631 Ergebnisse

In this essay the author reviews empirical studies in economics that analyze factors behind the rise of nationalist and populist parties in Western countries. He stresses that economic factors (e.g., trade shocks and economic crisis) play a crucial role in the rise of populist parties; however, the discussion of mechanisms driving this trend remains unsatisfying

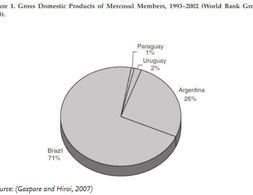

MERCOSUR (Mercado Común del Sur or Common Southern Market) was the first formalized attempt to integrate South American countries economically and politically.

Social and Solidarity Economy (SSE) and Feminist Economics make a conjoint statement: The way we see the economic system has nothing to do with human beings nor those who have been surviving outside the market.

Neoliberalism is dead. Again. After the election of Trump and the victory of Brexit in 2016, many diagnosed the demise of the ideology of Margaret Thatcher, Ronald Reagan, Augusto Pinochet, and the WTO. Yet the philosophy of the free market and the strong state has an uncanny capacity to survive and even thrive in crisis.

The dominant view of inflation holds that it is macroeconomic in origin and must always be tackled with macroeconomic tightening. In contrast, we argue that the US COVID-19 inflation is predominantly a sellers’ inflation that derives from microeconomic origins, namely the ability of firms with market power to hike prices.

Jens Beckert and Richard Bronk, authors of "Uncertain Times", explore the extent to which flaws, blind spots and more importantly bias created by macroeconomics models, based on forecasts and statistical devices, shape crisis and the market economy in which we live.

This book arose from our conviction that the NNS-DSGE approach to the analysis of aggregate market outcomes is fundamentally flawed. The practice of overcoming the SMD result by recurring to a fictitious RA leads to insurmountable methodological problems and lies at the root of DSGE models’ failure to satisfactorily explain real world features.

This book presents recent thought on market efficiency, using a complex systems approach to move past equilibrium models and quantify the actual efficiency of markets.

Debunking Economics - Revised and Expanded Edition exposes what many non-economists may have suspected and a minority of economists have long known: that economic theory is not only unpalatable, but also plain wrong. When the original Debunking Economics was published back in 2001, the market economy seemed invincible, and conventional "neoclassical" economic theory basked in the limelight.

Capitalism is dissolving boundaries - not only in the sense of ever-expanding global trade flows, but also in the concrete everyday working lives of individuals. What implications does this have for our understanding of freedom, work and borders?

Modern Monetary Theory (MMT) is a school of monetary and macroeconomic thought that focuses on the analysis of the monetary and credit system, and in particular on the question of credit creation by the state.

This panel was part of the conference "Next Generation Gentral Banking - Climate Change, Inequality, Financial Instability" 03. - 05.02.2021.

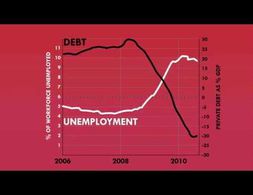

The recent financial meltdown and the resulting global recession have rekindled debates regarding the nature of contemporary capitalism.

This book sets out to encourage a debate about the role that economic theory and philosophy of economics can play. A good part of economics consists of theoretical developments which describe completely imaginary worlds and have no connections to actual market economies

Understanding the American stock market boom and bust of the 1920s is vital for formulating policies to combat the potentially deleterious effects of busts on the economy.

Economics should schematically explain the key elements and main strands of this core part of social life: the actual workings of our economies. This book argues that orthodox, modern neoclassical economics does not fulfil this core task. Standard economics models do not address the real functioning of our market economies, but rather an imagined economy.

This open access book presents an alternative to capitalism and state socialism through the modelling of a post-market and post-state utopia based on an upscaling of the commons, feminist political economy and democratic and council-based planning approaches.

'This Cambridge professor delights in paradox. And myth-busting . . . he does this with charm and a desire to see how things work in the real world' Guardian, 'In Praise of Ha-Joon Chang' In this revelatory book, Ha-Joon Chang destroys the biggest myths of our times and shows us the truth about how the world really works, including- there's no such thing as a free market.

