468 results

Towards a post-work future: a necessary agenda to reconcile feminist & ecological concerns with work

In this essay the author outlines the basis for embracing a post-work agenda, rooted in an emancipatory potential from the domination of waged work, which could help answer both feminist and ecological concerns with work.

Firms are the primary places where economic activity takes place in modern capitalist economies: they are where most stuff is produced; where many of us spend 40 hours a week; and where big decisions are made about how to allocate resources. Establishing how they work is hugely important because it helps us to understand patterns of production and consumption, including how firms will react to changes in economic conditions and policy. And a well-established literature – led by post-Keynesians and institutionalists – holds that the best way to determine how firms work is to…wait for it...ask firms how they work. This a clearly sensible proposition that is contested in economics for some reason, but we’ll ignore the controversy here and just explore the theory that springs from this approach.

In this essay the authors argue for a wider concept of care work that includes community building, civic engagement and environmental activism. On the basis of the case of Cargonomia, a grassroot initiative in Budapest, they show that such a wider concept of care work could allow for different narratives that promote sustainable lifestyles with a milder environmental and social impact on the planet and its communities.

hether it's working for free in exchange for 'experience', enduring poor treatment in the name of being 'part of the family', or clocking serious overtime for a good cause, more and more of us are pushed to make sacrifices for the privilege of being able to do work we enjoy. Work Won't Love You Back examines how we all bought into this 'labour of love' myth: the idea that certain work is not really work, and should be done for the sake of passion rather than pay.

This essay suggests to bring together two aspects of economic thought which so far have developed largely separately: degrowth and feminist economics. In this strive, the concept of care work and its role in feminist economics will be introduced and the downsides of the commodification of care work will be discussed. Subsequently, contributions to the discussion on the (re)valuation of care work will be taken into account.

This text provides an overview of feminist perspectives on various kinds of work and reproductive labour. The authors start at the intersection of Marxism and Feminism. They, then, give a historical background on the United States feminist movement. They, finally, provide alternative perspectives on work and reproductive labor that are not based on Marxist Feminist theory.

The outbreak of COVID-19 has substantially accelerated the digitalization of the economy. Yet, this unprecedented growth of digital technology brought novel challenges to the labour market. Rise in income inequalities and precarious working conditions or polarization of jobs. In this essay, we try to assess what tools to use to counter these trends.

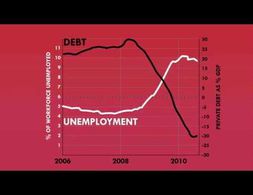

Due to the economic crisis of 2008/2009, households faced drastic decreases in their incomes, the availability of jobs. Additionally, the structure of the labour market changed, while austerity measures and public spending cuts left households with less support and safeguards provided by the state. How have these developments affected the burden of unpaid labour and what influence did this have on gender relations?

This course is designed to provide students with an understanding of work-related gender issues and to enable students to analyze the issues using the tools of economics.

This graduate-level course examines issues related to women’s paid and unpaid work during a time of rapid integration of world markets. Students will analyze the role of government policy, unions, corporate responsibility, and social movements in raising women's wages, promoting equal opportunity, fighting discrimination in the workplace, and improving working conditions.

Markets are the focus in modern economics: when they work, when they don’t and what we can or can’t do about it. There are many ways to study markets and how we do so will inevitably affect our conclusions about them, including policy recommendations which can influence governments and other major organisations. Pluralism can be a vital corrective to enacting real policies based on only one perspective and a plethora of approaches provide alternatives to the canonical view. Although they have differing implications, these approaches share the idea that we should take a historical approach, analysing markets on a case-by-case basis; and they share a faith in the power of both individuals and collectives to overcome the problems encountered when organising economic activity.

This study aims to provide insights on how the Social and Solidarity Economy (SSE) is contributing to the future of work.

The infographic focuses on women's hidden work that goes unrewarded due to the patriarchal setup and how it can be economically analysed. The article on which the infographic is based is written in an Indian context, although the phenomenon isn't confined to a single nation alone.

