190 Ergebnisse

This paper attempts to clarify how the European economic crisis from 2007 onwards can be understood from the perspective of a Marxian monetary theory of value that emphasizes intrinsic, structural flaws regarding capitalist reproduction. Chapter two provides an empirical description of the European economic crisis, which to some extent already reflects the structural theoretical framework presented in chapter three. Regarding the theoretical framework Michael Heinrich's interpretation of 'the' Marxian monetary theory of value will be presented. Heinrich identifies connections between production and realization, between profit and interest rate as well as between industrial and fictitious capital, which represent contradictory tendencies for which capitalism does not have simple balancing processes. In the context of a discussion of 'structural logical aspects' of Marx's Critique of the Political Economy, explanatory deficits of Heinrich's approach are analyzed. In the following, it is argued that Fred Moseley's view of these 'structural logical aspects' allows empirical 'applications' of Marxian monetary theories of value. It is concluded that a Marxian monetary theory of value, with the characteristics of expansive capital accumulation and its limitations, facilitates a structural analysis of the European economic crisis from 2007 onwards. In this line of argument, expansive production patterns are expressed, among other things, in global restructuring processes, while consumption limitations are mitigated by expansive financial markets and shifts in ex-port destinations.

Modern Monetary Theory (MMT) is a school of monetary and macroeconomic thought that focuses on the analysis of the monetary and credit system, and in particular on the question of credit creation by the state.

After completing the module, participants should have gained a basic understanding of the economic school of thought referred to as "Modern Monetary Theory" and should be able to analyze the monetary processes at play in the economy and evaluate fiscal and monetary policy decisions from an MMT-perspective.

Exploring Economics, an open-access e-learning platform, giving you the opportunity to discover & study a variety of economic theories, topics, and methods.

Since 2007, central banks of industrialized countries have counteracted financial instability, recession, and deflationary risks with unprecedented monetary policy operations. While generally regarded as successful, these measures also led to an exceptional increase in the size of central bank balance sheets. The book first introduces the subject by explaining monetary policy operations in normal times, including the key instruments (open market operations, standing facilities, reserve requirements, and the collateral framework).

This book is about history of monetary economic thought. From the 18th century with Hume and Smith to the early 20th, the author explains the different schools of thought regarding the monetary theories and policies and specially the central banking theory.

Although money plays a key role in our lives, the workings of our monetary system are a mystery to most of us. ‘The Waterworks of Money’ by cartographer Carlijn Kingma is an attempt to demystify the world of big finance. It visualizes the flow of money through our society, its hidden power made manifest.

If you see money as water, our monetary system is the irrigation system that waters the economy. The better the flow, the more prosperous society will be. Just as water makes crops thrive, so money sets the economy in motion. Or at least that’s the idea. In reality, inequality is growing in many countries and people are dealing with a ‘cost of living crisis’. Meanwhile, the progress with making our economies sustainable is stalling, and financial instability remains an ongoing threat. These problems cannot be seen in isolation from the architecture of our money system. If we truly want to tackle them, we will have to address the design flaws of our current money system.

For more info check: https://www.waterworksofmoney.com or https://www.carlijnkingma.com

For the Dutch version of the animation check: https://www.ftm.nl/waterwerk

Current exhibitions: 'The Future of Money' at Kunstmuseum Den Haag, 14 April, 2023 - 8 September 2023. 'Plumbing The System' at the Dutch Pavilion of the Venice Biennale, 20 May 2023 - 26 November 2023

The second animation video of this series will be released in September 2023.

The Waterworks of Money is a collaboration of cartographer Carlijn Kingma, investigative financial journalist Thomas Bollen, and professor New Finance Martijn van der Linden. Kingma spent 2300 drawing hours, based on in-depth research and interviews with more than 100 experts –ranging from central bank governors and board members of pension funds and banks to politicians and monetary activists.

The structure of our monetary system is not a natural phenomenon. We can choose to change its architecture. Designing the money system– and the laws and institutions that govern it–is ultimately a democratic task, and not a commercial or technocratic one. In practice, however, there is a major obstacle impeding the democratic process: financial illiteracy. By making finance and money needlessly complex, economists, bankers and tax specialists have turned most of us into ‘financial illiterates’. Everyone who doesn’t speak their financial jargon is excluded from the democratic debate on how our monetary system should work.

