✕

499 results

Feminist economist Nancy Folbre presents a historical analysis of the interrelated development of Patriarchy and Capitalism. She describes the role of women in the reproduction of labour, their “specialization” in care and their changing involvement in the labour market. Folbre argues that capitalism weakens patriarchy but at the same time relies on unpaid caring activities.

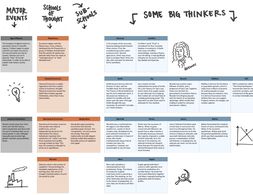

This historic timeline presents economic events, economic thinkers and schools of thought from the 18th century until the 2007/2008 financial and economic crisis with short texts on the respective event or perspective.

In this lecture, Prof. Israel Kirzner presents a historical overview of the development of the Austrian school. The talk covers a timespan from the beginnings of the Austrian School in the early 1870's till just before the more recent 'revival' of the School in the mid-1970's.

Snow removal, ambulance transport, and school performance -the film aims at illustrating the principles of gender mainstreaming through concrete examples.

Happy International Women s Day This International Women s Day 2018 is an opportune moment to highlight prominent scholars of Feminist Economics As a subdiscipline of economics Feminist Economics analyzes the interrelationship between gender and the economy often critiquing inequities and injustices perpetuated by mainstream paradigms Work of this nature …

Social and Solidarity Economy (SSE) and Feminist Economics make a conjoint statement: The way we see the economic system has nothing to do with human beings nor those who have been surviving outside the market.

Anwar Shaikh explores alternative economic explanations, emphasizing 'real competition' theory and the role of imperfections in economic patterns.

In this article, Perry Mehrling, a professor of economics at Barnard College, presents and discusses three theories of banking which are guiding bank regulation. These are credit creation theory, fractional reserve theory and debt intermediation theory.

What data is used in the economic models of the IPCC? How problematic is it, that tipping points are often ignored? A very interesting presentation by Steve Keen during the OECD Conference "Averting Systemic Collapse".

In this talk Robert Skidelsky analyses how sociology did and could enrich economic analyses, but also how critical sociological insights have been colonised by mainstream economics.

In this video, Rajan Raghuram highlights ‘A hereditary Meritocracy’. He identifies the “limitations” with the current economic systems of democracy and markets.

The article discusses the state’s influence on innovation through financial support and provides examples how the state could receive a financial share of successful enterprises in order to keep on driving innovation in the future.

Overview page for the collection of nobel laureateas on Exploring Economics

This talk is an exploration of a feminist centred world, where women's labour, women's energy, women's contributions to the economy are not a side event but the main event.

Marxist scholar David Harvey explains key concepts of capital from Marx. Applying Marx's analysis of capital to today's world, showing both the longevity and relevance of Marx's Capital, 150 years after its publication.

In this short talk 'Measuring the Danger of Segregation' Trevon Logan, Professor of Economics at The Ohio State University, explores the impacts of structural racism on economics and health.

Economists claim they are not biased or ideological, but research by economist Mohsen Javdani tells another story. Javdani discovered that 82% of economists claim that statements and arguments should be evaluated on the content only, but the results of the study show the exact opposite.

Understanding international trade is central to economics and is currently a hot political issue. It’s an area where popular perceptions of mainstream economics are low, since they have historically missed some important downsides of trade agreements, especially the hollowing out of former manufacturing hubs in the Western world. et economists have for long time had a theory of trade with an impressive amount of scientific clout behind it: the gravity trade model.

Economists like to base their theories on individual decision making. Individuals, the idea goes, have their own interests and preferences, and if we don’t include these in our theory we can’t be sure how people will react to changes in their economic circumstances and policy. While there may be social influences, in an important sense the buck stops with individuals. Understanding how individuals process information to come to decisions about their health, wealth and happiness is crucial. You can count me as someone who thinks that on the whole, this is quite a sensible view.

Hamilton argues that economics lacks the political economy context in order to understand racism, and demonstrates how racism is embedded in the political economy of America.

Most mainstream neoclassical economists completely failed to anticipate the crisis which broke in 2007 and 2008. There is however a long tradition of economic analysis which emphasises how growth in a capitalist economy leads to an accumulation of tensions and results in periodic crises. This paper first reviews the work of Karl Marx who was one of the first writers to incorporate an analysis of periodic crisis in his analysis of capitalist accumulation. The paper then considers the approach of various subsequent Marxian writers, most of whom locate periodic cyclical crises within the framework of longer-term phases of capitalist development, the most recent of which is generally seen as having begun in the 1980s. The paper also looks at the analyses of Thorstein Veblen and Wesley Claire Mitchell, two US institutionalist economists who stressed the role of finance and its contribution to generating periodic crises, and the Italian Circuitist writers who stress the problematic challenge of ensuring that bank advances to productive enterprises can successfully be repaid.

This paper investigates how the concept of public purpose is used in Modern Monetary Theory (MMT). As a common denominator among political scientists, the idea of public purpose is that economic actions should aim at benefiting the majority of the society. However, the concept is to be considered as an ideal of a vague nature, which is highly dependent on societal context and, hence, subject to change over time. MMT stresses that government spending plans should be designed to pursue a certain socio-economic mandate and not to meet any particular financial outcome. The concept of public purpose is heavily used in this theoretical body of thought and often referred to in the context of policy proposals as the ideas of universal job guarantee and banking reform proposals show. MMT scholars use the concept as a pragmatic benchmark against which policies can be assessed. With regards to the definition of public propose, MMT scholars agree that it is dependent on the social-cultural context. Nevertheless, MMT scholars view universal access to material means of survival as universally applicable and in that sense as the lowest possible common denominator.

