545 Ergebnisse

The novel coronavirus (Covid-19) is rapidly spreading around the world. The real economy is simultaneously hit by a supply shock and a demand shock by the spread of coronavirus. Such a twin shock is a rare phenomenon in recent economic history.

As the Covid-19 fueled economic downturn begins to intensify this winter, an extended study of the Italian cooperative sector’s historical resilience in times of crisis can serve as a learning experience for other countries seeking to create policies that foster more stable economies, with job security, care for marginalized communities and adequate counter-cyclical policies. Particularly, the Italian cooperative sector’s contributions to three aspects should be noted in closing. Firstly, the innovative phenomenon of cooperative enterprises has contributed to social inclusion of immigrant communities, the activation of youth, the unemployed and people with disabilities, a true compensation for both a market and state failure. Secondly, they have contributed to a reduction in income and wealth inequalities at a time when the issue of inequality is of global significance. Thirdly, the Italian cooperative movement has helped local communities revitalize in the face of demographic shifts and rendered them more resilient to the ravages of globalization. Each of these in their own right is a remarkable achievement.

Marxian Political Economy focuses on the exploitation of labour by capital. The economy is not conceived as consisting of neutral transactions for exchange and cooperation, but instead as having developed historically out of asymmetric distributions of power, ideology and social conflicts.

Based on a critique on econometric and DSGE models (in particular in the context of the financial crisis), Doyne Farmer presents his current research programme that aims at building an agent-based model of the financial and economic crisis. It models heterogeneous agents and from there simulates the economy, firstly for the housing market. The interview gives a short insight in the research programme.

The author identifies three principal economic phenomena, which are explained: long run productivity growth as the central driver of increasing economic activity, short-term and long-term debt cycles. The latter two are explained to some detailed with reference to money creation, central banking and long term crisis tendencies. With regards to the long run debt cycle, which leads into deleveraging and recession, some policy measures which can smoothen the crisis are discussed.

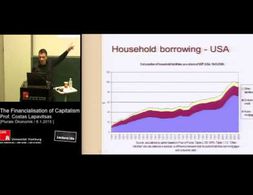

Economist and politician Costas Lapavitsas: presents differing theoretical definitions of financialization, namely from Marxist and Post-Keynesian thinkers and compares their approaches. By presenting pattern and features of the economic and financial crisis, he interprets the latter as a crisis of financialization. Lapavitsas emphasizes his arguments by presenting data from the U.S. and Germany on the transformation of business, banks and households.

Since the beginning of the twenty-first century, there has been an unprecedented move towards 'rethinking economics' due to the damages generated by the global financial crisis that burst in 2007-2008. Almost a decade after this crisis, policy is still unable to provide all citizens greater wellbeing or at least an encouraging economic future.

Today it feels like everybody is talking about the problems and crises of our times: the climate and resource crisis, Greece's permanent socio-political crisis or the degrading exploitative practices of the textile industry.

Die enorm innovationsstarke deutsche Industrie ist in der Lage, viele der für die Erreichung von Klimaneutralität benötigten technischen Lösungen zu entwickeln und auf den Markt zu bringen. Dies ist jedoch kein Selbstläufer, sondern erfordert auch ein langfristiges Engagement der öffentlichen Hand. Ein Beitrag von Jan-Erik Thie und Benjamin Görlach.

Wer sich ökologisch und sozial verhält, wird dafür oft finanziell bestraft. Dies ist jedoch kein Naturgesetz, sondern hängt ganz erheblich von unserer Steuer- und Subventionspolitik ab.

Steve Keen analyses how mainstream economics fails when confronted with the covid-19-pandemic. Mainstream economics has propagated the dismantling of the state and the globalization of production - both of which make the crisis now so devastating. More fundamentally, mainstream economics deals with market systems, when what is needed to limit the virus’s spread is a command system.

The workshop introduces into the field of critical political economy and tries to identify the role of finacial markets in capitalism, the reason for financial crises and the relevance of Marx in regard to these topics.

Wechselkurstheorie in drei Standardlehrbüchern der Volkswirtschaftslehre Jan Priewe Quelle van Treeck Till and Janina Urban Wirtschaft neu denken Blinde Flecken in der Lehrbuchökonomie iRights Media 2016 Das Buch kann hier bestellt werden http irights media de publikationen wirtschaft neu denken Rezensierte Bücher Krugman P Obstfeld M Melitz M J 2015 …

The global financial crisis (GFC) led to increasing distrust in economic research and the economics profession, in the process of which the current state of economics and economic education in particular were heavily criticized. Against this background we conducted a study with undergraduate students of economics in order to capture their view of economic education.

The book deals with the financial instability hypothesis of Hyman P. Minsky and its application to current developments. The first part of the work summarizes the hypothesis and mentions works elaborating the hypothesis. The second part applies the hypothesis to the financial crisis 0f 2008/09.

Bei der Klimafrage müssen nicht nur ökologische, sondern auch gesellschaftliche Aspekte berücksichtigt werden. Denn ein dauerhaftes Makromanagement, das die Natur zwar preislich abbilden kann, dessen Richtungsbestimmung aber privatisiert bleibt, wird weder das Klima noch die Demokratie retten.