The Waterworks of Money bypasses the financial jargon. It is an attempt to boost systemic financial literacy. Only if ordinary citizens develop their own vocabulary to participate in the debate about their financial future, can they tell their politicians which kind of ‘financial irrigation system’ they want.

Authors: Carlijn Kingma, Thomas Bollen, Martijn Jeroen van der Linden

Animation: Tiepes, Christian Schinkel, Cathleen van den Akker

Narrator: Loveday Smith

Translation: Erica Moore

Voice recording: Huub Krom

Music and sound: Rob Peters

Photography: Studio OPPA

Partners: Follow the Money, De Haagse Hogeschool, Stimuleringsfonds Creatieve Industrie, Brave New Works, Rabobank, Kunstmuseum Den Haag, Rijksmuseum Twenthe

Modern Monetary Theory and Practice: An Introductory Text is an introductory textbook for university-level macroeconomics students. It is based on the principles of Modern Monetary Theory (MMT).

This video by the Khan Academy presents the difference between monetary policy and fiscal policy and how they affect aggregate demand. The video especially elaborates on the basic explanation on how expansionary monetary policy increases aggregate demand via the market for money and the AD-AS model.

In "The Money Problem, "Morgan Ricks argues for a reform of the American monetary system. Taking up foundational questions of monetary policy, he asks: how would we construct a monetary system if we were starting from scratch? What are the characteristics of a monetary instrument?

In diesem Beitrag diskutiert Ingo Stützle die Modern Monetary Theory (MMT) kritisch aus einer an Marx orientierten Ökonomiekritik. Dabei wird argumentiert, dass die MMT zwar wichtige Fragen aufwirft, aber weder einen adäquaten Begriff von Geld noch von Kapitalismus hat, was mitunter zu Fehlschlüssen führt. Dabei ist der wesentliche Punkt, dass die MMT auf der Basis eines falschen Verständnisses von Geld die notwendige Begrenztheit staatlicher Verfügungs- und Gestaltungsmacht im Kapitalismus nicht versteht.

Die Modern Monetary Theory (kurz: MMT, dt: moderne Geldtheorie) ist eine geldtheoretische und makroökonomische Denkschule, bei der es hauptsächlich um die Analyse des Geld- und Kreditsystems und insbesondere um die Frage der Kreditschöpfung geht.

This book provides a new methodological approach to money and macroeconomics. Realizing that the abstract equilibrium models lacked descriptions of fundamental issues of a modern monetary economy, the focus of this book lies on the (stylized) balance sheets of the main actors. Money, after all, is born on the balance sheets of the central bank or commercial bank.

This paper investigates how the concept of public purpose is used in Modern Monetary Theory (MMT). As a common denominator among political scientists, the idea of public purpose is that economic actions should aim at benefiting the majority of the society. However, the concept is to be considered as an ideal of a vague nature, which is highly dependent on societal context and, hence, subject to change over time. MMT stresses that government spending plans should be designed to pursue a certain socio-economic mandate and not to meet any particular financial outcome. The concept of public purpose is heavily used in this theoretical body of thought and often referred to in the context of policy proposals as the ideas of universal job guarantee and banking reform proposals show. MMT scholars use the concept as a pragmatic benchmark against which policies can be assessed. With regards to the definition of public propose, MMT scholars agree that it is dependent on the social-cultural context. Nevertheless, MMT scholars view universal access to material means of survival as universally applicable and in that sense as the lowest possible common denominator.

Nathan Tankus created this series to introduce people outside of the inner financial circles of professionals, journalists and policymakers to the basic mechanisms and dynamics of monetary policy.

Post-Colonialisms Today researcher Chafik Ben Rouine looks to Tunisia’s post-independence central banking method to provide insight on what progressive monetary policy can look like.

John Christensen from the Tax Justice Network addresses the Modern Monetary Theory idea that governments don't need tax revenues if they want to spend money. Doing so, he sums up the main points made by MMT proponents and their critics, and shows how MMT can be reconciled with another progressive economic narrative: "Modern Tax Theory". While MMT made valuable contributions to the policy debate on fiscal policy, it misrepresents the importance of taxation as a political matter and as a way to generate public revenues. This is where MMT steps in.

Peter Bofinger argues that the Modern Monetary Theory gives theoretical justification for bold answers to the corona crisis.

