to the vital role enterprises within the Social Economy, whether traditional worker cooperatives, consumer cooperatives or social cooperatives, play. Moreover, the government simply needs to step in at such times, just as it stepped in to save large multinational firms like General Motors, AIG or Germany’s Commerzbank when they were threatened by liquidity concerns caused by a recession.

Conclusion

As the Covid-19 fueled economic downturn begins to intensify this winter, an extended study of the Italian cooperative sector’s historical resilience in times of crisis can serve as a learning experience for other countries seeking to create policies that foster more stable economies, with job security, care for marginalized communities and adequate counter-cyclical policies. Particularly, the Italian cooperative sector’s contributions to three aspects should be noted in closing. Firstly, the innovative phenomenon of cooperative enterprises has contributed to social inclusion of immigrant communities, the activation of youth, the unemployed and people with disabilities, a true compensation for both a market and state failure. Secondly, they have contributed to a reduction in income and wealth inequalities at a time when the issue of inequality is of global significance. Thirdly, the Italian cooperative movement has helped local communities revitalize in the face of demographic shifts and rendered them more resilient to the ravages of globalization. Each of these in their own right is a remarkable achievement.

This path appears especially attractive in a time when many governments are not fulfilling their responsibilities to their citizens in these regards, and state failure accompanies the market failure resulting from large multinationals hoarding cash or using it for stock buybacks or mergers & acquisitions. In a recent public statement, Federal Reserve Chairman Jerome Powell described the consequences of doing too little to stymie the downturn as potentially “tragic”. A robust legal and institutional environment for cooperatives and the Social Economy would only help stabilize many currently ailing economies and prevent the most tragic outcomes from occurring. Such an environment would contribute to this end by ensuring a pluralistic market economy with more options for citizens to participate. Political parties and social movements should take note of Italy’s example.

There is still so much to discover!

In the Discover section we have collected hundreds of videos, texts and podcasts on economic topics. You can also suggest material yourself!

Discover material Suggest material

[i] For example, it is obviously less burdensome to start a company with three people than it is to require 9, as was traditionally the case in Italy.

[ii] See the table below and also refer to Ammirato, pp. 122-126

Go to: How to strengthen the social economy