Momentan findet in der Klimapolitik eine Verzögerungstaktik unter dem Vorwand „sozialer“ Gestaltung der Klimapolitik statt. Noch unsozialer wäre es jedoch, eine noch uneffektivere Klimapolitik zu machen. Der Grund dafür liegt in einem Zusammenhang von Ungleichheit und Klimawandel, den der englische Wissenschaftler Ian Gough im Journal of Social Policy unter dem Begriff „Dreifache (Un-)gerechtigkeit“ erläutert.

Recovery from the Covid-19 crisis provides a chance to implement economic measures that are also beneficial from environmental and social perspectives. While ‘green’ recovery packages are crucial to support economies tracking a low-carbon transition in the short-term, green measures such as carbon pricing are also key to improving welfare in the long-term. This commentary specifies the need for carbon pricing, outlines its implications for our everyday lives, and explains how it works alongside value-based change in the context of climate action and societal well-being.

How long the COVID-19 crisis will last, and what its immediate economic costs will be, is anyone's guess. But even if the pandemic's economic impact is contained, it may have already set the stage for a debt meltdown long in the making, starting in many of the Asian emerging and developing economies on the front lines of the outbreak.

The idea of a Green New Deal was launched into popular consciousness by US Congressperson Alexandria Ocasio-Cortez in 2018. Evocative of the far-reaching ambitions of its namesake, it has become a watchword in the current era of global climate crisis. But its new ubiquity brings ambiguity: what - and for whom - is the Green New Deal?

Eine Erklärung für das Auseinanderdriften zwischen Wortführern und Basis könnte immerhin darin liegen, dass es tatsächlich einen erhöhten Bedarf an neuen Antworten gibt – der an der Basis auch schon zu einer Art Aufbruch geführt hat, wie er in anderen Ländern zu beobachten ist. Nur dass dies in Deutschland nur sehr bedingt Ausdruck findet in den öffentlichen Debatten, in denen nach wie vor Institutionen und Vertreter des Fachs dominieren, die das Denken in den vergangenen Jahrzehnten des angebotsorientierten Paradigmas geprägt haben – ob im Sachverständigenrat, den Instituten oder der Bundesbank. Was wiederum erklären würde, warum trotz zunehmender Offenheit und Vielfalt der Eindruck im In- und Ausland fortbesteht, die deutsche Ökonomie sei anders als alle anderen auf der Welt.

Aim of this intensive workshop is 1.) to introduce the participants to the macroeconomic workings of the climate crisis as the background of sustainable finance; 2.) to introduce financial assets with ESG (Environmental, Social and Governance) criteria attached to them and their markets and important institutional players; 3.) to provide a critical perspective on the current setup of sustainable finance; 4.) and to work on in-depth case studies illustrating the workings on ESG-finance markets, its emitters and traders as well as their macroeconomic implications.

David Harvey illustrates the five most common narratives on why the financial and economic crisis took place – from human frailty to policy failure.

Green Growth has been increasingly discussed as a solution to the socio-ecological crisis. But can economic growth be sustainable at all?

Heterodox Macroeconomics offers a detailed understanding of the foundations of the recent global financial crisis

In the graveyard of economic ideology, dead ideas still stalk the land.

The recent financial crisis laid bare many of the assumptions behind market liberalism—the theory that market-based solutions are always best, regardless of the problem. For decades, their advocates dominated mainstream economics, and their influence created a system where an unthinking faith in markets led many to view speculative investments as fundamentally safe.

"Leveraged" provides an authoritative guide to the new economics of our crisis-filled century with a focus on financial crises and financial economics.

It has become a contentious term in- and outside of economic policy: austerity. Allegedly the culprit behind the shortfalls of governments' reaction to the Great Financial Crisis, the policy makes for a spirited debate.

In this interview, the political activist, author and lecturer Dr. Vandana Shiva explains the linkage between ecology, feminism and economics along the lines of current effects and implications of the Corona-Crisis in India and around the world.

How exactly are persisting social inequalities and the operations of modern finance connected? Adam Tooze provides a detailed answer to a still relevant problem by focusing on the Great Financial Crisis and the role of the finance industry in the USA.

This essay analyses how the role of central banks changed since the global financial crisis, and how this directional change was accelerated by the outbreak of Covid-19.

Since the 1980s, the financial sector and its role have increased significantly. This development is often referred to as financialization. Authors working in the heterodox tradition have raised the question whether the changing role of finance manifests a new era in the history of capitalism. The present article first provides some general discussion on the term financialization and presents some stylized facts which highlight the rise of finance. Then, it proceeds by briefly reviewing the main arguments in the Marxian framework that proposedly lead to crisis. Next, two schools of thought in the Marxian tradition are reviewed which consider financialization as the latest stage of capitalism. They highlight the contradictions imposed by financialization that disrupt the growth process and also stress the fragilities imposed by the new growth regime. The two approaches introduced here are the Social Structure of Accumulation Theory and Monthly Review School. The subsequent part proceeds with the Post-Keynesian theory, first introducing potential destabilizing factors before discussing financialization and the finance-led growth regime. The last section provides a comparative summary. While the basic narrative in all approaches considered here is quite similar, major differences stem from the relationship between neoliberalism and financialization and, moreover, from the question of whether financialization can be considered cause or effect.

Wir nutzen Cookies. Klicke auf "Akzeptieren" um uns dabei zu helfen, Exploring Economics immer besser zu machen!