This paper starts with an evaluation of three common arguments against pluralism in economics: (1) the claim that economics is already pluralist, (2) the argument that if there was the need for greater plurality, it would emerge on its own, and (3) the assertion that pluralism means ‘anything goes’ and is thus unscientific. Pluralist responses to all three arguments are summarized. The third argument is identified to relate to a greater challenge for pluralism: an epistemological trade-off between diversity and consensus that suggests moving from a discussion about ‘pros’ and ‘cons’ towards a discussion about the adequate degree of plurality. We instantiate the trade-off by showing how it originates from two main challenges: the need to derive adequate quality criteria for a pluralist economics, and the necessity to propose strategies that ensure the communication across different research programs. The paper concludes with some strategies to meet these challenges.

Central banks have once again proven to be the first line of defense in crisis-ridden times. With their far reaching actions they prevented the world from experiencing a collapse of financial markets on top of the severe health and economic crisis caused by Covid-19.

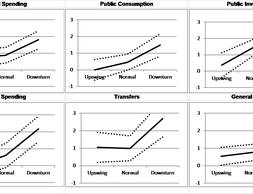

What influence do changes in tax policy or state decisions on expenditure have on economic growth? For decades, this question has been controversially debated.

Smith contends that there is no possible solution to our global ecological crisis within the framework of any conceivable capitalism. The only alternative to market-driven planetary collapse is to transition to a largely planned, mostly publicly-owned economy based on production for need, on democratic governance and rough socio-economic equality, and on contraction and convergence between the global North and South.

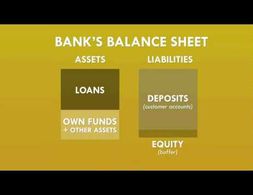

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

This video by the Khan Academy presents the difference between monetary policy and fiscal policy and how they affect aggregate demand. The video especially elaborates on the basic explanation on how expansionary monetary policy increases aggregate demand via the market for money and the AD-AS model.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

In this Ted Talk, Mariana Mazzucato argues against the juxtaposition of the state and entrepreneurial activities. By presenting examples of her research on the relation between innovation and (inclusive) growth, she shows how many innovations were led by states' initiatives. Mazzucato confronts the liberal narrative of the a state that merely provides the frame for the market.

Banking 101 is a series of 6 short videos that ask the following questions: How do banks work and how is money created? Is reveals common misunderstandings of money creation and the role of banks. Furthermore, the videos show how models taught in many introductory classes to economics (Econ 101) do not reflect those processes:

Part 1) “Misconceptions around Banking” questions common comprehensions of how banks work (savings = investments).

Part 2) “What's wrong with the money multiplier” states that the model of the money multiplies is inaccurate.

Part 3) “How is money really made by banks” explains the process of money creation, loans and inter-bank settlement.

Part 4) “How much money banks create?” asks what limits the money creation by banks and presents the difference between reserve ratio, liquidity ration, equity and refers to the inter-bank market.

Part 5) Explores the question if banks create money or just credit and especially refers to credit risks.

Part 6) Explains how money gets destroyed when loans are paid back.

Note: The videos refer to the UK monetary and banking system, some explanations don't apply to other banking systems, e.g. the reserve ratio.

Paul Mason presents the main arguments of his book PostCapitalism. First, he argues that capitalism runs out of its capability to adapt to crises and second states that information technology challenges the capitalist system. In a nutshell, he argues that a society which fully exploits information technologies can't include concepts such as intellectual property, free market or private ownership. This has far-reaching consequences for the organisation of wages and work. The talk stops at minute 37.30.

Feminist economist Nancy Folbre presents a historical analysis of the interrelated development of Patriarchy and Capitalism. She describes the role of women in the reproduction of labour, their “specialization” in care and their changing involvement in the labour market. Folbre argues that capitalism weakens patriarchy but at the same time relies on unpaid caring activities.

Wir nutzen Cookies. Klicke auf "Akzeptieren" um uns dabei zu helfen, Exploring Economics immer besser zu machen!