This is an important contribution both to advancing theoretical and empirical understandings of African monetary sovereignty and to putting problems and possibilities relating to African monetary sovereignty on the political agenda This is of utmost importance given that these issues have largely not received much attention in contemporary discussions of …

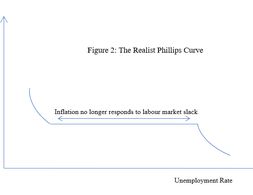

From the perspective of mainstream theory the effectiveness of monetary policy in bringing down inflation depends on two very important equations the aggregate demand equation and the infamous Phillips Curve Without these it becomes more difficult or rather impossible for central banks to carry out monetary policy and obtain the …

Central banks have once again proven to be the first line of defense in crisis-ridden times. With their far reaching actions they prevented the world from experiencing a collapse of financial markets on top of the severe health and economic crisis caused by Covid-19.

As part of the 2019/2020 Exploring Economics Experience, one of our supporters Prof. Steve Keen gave a presentation to our editorial team. Read more

This essay analyses how the role of central banks changed since the global financial crisis, and how this directional change was accelerated by the outbreak of Covid-19.

Source image New Economic Thinking Youtube channel Some years ago in the aftermath of the great financial crisis GFC of the first decade of the twentieth century Paul Krugman famously remarked that most macroeconomics of the last thirty years was spectacularly useless at best and positively harmful at worst It …

The video presents different ways of how to measure the money supply and thereby explains the differences between M0, M1 and M2.

In diesem Podcast beantwortet Aaron Sahr unter anderem folgende Frage: Woher stammt das Geld zur Rettung unserer kapitalistischen Wirtschaft in einer Finanzkrise?

The article discusses whether the turning point in EU's Russia policy with sanctions aimed directly at Putin's war chest of foreign reserves will change the landscape of countries' foreign assets.

This book challenges the mainstream paradigm, based on the inter-temporal optimisation of welfare by individual agents. It introduces a methodology for studying how institutions create flows of income, expenditure and production together with stocks of assets and liabilities, thereby determining how whole economies evolve through time.

The last 15 years have seen extensive research into ecosystem service valuation (ESV), spurred by the Millenium Ecosystem Assessment in 2005 (Baveye, Baveye & Gowdy, 2016). Ecosystem services are defined as “the benefits people obtain from ecosystems” (Millenium Ecosystem Assessment, p.V). For example, ecosystems provide the service of sequestering carbon which helps regulate the climate. Valuation means giving ecosystems or their services a monetary price, for example researchers have estimated that the carbon sequestration services of the Mediterranean Sea is between 100 and 1500 million euros per year. The idea of ESV was a response to the overuse of natural resources and degradation of ecosystems, allegedly due to their undervaluation and exclusion from the monetary economy. ESV can be used (1) for policy decision-making, for example allocating funding to a reforestation project (2) for setting payments to people who increase ecosystem services, for example a farmer increasing the organic carbon content of their soil, and (3) for determining fees for people who degrade ecosystem services, for example a company that causes deforestation.

The mandate of central banks has seemed clear for decades : keep inflation low. Nevertheless borders between monetary, financial and economic policy have been blurry even before the pandemic.. Faced with the challenges of the climate crisis, slow growth, unemployment and inequality, does the financial and monetary system need a new constitutional purpose.

This Blog Post describes the U.S. federal reserve money system from the perspective of the Modern Monetary Theory (MMT). Therefore it presents a theory of money creation, gives simple examples how this influences the economy and the historical process of why the monetary system of the US has developed this way.

The principle of effective demand, and the claim of its validity for a monetary production economy in the short and in the long run, is the core of heterodox macroeconomics, as currently found in all the different strands of post-Keynesian economics (Fundamentalists, Kaleckians, Sraffians, Kaldorians, Institutionalists) and also in some strands of neo-Marxian economics, particularly in the monopoly capitalism and underconsumptionist school In this contribution, we will therefore outline the foundations of the principle of effective demand and its relationship with the respective notion of a capitalist or a monetary production economy in the works of Marx, Kalecki and Keynes. Then we will deal with heterodox short-run macroeconomics and it will provide a simple short-run model which is built on the principle of effective demand, as well as on distribution conflict between different social groups (or classes): rentiers, managers and workers. Finally, we will move to the long run and we will review the integration of the principle of effective demand into heterodox/post-Keynesian approaches towards distribution and growth.

Wir nutzen Cookies. Klicke auf "Akzeptieren" um uns dabei zu helfen, Exploring Economics immer besser zu machen!