The principle of effective demand, and the claim of its validity for a monetary production economy in the short and in the long run, is the core of heterodox macroeconomics, as currently found in all the different strands of post-Keynesian economics (Fundamentalists, Kaleckians, Sraffians, Kaldorians, Institutionalists) and also in some strands of neo-Marxian economics, particularly in the monopoly capitalism and underconsumptionist school In this contribution, we will therefore outline the foundations of the principle of effective demand and its relationship with the respective notion of a capitalist or a monetary production economy in the works of Marx, Kalecki and Keynes. Then we will deal with heterodox short-run macroeconomics and it will provide a simple short-run model which is built on the principle of effective demand, as well as on distribution conflict between different social groups (or classes): rentiers, managers and workers. Finally, we will move to the long run and we will review the integration of the principle of effective demand into heterodox/post-Keynesian approaches towards distribution and growth.

This paper presents an overview of different models which explain financial crises, with the aim of understanding economic developments during and possibly after the Great Recession. In the first part approaches based on efficient markets and rational expectations hypotheses are analyzed, which however do not give any explanation for the occurrence of financial crises and thus cannot suggest any remedies for the present situation. A broad range of theoretical approaches analyzing financial crises from a medium term perspective is then discussed. Within this group we focused on the insights of Marx, Schumpeter, Wicksell, Hayek, Fisher, Keynes, Minsky, and Kindleberger. Subsequently the contributions of the Regulation School, the approach of Social Structures of Accumulation and Post-Keynesian approach, which focus on long-term developments and regime shifts in capitalist development, are presented. International approaches to finance and financial crises are integrated into the analyses. We address the issue of relevance of all these theories for the present crisis and draw some policy implications. The paper has the aim to find out to which extent the different approaches are able to explain the Great Recession, what visions they develop about future development of capitalism and to which extent these different approaches can be synthesized.

Professor Joseph Aldy from Harvard Kennedy School gives us some insights about how economics can set the balance between policymakers, scientists, employers and citizens.

In this podcast, Laura Basu focuses on how capitalist markets and nation-states perpetuate structural racism.

The COVID-19 pandemic has had far-reaching implications across the African continent. This discussion brings to light the role of African think tanks, such as the African Center for Economic Transformation (ACET) in rethinking the continent’s development models, especially, in light of the unprecedented crisis.

This paper attempts to clarify how the European economic crisis from 2007 onwards can be understood from the perspective of a Marxian monetary theory of value that emphasizes intrinsic, structural flaws regarding capitalist reproduction. Chapter two provides an empirical description of the European economic crisis, which to some extent already reflects the structural theoretical framework presented in chapter three. Regarding the theoretical framework Michael Heinrich's interpretation of 'the' Marxian monetary theory of value will be presented. Heinrich identifies connections between production and realization, between profit and interest rate as well as between industrial and fictitious capital, which represent contradictory tendencies for which capitalism does not have simple balancing processes. In the context of a discussion of 'structural logical aspects' of Marx's Critique of the Political Economy, explanatory deficits of Heinrich's approach are analyzed. In the following, it is argued that Fred Moseley's view of these 'structural logical aspects' allows empirical 'applications' of Marxian monetary theories of value. It is concluded that a Marxian monetary theory of value, with the characteristics of expansive capital accumulation and its limitations, facilitates a structural analysis of the European economic crisis from 2007 onwards. In this line of argument, expansive production patterns are expressed, among other things, in global restructuring processes, while consumption limitations are mitigated by expansive financial markets and shifts in ex-port destinations.

This article examines the spread of financialization in Germany before the financial crisis. It provides an up-to date overview on the literature on financialization and reviews which of the phenomena typically associated with financialization have emerged in Germany. In particular, the article aims to clarify how the prevailing institutional structure and its changes had contributed to or had countervailed the spread of financialization and how it had shaped the specific German variant of financialization. For this end, it combines the rich literature on Germany's institutional structure with the more macroeconomic oriented literature on financializaton. With the combination of those different perspectives the article sheds light on the reasons for the spread of financialization and the specific forms it has taken in Germany.

In spite of the manifold critique about the state of economics in the aftermath of the financial crisis, an even increasing presence of economists and economic experts can be observed in the public sphere during the last years. On the one hand this reflects the still dominant position of economics in the social sciences as well as the sometimes ignorant attitude of economists towards findings of other social sciences. On the other hand this paper shows that the public debate on politico-economic issues among economists is dominated by a specific subgroup of economists, tightly connected to an institutional network of “German neoliberalism”. This group of “public economists” (i) is dominant in public debates even after the financial crisis, (ii) reproduces the formative German economic imaginary of the Social Market Economy in a German neoliberal interpretation and (iii) has a good access to German economic policymaking, rooted in a long history of economic policy advice.

The article compares market fundamentalism and right-wing populism on the basis of its core patterns of thinking and reasoning. Based on an analysis of important texts in both fields we find many similarities of these two concepts in their "inner images". Thus, we develop a scheme of the similar dual social worlds of right-wing-populism and market fundamentalism and offer some recent examples of market fundamentalism and right-wing populism mutually reinforcing each other or serving as a gateway for each other. We then apply our scheme for the analysis of the recent political developments and its ideological roots in the US under Donald Trump.

Exploring Economics, an open-source e-learning platform, giving you the opportunity to discover & study a variety of economic theories, topics, and methods.

We use cookies on our website. Click on Accept to help us to make Exploring Economics constantly better!