Work defines who we are It determines our status and dictates how where and with whom we spend most of our time It mediates our self worth and molds our values But are we hard wired to work as hard as we do Did our Stone Age ancestors also live …

What are the challenges and opportunities for achieving decent work in global supply chains How do transnational corporations and their global supply chains operate How can they be more effectively governed Mark Anner Esther Busser Michael Fichter Tandiwe Gross Frank Hoffer Jenny Holdcroft Praveen Jha Maité Llanos Adam Lee Victor …

In this new book Smith returns to Solow s classic productivity paradox which essentially states that we can see automation everywhere like the spheres of leisure sociality and politics but not in the productivity statistics He examines why labor saving automation in the service age in the Global North has …

Feminist economist Nancy Folbre presents a historical analysis of the interrelated development of Patriarchy and Capitalism. She describes the role of women in the reproduction of labour, their “specialization” in care and their changing involvement in the labour market. Folbre argues that capitalism weakens patriarchy but at the same time relies on unpaid caring activities.

Caring activities are one central element of feminist economists' analysis – also since in particular unremunerated work is a blind spot in mainstream economics and most other economic paradigms. Those focus on the market sphere: activities are considered as productive and as real labour if they are remunerated and market-intermediated. Goods and services are considered as labour if they create a value which can be traded on the market. Feminist Economics remarks that this perspective creates certain dichotomies and consequent devaluations: unproductive – productive; private – public; unpaid – remunerated OR paid less – well paid; female – male; soft work – hard work; caring – rationality.

To what extent does gender affect people's patterns of labor force participation, educational preparation for work, occupations, hours of work (paid and unpaid) and earnings?

Is capitalism the context where gender inequalities are reproduced, or is capitalism something more than a context? What are the differences among women and how can we place them theoretically and politically. Reproductive work, is it a women’s work? These questions are disscused in a three-session workshop.

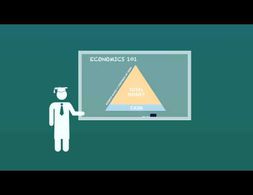

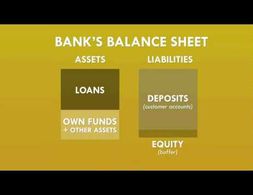

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

The dossier explores the nature of care work and the gendered constructions and dichotomies that are associated with it. Drawing from feminist analysis the double burden, the undervaluation of feminised labour, the commodification of affective labour and the remittance economy are inquired into. Moreover, it is discussed how welfare regimes rely on the different organization of care work.

This brief note explores the possibility of working towards an enlarged self-definition of economics through economists’ study and appreciation of economic sociology. Common ground between economic sociology and heterodox economics is explored, and some of Richard Sennett’s ideas are used as prompts to raise some pertinent and hopefully interesting questions about economics. In particular, the note revisits the question of whether there is a possibility of changing our understanding of what kind of social scientific work falls within the domain of economics proper once we start critically engaging with work conventionally considered to be outside of that domain. In part, the note is intended to offer undergraduate students in economics – and possibly even those further down the road in their education – food for thought about what constitutes economics.

The general idea of a Job Guarantee (JG) is that the government offers employment to everybody ready, willing and able to work for a living wage in the last instance as an Employer of Last Resort. The concept tackles societal needs that are not satisfied by market forces and the systemic characteristic of unemployment in capitalist societies. Being a central part of the Modern Monetary Theory (MMT), attention for the JG concept rose in recent years.

Capitalism is dissolving boundaries - not only in the sense of ever-expanding global trade flows, but also in the concrete everyday working lives of individuals. What implications does this have for our understanding of freedom, work and borders?

Feminist economics focuses on the interdependencies of gender relations and the economy. Care work and the partly non-market mediated reproduction sphere are particularly emphasised by feminist economics.

This article explores if power dynamics in the household can be changed, and if so, how. In this context the focus is laid on government childcare policy and its various channels of possible influence.

Nous utilisons des cookies sur notre site Web. Cliquez sur Accepter pour nous aider à améliorer constamment Exploring Economics !