510 Ergebnisse

Ecologcial economics conceptualizes our society as embedded within the environment and our economic system as embedded within society and the environment.

Public lectures on some Traditional Economic Solutions to poverty in Nigeria, specifically the Igbo Apprentice System, Yoruba Ajo Thrift Savings, and Hausa Integral Communalism.

In the graveyard of economic ideology, dead ideas still stalk the land.

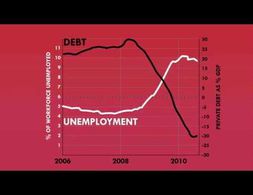

The recent financial crisis laid bare many of the assumptions behind market liberalism—the theory that market-based solutions are always best, regardless of the problem. For decades, their advocates dominated mainstream economics, and their influence created a system where an unthinking faith in markets led many to view speculative investments as fundamentally safe.

Once in a while the world astonishes itself. Anxious incredulity replaces intellectual torpor and a puzzled public strains its antennae in every possible direction, desperately seeking explanations for the causes and nature of what just hit it. 2008 was such a moment. Not only did the financial system collapse, and send the real economy into a tailspin, but it also revealed the great gulf separating economics from a very real capitalism.

The 2007–08 credit crisis and the long recession that followed brutally exposed the economic and social costs of financialization. Understanding what lay behind these events, the rise of “fictitious capital” and its opaque logic, is crucial to grasping the social and political conditions under which we live. Yet, for most people, the operations of the financial system remain shrouded in mystery.

Those who control the world’s commanding economic heights, buttressed by the theories of mainstream economists, presume that capitalism is a self-contained and self-generating system.

The Great Recession 2.0 is unfolding before our very eyes. It is still in its early phase. But dynamics have been set in motion that are not easily stopped, or even slowed. If the virus effect were resolved by early summer—as some politicians wishfully believe—the economic dynamics set in motion would still continue. The US and global economies have been seriously ‘wounded’ and will not recover easily or soon. Those who believe it will be a ‘V-shape’ recovery are deluding themselves. Economists among them should know better but are among the most confused. They only need to look at historical parallels to convince themselves otherwise.

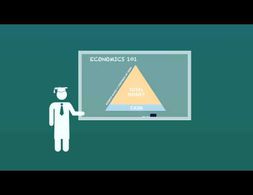

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Paul Mason presents the main arguments of his book PostCapitalism. First, he argues that capitalism runs out of its capability to adapt to crises and second states that information technology challenges the capitalist system. In a nutshell, he argues that a society which fully exploits information technologies can't include concepts such as intellectual property, free market or private ownership. This has far-reaching consequences for the organisation of wages and work. The talk stops at minute 37.30.

Prof. Kädtler (Soziologe) betrachtet die Kapitalismusform des "Finanzmarktkapitalismus" aus soziologischer Perspektive, im besonderen aus Sicht der Konventionenökonomik. Nach Einführungen in (a) Finanzmärkte, (b) Finanzialisierung und Finanzmarktkapitalismus (ab 9:30) sowie (c) Formationstheorien und „Cultural Economy"-Ansätze (u.a. Konventionenökonomik) (ab 16:00), liegt der Schwerpunkt der Analyse darauf, (d) mithilfe der Konventionenökonomik zu erklären, wie ein System des Finanzmarktkapitalismus entstehen konnte (ab 38:00). Kurz geht der Vortragende am Ende der Frage nach, warum sich die Situation auch nach der globalen Finanzkrise nicht geändert hat. Der Vortrag bietet einen interessanten ersten Einblick in die soziologische Perspektive auf Finanzmarktkapitalismus. Die Hauptanalyse und die Anwendung der Theorie an praktischen Beispielen ist eher kurz gehalten, allerdings werden relevante Schulen und Autoren genannt, die weiter recherchiert werden können.

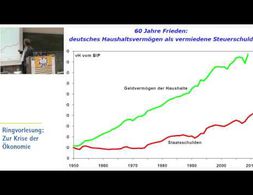

Walter Ötsch beschreibt wie die Ökonomik sich von der Moralwissenschaft unter Adam Smith zu einer Wissenschaft mit einem biologisch determinierten Menschenbild unter Malthus und Ricardo entwickelt. In diesem Prozess kommen naturwissenschaftliche Metaphern (Uhr-System, Waage-Gleichgewicht, Computer-Information) immer mehr zum Tragen. Anhand der Geschichte wird die Entwicklung der modernen Neoklassik gezeigt. Dann wird die marktliberale Interpretation der Neoklassik kritisiert. Zum Schluss wird noch auf das fehlende Narrativ der Ökonomik zur Finanzkrise eingegangen und auf den nicht stattgefundenen Bruch mit der Marktradikalität der Eliten.

In seinem Vortrag erläutert Helge Peukert wie die neoklassische Denkschule und Wirtschaftspolitik zu der internationalen Finanz- und Schuldenkrise der letzten Jahre geführt hat. Hierbei übt Peukert besonders Kritik am bestehenden Banken - und Finanzsystem. Er zeigt auf welche Gefahren und Antriebsfaktoren solch ein System bergen kann.

Das VWL-Basiswissen bietet Lerneinheiten zu Grundbegriffen und Denkrichtungen der Volkswirtschaftslehre an. Neben Einheiten zum BIP, Zahlungsbilanzen, Inflation, Wechelkursen gibt es Module zur Messung sozio-ökonomische Ungleichheiten und einer interdisziplinären Betrachtung auf Entwicklung. Im Theoriebereich liegt ein Fokus auf Globaler Ökonomie und Entwicklungstheorie, u.a. werden die Welt-System Theorie und postkoloniale Ansätue vorgestellt.

Founded in 1968, The Union for Radical Political Economics (URPE) is an interdisciplinary membership organization of academics and of activists. Its mission is to promote the study, development and application of radical political economic analysis to social problems. Concretely, this involves a continuing critique of both the capitalist system, and of all forms of exploitation and oppression. URPE’s mission also includes, coming out of this critique, helping to construct a progressive social policy, and a human-centered radical alternative to capitalism.

The page "Positive Money" gathers text and short videos which explain how money is created by banks by giving loans. It furthermore presents the consequences of this process on housing prices, inequality and the environment and its role in the financial crisis. The dossier is provided by the campaign "Positive Money" which aims at a democratic control over money creation. Besides texts by the campaign, the page makes available links to journal and conference articles on the topic. The page focuses on the banking system of the UK.

First historical instances of colonialism such as the crusades are revisited. Then a lengthy account of the colonial experience of the Spanish Kingdom in South America and of the British Empire in India is given. The Indian case is illustrated with large amounts of archival materials from a colonial administrator. There the workings of the colonial bureaucracy and law and its (positive) achievements as well as the ignorance and arrogance of the external rulers are demonstrated. After narrating the Indian independence to some depth some recent colonial wars (Algeria, Vietnam, Congo, Angola) are briefly examined. In the end, the impact of colonialism on current, i.e. 1970s, (economic) international relations is discussed. The general tenor is that colonialism is a dysfunctional system. Still, agency is mostly placed with the empire rather than with the ruled.

Wir brauchen Alternativen zu einem System, das auf die stetige Ausbeutung natürlicher Ressourcen angewiesen ist. Die Kreislaufwirtschaft stellt ein derartiges Wirtschaftskonzept dar – dem es jedoch bisher an politischer Tatkraft fehlt. Ein Beitrag von Burcu Gözet.

Mark Blyth criticises the political inability to solve the persistent economic crisis in Europe against the background of a deflationary environment. Ideological blockades and impotent institutions are the mutually reinforcing causes of European stagnation. The deeper roots lie in the structural change of the economic system since the 1980s, when neoliberalism emerged as hegemonic ideology. This ideology prepared the ground for austerity and resulting deflationary pressures and a strategy of all seeking to export their way out of trouble. Worryingly this is breeding populist and nationalist resentments in Europe.

In this lecture, Beatrice Cherrier explains why it is worth to research the history of JEL codes. The changing relationship between theory and application and the rise and death of new economic topics in the XXth century through the successive revisions of the classification system economists use to publish, recruit and navigate their discipline.

Based on Modern Money Theory (MMT), Stephanie Kelton compares the cryptocurrency to the fiat money system (or simply what we have today).

Podcast series with six 12-minute parts introducing the the values and ideas behind our neoliberal economic system: where it came from, how it spread, and how we could do things differently.

The mandate of central banks has seemed clear for decades : keep inflation low. Nevertheless borders between monetary, financial and economic policy have been blurry even before the pandemic.. Faced with the challenges of the climate crisis, slow growth, unemployment and inequality, does the financial and monetary system need a new constitutional purpose.

This paper surveys the development of the concept of socialism from the French Revolution to the socialist calculation debate. Karl Marx’s politics of revolutionary socialism led by an empowered proletariat nurtured by capital accumulation envisions socialism as a “top-down” system resting on political institutions, despite Marx’s keen appreciation of the long-period analysis of the organization of social production in the classical political economists. Collectivist thinking in the work of Enrico Barone and Wilfredo Pareto paved the way for the discussion of socialism purely in terms of the allocation of resources. The Soviet experiment abandoned the mixed economy model of the New Economic Policy for a political-bureaucratic administration of production only loosely connected to theoretical concepts of socialism. The socialist calculation debate reductively recast the problem of socialism as a problem of allocation of resources, leading to general equilibrium theory. Friedrich Hayek responded to the socialist calculation debate by shifting the ground of discussion from class relations to information revelation

How did the coronavirus almost bring down the Global Financial System? What effects does monetary policy have on inequality? What role do Central Banks have in the social-ecological transformation? How could Central Banks tackle climate change? What is Central Bank Digital Currency?

Is our system capable of energy transition and climate protection? How plural is economic policy in practice and who makes the big decisions? What kind of change do we want?

This course attempts to explain the role and the importance of the financial system in the global economy. Rather than separating off the financial world from the rest of the economy, financial equilibrium is studied as an extension of economic equilibrium. The course also gives a picture of the kind of thinking and analysis done by hedge funds.

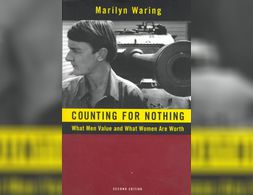

This is a revolutionary and powerfully argued feminist analysis of modern economics, revealing how woman's housework, caring of the young, sick and the old is automatically excluded from value in economic theory. An example of this pervasive and powerful process is the United Nations System of National Accounts which is used for wars and determining the balance of payments and loan requirements.

Wir nutzen Cookies. Klicke auf "Akzeptieren" um uns dabei zu helfen, Exploring Economics immer besser zu machen!